- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2327

Should Meilleure Health International Industry Group (HKG:2327) Be Disappointed With Their 54% Profit?

Meilleure Health International Industry Group Limited (HKG:2327) shareholders might understandably be very concerned that the share price has dropped 31% in the last quarter. But over three years, the returns would have left most investors smiling To wit, the share price did better than an index fund, climbing 54% during that period.

Check out our latest analysis for Meilleure Health International Industry Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

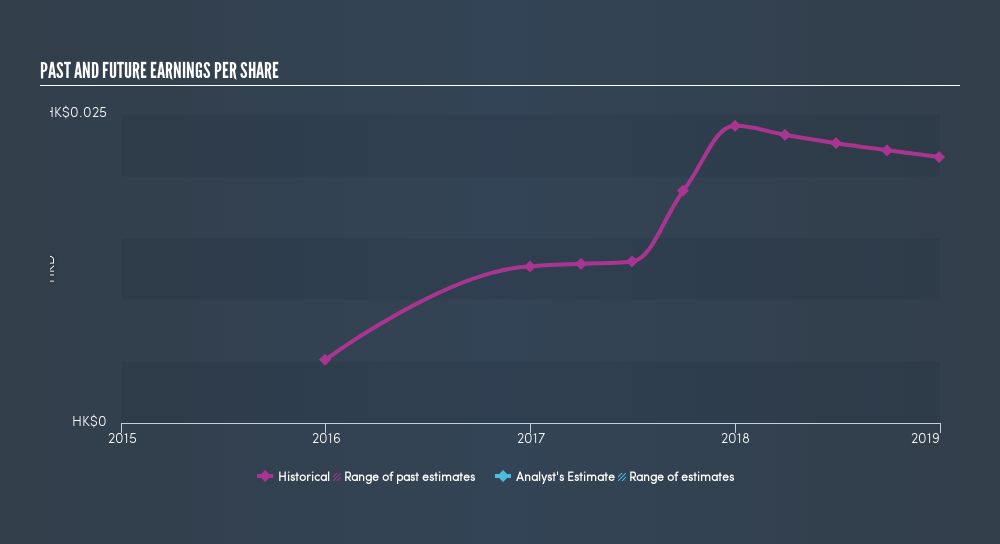

During three years of share price growth, Meilleure Health International Industry Group achieved compound earnings per share growth of 61% per year. This EPS growth is higher than the 15% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat.

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Meilleure Health International Industry Group's earnings, revenue and cash flow.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. In some ways, TSR is a better measure of how well an investment has performed. Over the last 3 years, Meilleure Health International Industry Group generated a TSR of 56%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

We're pleased to report that Meilleure Health International Industry Group shareholders have received a total shareholder return of 31% over one year. That gain is better than the annual TSR over five years, which is 9.0%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:2327

Meilleure Health International Industry Group

An investment holding company, engages in trading of construction materials in the People’s Republic China, Europe, and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives