- India

- /

- Consumer Durables

- /

- NSEI:JCHAC

Shareholders Are Thrilled That The Johnson Controls-Hitachi Air Conditioning India (NSE:JCHAC) Share Price Increased 119%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. Long term Johnson Controls-Hitachi Air Conditioning India Limited (NSE:JCHAC) shareholders would be well aware of this, since the stock is up 119% in five years.

See our latest analysis for Johnson Controls-Hitachi Air Conditioning India

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

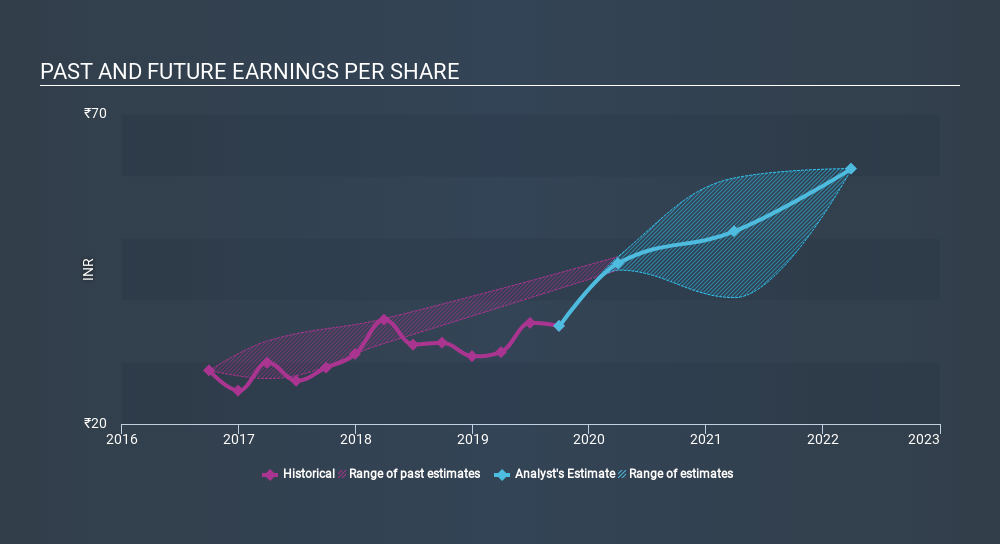

During five years of share price growth, Johnson Controls-Hitachi Air Conditioning India achieved compound earnings per share (EPS) growth of 13% per year. This EPS growth is slower than the share price growth of 17% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 53.69.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

While share prices often depend primarily on earnings, they can be sensitive to an investment's risk level as well. For example, we've discovered 1 warning sign for Johnson Controls-Hitachi Air Conditioning India (of which 1 is major) which any shareholder or potential investor should be aware of.

A Different Perspective

It's nice to see that Johnson Controls-Hitachi Air Conditioning India shareholders have received a total shareholder return of 9.0% over the last year. That's including the dividend. However, the TSR over five years, coming in at 17% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Is Johnson Controls-Hitachi Air Conditioning India cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:JCHAC

Johnson Controls-Hitachi Air Conditioning India

Manufactures and distributes air conditioners, chillers, refrigerators, air purifiers, and variable refrigerant flow systems in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives