- United States

- /

- Banks

- /

- NasdaqGS:IBCP

Should You Be Adding Independent Bank (NASDAQ:IBCP) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Independent Bank (NASDAQ:IBCP). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Independent Bank

Independent Bank's Earnings Per Share Are Growing.

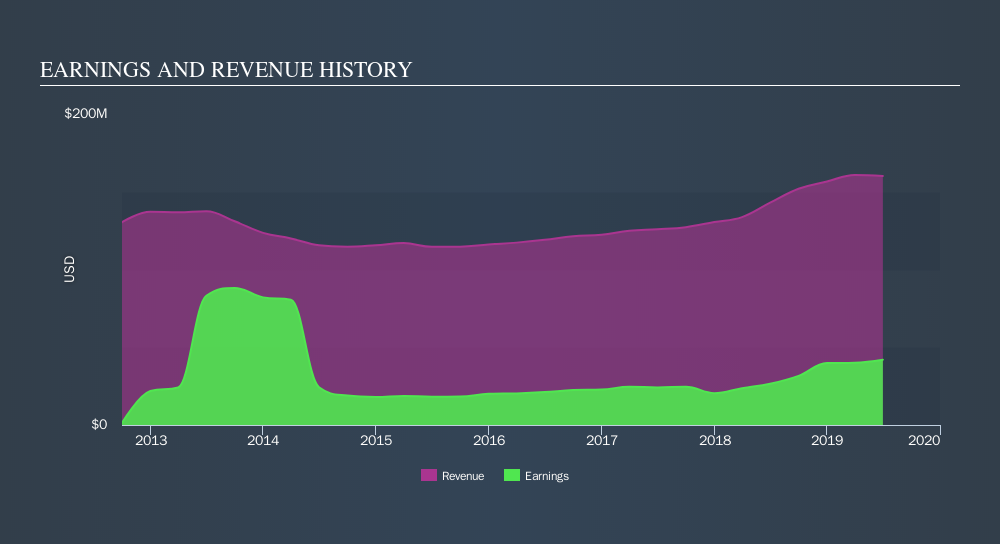

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Independent Bank has grown EPS by 23% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Independent Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Independent Bank's EBIT margins were flat over the last year, revenue grew by a solid 12% to US$160m. That's progress.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Independent Bank.

Are Independent Bank Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders both bought and sold Independent Bank shares in the last year, but the good news is they spent US$8.7k more buying than they netted selling. So, on balance, the insider transactions are mildly encouraging. We also note that it was the Chairman of the Board, Michael Magee, who made the biggest single acquisition, paying US$89k for shares at about US$23.00 each.

On top of the insider buying, it's good to see that Independent Bank insiders have a valuable investment in the business. Indeed, they hold US$15m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 3.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Brad Kessel, is paid less than the median for similar sized companies. For companies with market capitalizations between US$200m and US$800m, like Independent Bank, the median CEO pay is around US$1.8m.

Independent Bank offered total compensation worth US$1.1m to its CEO in the year to December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Independent Bank Deserve A Spot On Your Watchlist?

For growth investors like me, Independent Bank's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Independent Bank is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Independent Bank is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:IBCP

Independent Bank

Operates as the bank holding company for Independent Bank that provides banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives