- Canada

- /

- Retail REITs

- /

- TSX:CRT.UN

Should You Be Pleased About The CEO Pay At CT Real Estate Investment Trust's (TSE:CRT.UN)

Ken Silver has been the CEO of CT Real Estate Investment Trust (TSE:CRT.UN) since 2013. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for CT Real Estate Investment Trust

How Does Ken Silver's Compensation Compare With Similar Sized Companies?

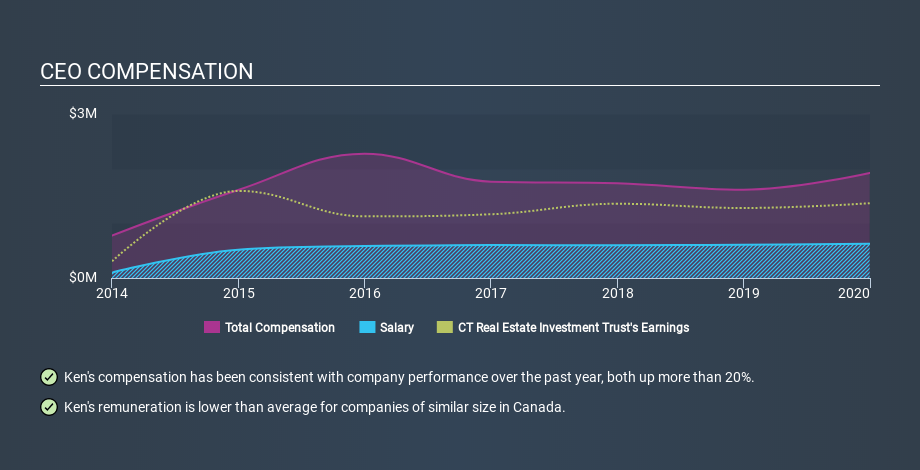

According to our data, CT Real Estate Investment Trust has a market capitalization of CA$3.2b, and paid its CEO total annual compensation worth CA$1.9m over the year to December 2019. That's a notable increase of 19% on last year. While we always look at total compensation first, we note that the salary component is less, at CA$627k. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. When we examined a selection of companies with market caps ranging from CA$1.4b to CA$4.3b, we found the median CEO total compensation was CA$3.0m.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of CT Real Estate Investment Trust. On an industry level, roughly 33% of total compensation represents salary and 67% is other remuneration. Our data reveals that CT Real Estate Investment Trust allocates salary in line with the wider market.

At first glance this seems like a real positive for shareholders, since Ken Silver is paid less than the average total compensation paid by similar sized companies. Though positive, it's important we delve into the performance of the actual business. You can see, below, how CEO compensation at CT Real Estate Investment Trust has changed over time.

Is CT Real Estate Investment Trust Growing?

CT Real Estate Investment Trust has reduced its earnings per share by an average of 1.0% a year, over the last three years (measured with a line of best fit). It achieved revenue growth of 3.5% over the last year.

Unfortunately there is a complete lack of earnings per share improvement, over three years. The fairly low revenue growth fails to impress given that the earnings per share is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Shareholders might be interested in this free visualization of analyst forecasts.

Has CT Real Estate Investment Trust Been A Good Investment?

With a total shareholder return of 11% over three years, CT Real Estate Investment Trust shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

It looks like CT Real Estate Investment Trust pays its CEO less than similar sized companies.

Ken Silver is remunerated more modestly than is a normal at similar sized companies. However, the earnings per share are not moving in the right direction, and the returns to shareholders could have been better. We would like to see EPS growth from the business, although we wouldn't say the CEO pay is high. Taking a breather from CEO compensation, we've spotted 4 warning signs for CT Real Estate Investment Trust (of which 1 doesn't sit too well with us!) you should know about in order to have a holistic understanding of the stock.

Important note: CT Real Estate Investment Trust may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSX:CRT.UN

CT Real Estate Investment Trust

CT REIT is an unincorporated, closed-end real estate investment trust formed to own income-producing commercial properties located primarily in Canada.

Established dividend payer with proven track record.

Market Insights

Community Narratives