- Finland

- /

- Healthcare Services

- /

- HLSE:TTALO

Should Terveystalo Oyj (HEL:TTALO) Be Part Of Your Dividend Portfolio?

Could Terveystalo Oyj (HEL:TTALO) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

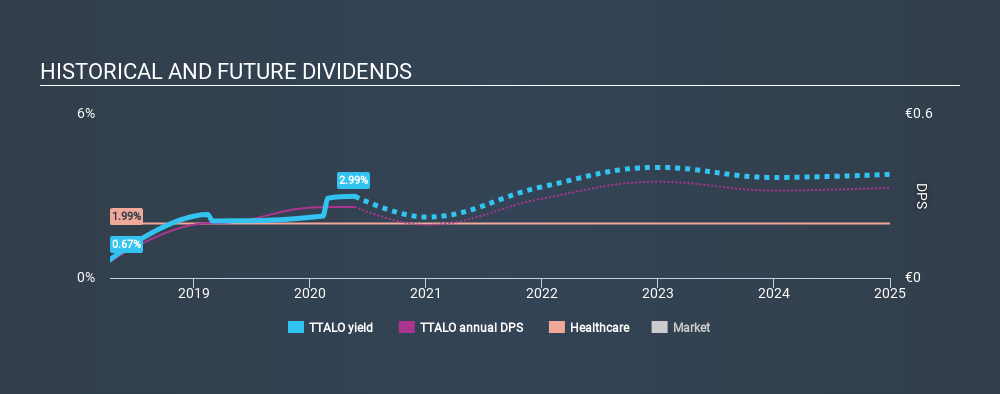

With only a two-year payment history, and a 3.0% yield, investors probably think Terveystalo Oyj is not much of a dividend stock. Many of the best dividend stocks typically start out paying a low yield, so we wouldn't automatically cut it from our list of prospects. During the year, the company also conducted a buyback equivalent to around 2.3% of its market capitalisation. Some simple analysis can reduce the risk of holding Terveystalo Oyj for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Terveystalo Oyj paid out 73% of its profit as dividends. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

Is Terveystalo Oyj's Balance Sheet Risky?

As Terveystalo Oyj has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. With net debt of 2.78 times its EBITDA, Terveystalo Oyj has a noticeable amount of debt, although if business stays steady, this may not be overly concerning.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. Net interest cover of 6.60 times its interest expense appears reasonable for Terveystalo Oyj, although we're conscious that even high interest cover doesn't make a company bulletproof.

Consider getting our latest analysis on Terveystalo Oyj's financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. During the past two-year period, the first annual payment was €0.06 in 2018, compared to €0.26 last year. This works out to be a compound annual growth rate (CAGR) of approximately 108% a year over that time.

We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Terveystalo Oyj has grown its earnings per share at 46% per annum over the past five years. Earnings per share are sharply up, but we wonder if paying out more than half its earnings (leaving less for reinvestment) is an implicit signal that Terveystalo Oyj's growth will be slower in the future.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Terveystalo Oyj's payout ratio is within an average range for most market participants. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. Terveystalo Oyj has a credible record on several fronts, but falls slightly short of our standards for a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 4 warning signs for Terveystalo Oyj that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About HLSE:TTALO

Terveystalo Oyj

Provides occupational healthcare services in Finland, Sweden, and Estonia.

Undervalued with moderate growth potential.

Market Insights

Community Narratives