- United Arab Emirates

- /

- Insurance

- /

- ADX:SICO

Sharjah Insurance Company P.S.C And 2 Other Middle Eastern Penny Stocks To Monitor

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently shown mixed results, influenced by fluctuating oil prices and potential shifts in U.S. monetary policy. Despite these broader market dynamics, investors often find value in exploring smaller or newer companies known as penny stocks. While the term may seem outdated, these stocks can offer surprising opportunities for those seeking to uncover hidden value and financial resilience in lesser-known firms.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.81 | SAR2.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.74 | SAR1.5B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.984 | ₪354.91M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.08 | AED2.14B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.20 | AED369.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.04 | AED12.93B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.841 | AED504.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.76 | ₪216.66M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Sharjah Insurance Company P.S.C (ADX:SICO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharjah Insurance Company P.S.C. provides general, property, non-property, and life insurance products in the United Arab Emirates and internationally, with a market cap of AED225 million.

Operations: The company's revenue is primarily derived from underwriting activities, including AED7.38 million from fire insurance, AED0.72 million from marine insurance, and AED25.47 million from motor and engineering insurance.

Market Cap: AED225M

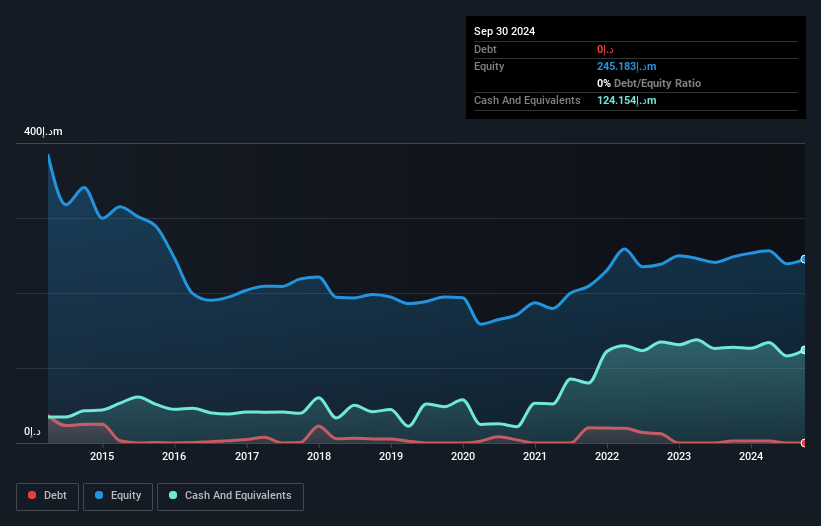

Sharjah Insurance Company P.S.C. has demonstrated significant earnings growth, with a reported 894.5% increase over the past year, surpassing both its historical average and the industry benchmark. The company is debt-free, enhancing its financial stability, and maintains strong liquidity with short-term assets exceeding both short- and long-term liabilities. Despite a low return on equity of 13%, its net profit margins have improved to 23.3%, reflecting operational efficiency gains. The recent earnings report highlights a turnaround from losses to profits, suggesting potential for continued recovery in financial performance amidst stable market volatility.

- Click to explore a detailed breakdown of our findings in Sharjah Insurance Company P.S.C's financial health report.

- Learn about Sharjah Insurance Company P.S.C's historical performance here.

Airtouch Solar (TASE:ARTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Airtouch Solar Ltd offers autonomous water-free robotic cleaning solutions for solar panels and has a market cap of ₪22.78 million.

Operations: The company's revenue is derived entirely from its Industrial Automation & Controls segment, amounting to ₪44.24 million.

Market Cap: ₪22.78M

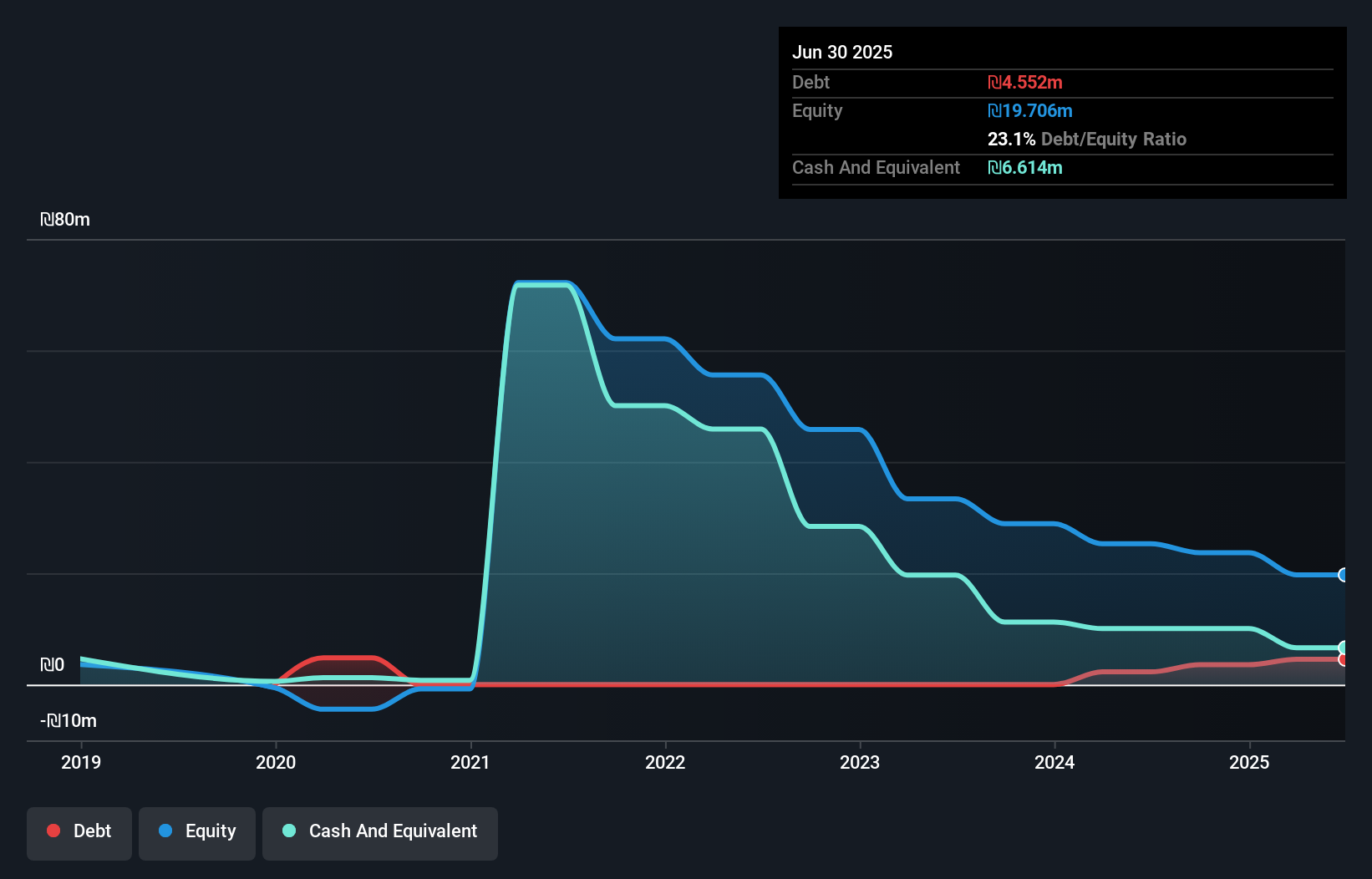

Airtouch Solar Ltd, with a market cap of ₪22.78 million, has shown improvement in financial stability by transitioning from negative to positive shareholder equity over the past five years. Despite being unprofitable, it has reduced its losses at a rate of 1.6% annually and maintains more cash than debt, providing a robust cash runway exceeding three years based on current free cash flow levels. Recent earnings reported sales of ₪16.36 million for the half-year ended June 2025, slightly down from the previous year, with a net loss increasing to ₪3.52 million, highlighting ongoing challenges in achieving profitability amidst fluctuating revenues.

- Take a closer look at Airtouch Solar's potential here in our financial health report.

- Review our historical performance report to gain insights into Airtouch Solar's track record.

Avrot Industries (TASE:AVRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avrot Industries Ltd specializes in the lining and coating of steel pipes in Israel, with a market cap of ₪203.46 million.

Operations: The company generates revenue through three main segments: coating and wrapping of steel pipe (₪77.47 million), plastic pipe manufacturing (₪34.74 million), and subcontractor activity in water and sewage infrastructure (₪21.12 million).

Market Cap: ₪203.46M

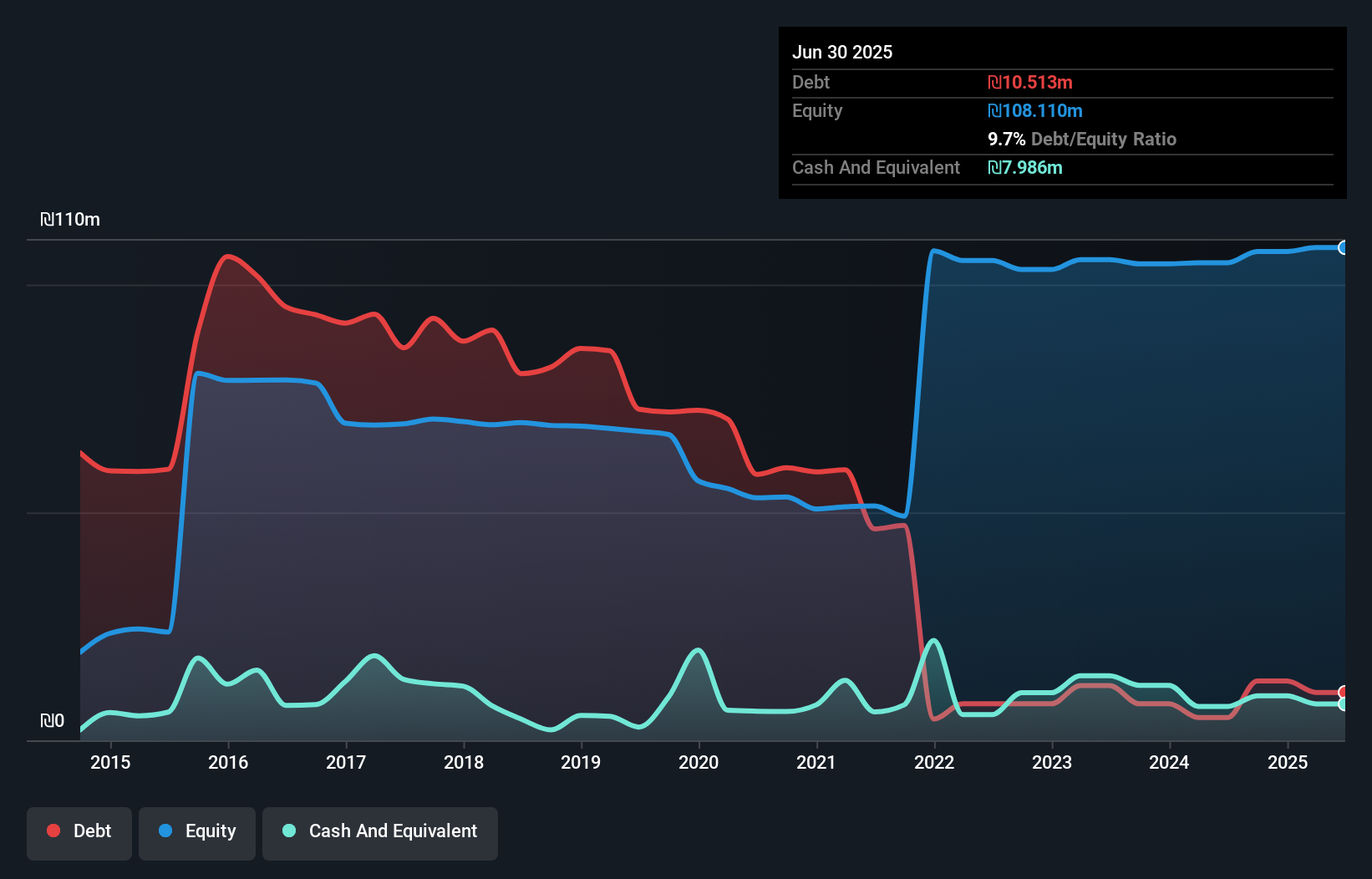

Avrot Industries Ltd, with a market cap of ₪203.46 million, has demonstrated financial improvement by becoming profitable this year and maintaining high-quality earnings. The company has effectively reduced its debt to equity ratio from 109.6% to 9.7% over five years, with net debt now at a satisfactory level of 2.3%. Its short-term assets exceed both short and long-term liabilities, indicating solid liquidity management. Recent earnings for the half-year ended June 2025 showed sales of ₪62.57 million and net income growth from ₪0.39 million to ₪0.847 million year-on-year, reflecting improved operational performance despite slightly lower sales figures compared to the previous year.

- Click here and access our complete financial health analysis report to understand the dynamics of Avrot Industries.

- Examine Avrot Industries' past performance report to understand how it has performed in prior years.

Key Takeaways

- Discover the full array of 80 Middle Eastern Penny Stocks right here.

- Searching for a Fresh Perspective? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:SICO

Sharjah Insurance Company P.S.C

Engages in the provision of general, property, non-property, and life insurance products in the United Arab Emirates and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives