- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

Should You Buy Électricite de Strasbourg Société Anonyme (EPA:ELEC) For Its 5.0% Dividend?

Could Électricite de Strasbourg Société Anonyme (EPA:ELEC) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

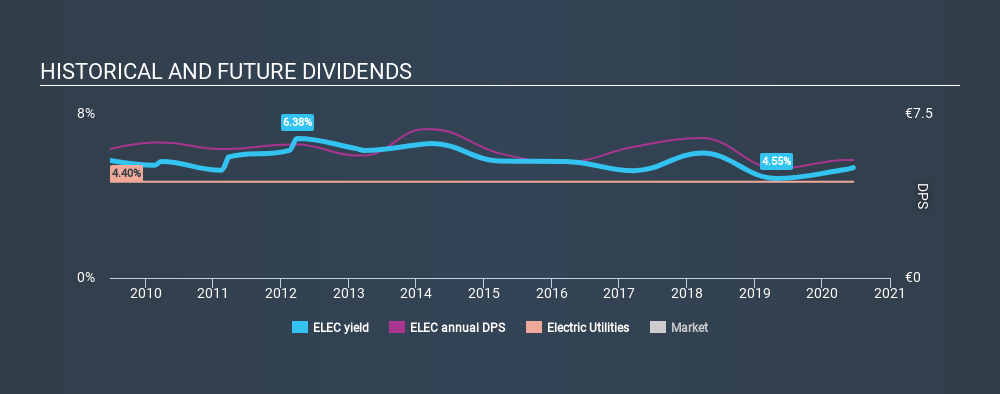

With Électricite de Strasbourg Société Anonyme yielding 5.0% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. It would not be a surprise to discover that many investors buy it for the dividends. Some simple research can reduce the risk of buying Électricite de Strasbourg Société Anonyme for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 74% of Électricite de Strasbourg Société Anonyme's profits were paid out as dividends in the last 12 months. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Électricite de Strasbourg Société Anonyme paid out 191% of its free cash flow last year, which we think is concerning if cash flows do not improve. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely. Électricite de Strasbourg Société Anonyme paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough free cash flow to cover the dividend. Cash is king, as they say, and were Électricite de Strasbourg Société Anonyme to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

With a strong net cash balance, Électricite de Strasbourg Société Anonyme investors may not have much to worry about in the near term from a dividend perspective.

Consider getting our latest analysis on Électricite de Strasbourg Société Anonyme's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Électricite de Strasbourg Société Anonyme has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past ten-year period, the first annual payment was €5.90 in 2010, compared to €5.40 last year. Dividend payments have shrunk at a rate of less than 1% per annum over this time frame.

We struggle to make a case for buying Électricite de Strasbourg Société Anonyme for its dividend, given that payments have shrunk over the past ten years.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Over the past five years, it looks as though Électricite de Strasbourg Société Anonyme's EPS have declined at around 3.3% a year. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we think Électricite de Strasbourg Société Anonyme has an acceptable payout ratio, although its dividend was not well covered by cashflow. Moreover, earnings have been shrinking. While the dividends have been fairly steady, we'd wonder for how much longer this will be sustainable if earnings continue to decline. With this information in mind, we think Électricite de Strasbourg Société Anonyme may not be an ideal dividend stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Électricite de Strasbourg Société Anonyme that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.