- United Kingdom

- /

- Chemicals

- /

- AIM:VRS

Shareholders Are Thrilled That The Versarien (LON:VRS) Share Price Increased 294%

Some Versarien plc (LON:VRS) shareholders are probably rather concerned to see the share price fall 41% over the last three months. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. In three years the stock price has launched 294% higher: a great result. After a run like that some may not be surprised to see prices moderate. Only time will tell if there is still too much optimism currently reflected in the share price.

Check out our latest analysis for Versarien

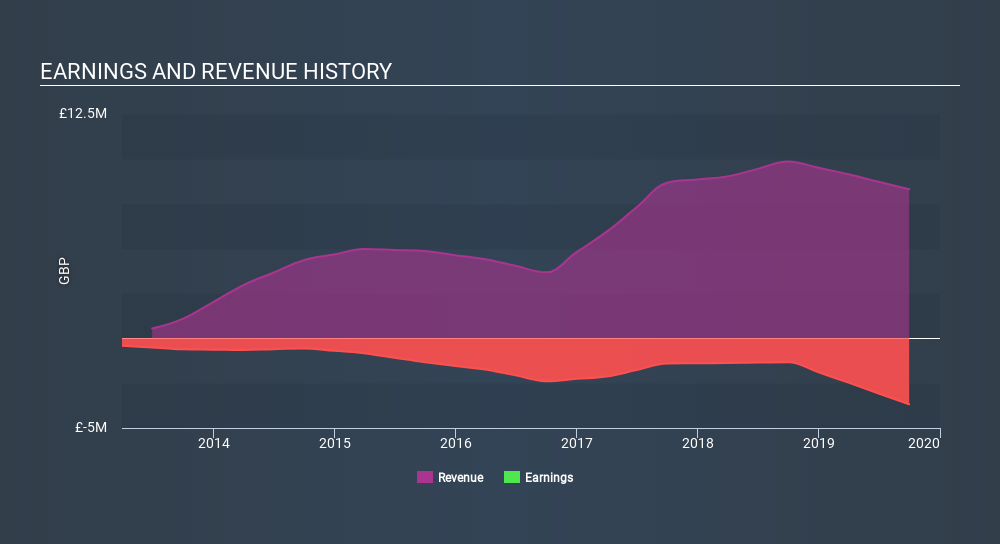

Given that Versarien didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Versarien saw its revenue grow at 19% per year. That's a very respectable growth rate. It's fair to say that the market has acknowledged the growth by pushing the share price up 58% per year. The business has made good progress on the top line, but the market is extrapolating the growth. It would be worth thinking about when profits will flow, since that milestone will attract more attention.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Versarien had a tough year, with a total loss of 50%, against a market gain of about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 28% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 5 warning signs for Versarien (2 can't be ignored!) that you should be aware of before investing here.

Of course Versarien may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:VRS

Versarien

Provides engineering solutions for various industry sectors in the United Kingdom, rest of Europe, North America, and internationally.

Medium-low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives