- United States

- /

- Software

- /

- NYSE:S

SentinelOne (S) Partners With Abstract Security To Enhance AI-Powered Threat Detection

Reviewed by Simply Wall St

SentinelOne (S) recently announced a partnership with Abstract Security to advance its cybersecurity capabilities, boasting streamlined threat detection and response through a unified security architecture. Additionally, the launch of its Singularity Cloud Security and AI SIEM on the AWS Marketplace has broadened access to its AI-driven security solutions. These developments may have supported the company's modest 5% price move over the last quarter. This is amid a generally buoyant market environment with the S&P 500 and Nasdaq reaching record highs, suggesting that SentinelOne's innovations added weight to positive broader market sentiment.

SentinelOne has 2 possible red flags we think you should know about.

SentinelOne's recent partnership with Abstract Security and the launch of its solutions on the AWS Marketplace could strengthen its positioning as a leading AI-native cybersecurity provider. These moves are likely to align with the company’s transformation efforts and support future revenue growth by potentially enhancing threat detection capabilities and broadening market access. However, while these developments come in a favorable market climate, their immediate impact on financial metrics may be subtle given the company's ongoing focus on AI-driven innovations and phasing out legacy products.

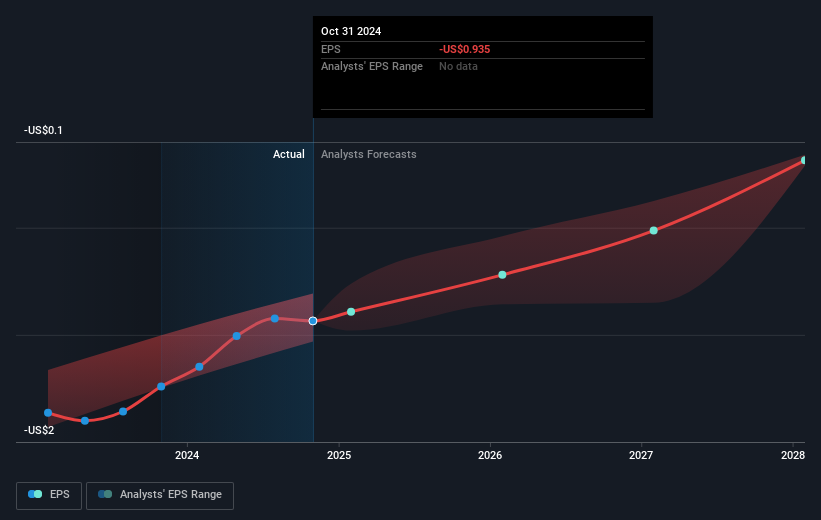

Over the longer term, SentinelOne's total shareholder returns indicate a 16.02% decline over the past year. During the same period, the broader market posted gains, with the US Software industry achieving returns of 23.1%, highlighting SentinelOne's current underperformance relative to its peers. Although SentinelOne is poised for revenue growth with analyst forecasts predicting substantial increases over the coming years, its earnings are expected to remain negative for the immediate future, which may temper investor enthusiasm.

The current share price of US$17.72 reveals a significant discount to the analyst consensus price target of US$23.01, suggesting potential upside if analyst expectations of revenue surpassing US$1 billion materialize and if profit margin trends align with industry averages. However, with projected revenue growth and existing profitability challenges, investors will be watching closely to see if the company's strategic initiatives translate into tangible financial improvements that align with these forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives