- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (CRM) Expands AI-Driven Customer Experiences Through Deeper NiCE Collaboration

Reviewed by Simply Wall St

Salesforce (CRM) took a 6% dip in its share price last week amidst a backdrop of positive market trends, with the S&P 500 and Nasdaq hitting record highs. While the company announced an expanded partnership with NiCE to integrate AI-driven services into its Service Cloud, this development seemed at odds with the broader market momentum and didn't provide enough uplift to counteract the decline. Additionally, Sprout Social's collaboration with Salesforce, enhancing social media management capabilities, could have added positive weight but was insufficient to alter the price trajectory significantly.

Buy, Hold or Sell Salesforce? View our complete analysis and fair value estimate and you decide.

The recent partnership and collaboration announcements involving Salesforce may impact its strategic direction by enhancing AI capabilities and expanding their Service Cloud offerings. However, despite these developments, the company's short-term share price reaction—falling by 6% amidst broader market growth—suggests possible investor skepticism or perceived execution risk. This news relates to Salesforce's long-term narrative as it seeks to leverage new technologies for growth, though challenges remain given the competitive landscape and the transition to new pricing models.

Looking at the bigger picture, over a three-year period, Salesforce's total shareholder return was 23.26%, reflecting a solid performance. However, over the past year, the company underperformed both the US market and the US Software industry, which saw returns of 19.6% and 32.8%, respectively. This contrast may indicate short-term challenges or market sentiment that hasn't yet fully recognized the potential long-term benefits of recent strategic initiatives.

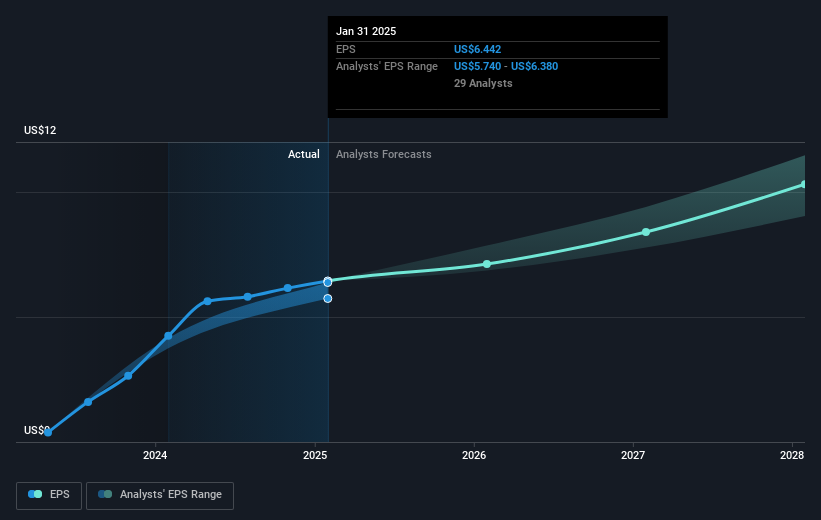

The recent news may influence revenue and earnings forecasts by potentially enhancing revenue streams through integrated AI-driven services. Yet, the immediate impact on financial projections may be muted given existing risks such as economic headwinds and competitive pressures. Salesforce's current US$231.66 share price represents a substantial discount to the consensus price target of US$349.411, suggesting significant upside potential if the company can capitalize on its strategic initiatives while mitigating associated risks. Investors should weigh these dynamics when evaluating Salesforce's future performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives