- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (NasdaqGS:SHOP) Welcomes Akeneo As Premier Partner To Enhance Global Commerce

Reviewed by Simply Wall St

Last month, Akeneo joined Shopify's (NasdaqGS:SHOP) Partner Program as a Premier Partner, enhancing their collaboration and reinforcing their commitment to merchant success with improved product experiences. This partnership, recognized with the launch of the Akeneo App for Shopify, has likely contributed to a 12% share price increase for Shopify over the past month. Additional events, such as Shopify's collaboration with Peruvian Connection and the introduction of Sovos's automated tax filing, would have supported this upward trend. Overall, these developments aligned well with the broader market's 12% rise over the past year.

We've spotted 2 risks for Shopify you should be aware of.

Shopify's recent partnership with Akeneo as a Premier Partner within Shopify's Partner Program is likely to strengthen applications for merchants, driving potential revenue growth and operational efficiencies. This collaboration, coupled with new launches like the Akeneo App for Shopify, aligns with Shopify’s strategy to boost merchant productivity and international presence. In the past three years, Shopify's total return, inclusive of share price and dividends, was a substantial 244.60%, demonstrating significant shareholder value creation over that period.

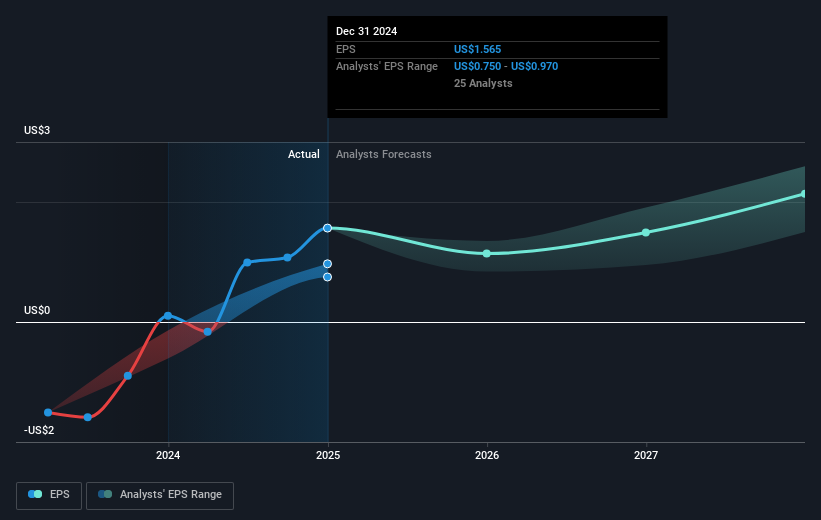

Over the past year, Shopify's shares outperformed the US market, which achieved a 12% increase, indicating resilience against broader industry trends. The company's focus on expanding its international reach and enhancing business efficiency is central to revenue and earnings growth forecasts. Earnings today stand at US$1.61 billion, with projected growth expected to reach US$2.7 billion by March 2028. Despite these positive prospects, the current share price of US$109.82 remains below the consensus price target of US$134.54, suggesting room for potential upside based on analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives