- Italy

- /

- Healthcare Services

- /

- BIT:AMP

Should You Use Amplifon's (BIT:AMP) Statutory Earnings To Analyse It?

As a general rule, we think profitable companies are less risky than companies that lose money. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. In this article, we'll look at how useful this year's statutory profit is, when analysing Amplifon (BIT:AMP).

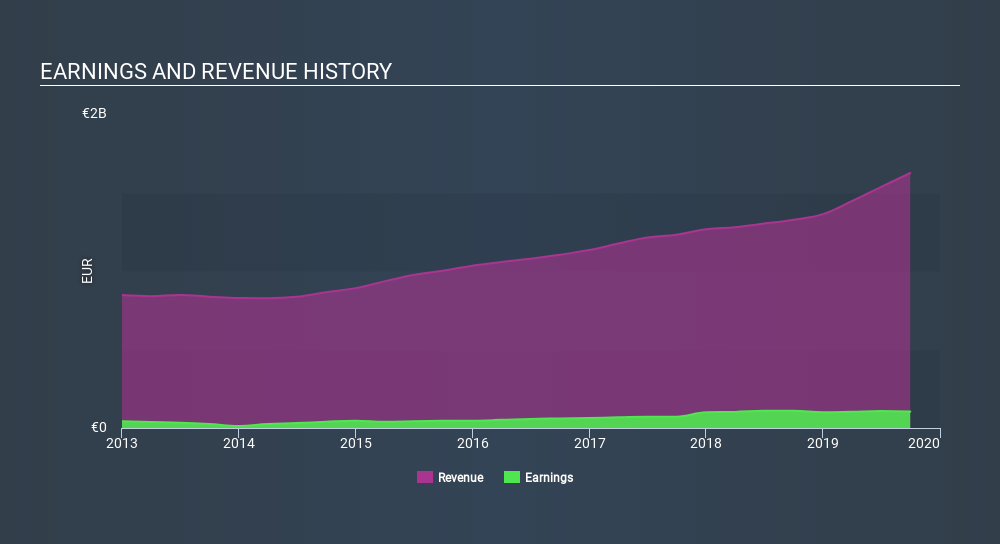

While Amplifon was able to generate revenue of €1.62b in the last twelve months, we think its profit result of €104.5m was more important. Happily, it has grown both its profit and revenue over the last three years (though we note its profit is down over the last year).

Check out our latest analysis for Amplifon

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. This article will discuss how unusual items have impacted Amplifon's most recent profit results. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

For anyone who wants to understand Amplifon's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by €23m due to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. If Amplifon doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Amplifon's Profit Performance

Unusual items (expenses) detracted from Amplifon's earnings over the last year, but we might see an improvement next year. Because of this, we think Amplifon's earnings potential is at least as good as it seems, and maybe even better! And on top of that, its earnings per share have grown at an extremely impressive rate over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. While it's really important to consider how well a company's statutory earnings represent its true earnings power, it's also worth taking a look at what analysts are forecasting for the future. At Simply Wall St, we have analyst estimates which you can view by clicking here.

This note has only looked at a single factor that sheds light on the nature of Amplifon's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:AMP

Amplifon

Engages in the distribution of hearing solutions and the fitting of customized products that helps people to rediscover various emotions of sound in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

BIM Birlesik Magazalar Set to Normalize Profit Margins by 2027 Due to New Legislation

Swiped Left by Wall Street: The BMBL Rebound Trade

Bayer to Achieve Fair Value of €40 Boosting Growth and Investor Confidence

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Early mover in a fast growing industry. Likely to experience share price volatility as they scale