- United Kingdom

- /

- Diversified Financial

- /

- AIM:MAB1

Should You Be Adding Mortgage Advice Bureau (Holdings) (LON:MAB1) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Mortgage Advice Bureau (Holdings) (LON:MAB1), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Mortgage Advice Bureau (Holdings)

Mortgage Advice Bureau (Holdings)'s Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Mortgage Advice Bureau (Holdings) has grown EPS by 11% per year. That growth rate is fairly good, assuming the company can keep it up.

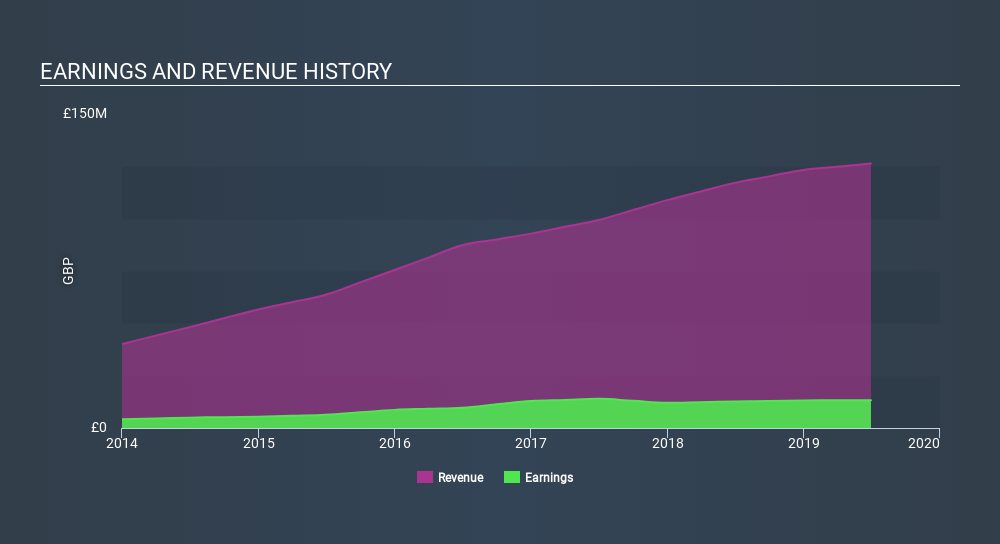

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Mortgage Advice Bureau (Holdings)'s revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Mortgage Advice Bureau (Holdings) maintained stable EBIT margins over the last year, all while growing revenue 7.9% to UK£126m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Mortgage Advice Bureau (Holdings)?

Are Mortgage Advice Bureau (Holdings) Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last twelve months Mortgage Advice Bureau (Holdings) insiders spent UK£26k on stock; good news for shareholders. While this isn't much, we also note an absence of sales.

Along with the insider buying, another encouraging sign for Mortgage Advice Bureau (Holdings) is that insiders, as a group, have a considerable shareholding. With a whopping UK£78m worth of shares as a group, insiders have plenty riding on the company's success. At 30% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Peter Christopher Brodnicki is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Mortgage Advice Bureau (Holdings) with market caps between UK£163m and UK£651m is about UK£749k.

The Mortgage Advice Bureau (Holdings) CEO received UK£499k in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Mortgage Advice Bureau (Holdings) Deserve A Spot On Your Watchlist?

One important encouraging feature of Mortgage Advice Bureau (Holdings) is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. We don't want to rain on the parade too much, but we did also find 2 warning signs for Mortgage Advice Bureau (Holdings) that you need to be mindful of.

The good news is that Mortgage Advice Bureau (Holdings) is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:MAB1

Mortgage Advice Bureau (Holdings)

Provides mortgage advice services in the United Kingdom.

High growth potential with solid track record.

Market Insights

Community Narratives