- United States

- /

- Specialized REITs

- /

- NasdaqGS:PCH

Should PotlatchDeltic (NASDAQ:PCH) Be Disappointed With Their 21% Profit?

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. For example, the PotlatchDeltic Corporation (NASDAQ:PCH) share price is up 21% in the last year, clearly besting the market return of around 16% (not including dividends). So that should have shareholders smiling. However, the stock hasn't done so well in the longer term, with the stock only up 0.9% in three years.

Check out our latest analysis for PotlatchDeltic

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, PotlatchDeltic actually saw its earnings per share drop 72%.

Given the share price gain, we doubt the market is measuring progress with EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

PotlatchDeltic's revenue actually dropped 9.8% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

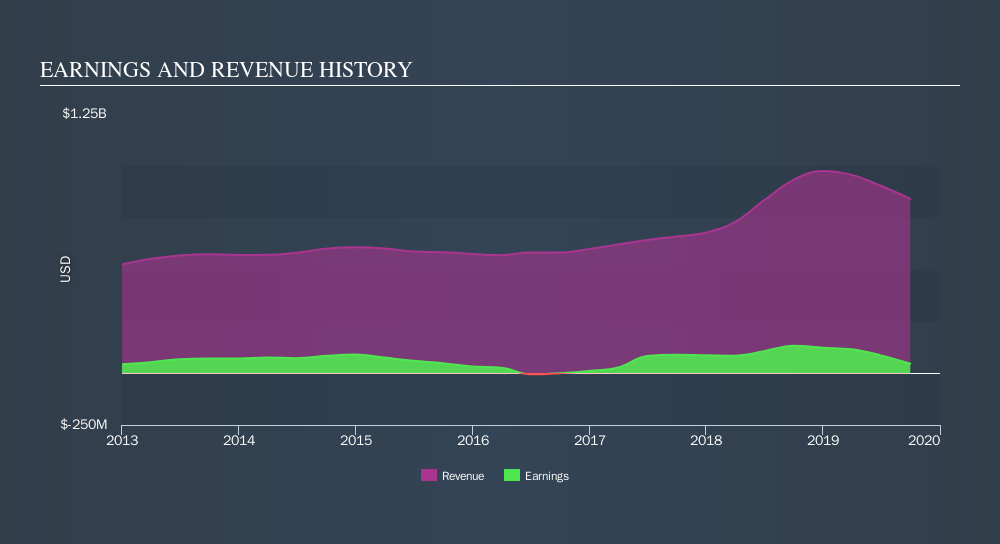

The company's revenue and earnings (over time) are depicted in the image below.

It is of course excellent to see how PotlatchDeltic has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling PotlatchDeltic stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, PotlatchDeltic's TSR for the last year was 27%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that PotlatchDeltic shareholders have received a total shareholder return of 27% over the last year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 6.6%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. If you would like to research PotlatchDeltic in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:PCH

PotlatchDeltic

PotlatchDeltic Corporation (Nasdaq: PCH) is a leading Real Estate Investment Trust (REIT) with ownership of 2.1 million acres of timberlands in Alabama, Arkansas, Georgia, Idaho, Louisiana, Mississippi and South Carolina.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives