- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

RTX (NYSE:RTX) Successfully Demonstrates Barracuda Mine Neutralization Vehicle in Narragansett Bay

Reviewed by Simply Wall St

Raytheon's recent achievement with its Barracuda mine neutralization vehicle underscores its dedication to advancing defense technologies. RTX (NYSE:RTX) shares saw a 21% increase over the last quarter, an impressive move given the market's flat performance amidst tariff uncertainties. While the Barracuda's success likely bolstered investor confidence, other events like successful rocket motor tests and strategic partnerships would have reinforced this momentum. Even though the broader market remained steady, these developments from Raytheon provided counterweight optimism, aligning the company's performance with significant advancements in its military technology offerings.

Find companies with promising cash flow potential yet trading below their fair value.

The recent advancements in Raytheon's Barracuda mine neutralization vehicle and other defense initiatives, such as successful rocket motor tests, are integral to the company's narrative of strong organic sales growth and margin expansion. These technological innovations could catalyze future revenue and earnings growth by bolstering operational efficiency and fulfilling growing defense demands. Over the past five years, Raytheon's total shareholder return, which includes share price appreciation and dividends, amounted to 177.50%, a significant achievement showing consistent value delivery to investors. In the past year, RTX's performance surpassed both the US Aerospace & Defense industry, which returned 41%, and the broader US market, which saw a 12.5% return.

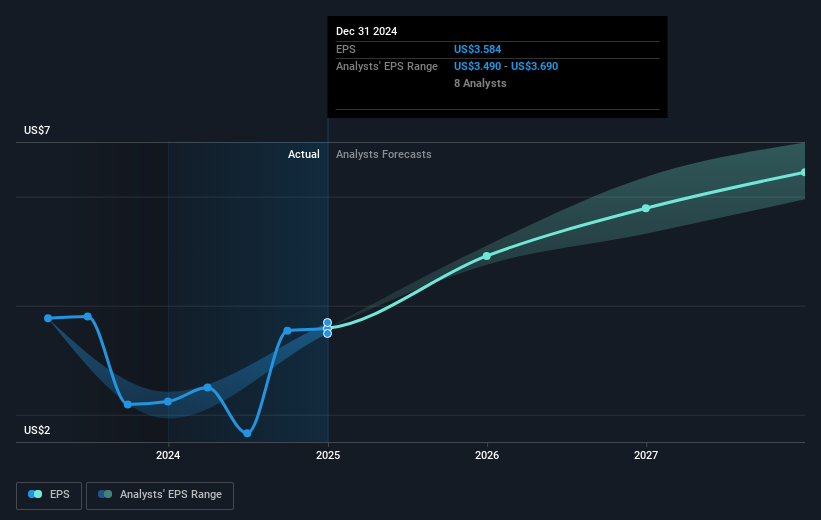

The company's efforts to enhance U.S. manufacturing and supply chain efficiency suggest a focus on long-term revenue stability amidst regulatory and market risks. Analysts project RTX's revenue to increase by 4.6% annually, with earnings growth meanwhile predicted to reach 14.31% per year. The stock's current share price of $128.16 reflects a slight discount when compared to the analyst consensus price target of $137.93, indicating potential upward movement if forecasts hold true. Given this context, Raytheon's initiatives and strategic alignments affirm its trajectory towards sustained growth in an industry where global defense expenditure is amplifying demand.

Explore historical data to track RTX's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives