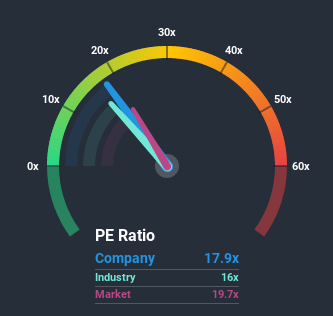

With a median price-to-earnings (or "P/E") ratio of close to 20x in New Zealand, you could be forgiven for feeling indifferent about Seeka Limited's (NZSE:SEK) P/E ratio of 17.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for Seeka as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Seeka

How Is Seeka's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Seeka's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. As a result, earnings from three years ago have also fallen 66% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the sole analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 5.9% per annum, which is noticeably less attractive.

With this information, we find it interesting that Seeka is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Seeka's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Seeka (2 don't sit too well with us!) that you need to be mindful of.

You might be able to find a better investment than Seeka. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you decide to trade Seeka, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NZSE:SEK

Seeka

Provides orchard lease and management, and post-harvest and retail services to the horticulture industry in New Zealand and Australia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives