- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Regeneron Pharmaceuticals (NasdaqGS:REGN) Adopts Innovative Technology for Faster Drug Discovery

Reviewed by Simply Wall St

Regeneron Pharmaceuticals (NasdaqGS:REGN) recently entered a licensing agreement with Telesis Bio Inc. to implement the Gibson SOLA™ platform, aiming to boost the company’s efficiency in the biotech sector. This development, along with robust clinical trial outcomes for its drug linvoseltamab, reflects the company's commitment to advancing its therapeutic capabilities. Despite these promising updates, the stock’s movement remained flat over the past month, aligning with broader market trends where major indexes also showed minimal movement. This suggests that while company-specific events unfolded, they did not noticeably influence its share price against the overall market backdrop.

The recent licensing agreement between Regeneron Pharmaceuticals and Telesis Bio Inc. could significantly enhance Regeneron's operational efficiency and speed up its R&D processes. This collaboration, along with positive clinical outcomes for linvoseltamab, positions the company well for expanding its drug portfolio, thereby potentially boosting both revenue and earnings in the future. Despite being integral developments, these strategic moves have yet to reflect in the short-term stock movement, as both the market and Regeneron’s share price have shown little fluctuation recently.

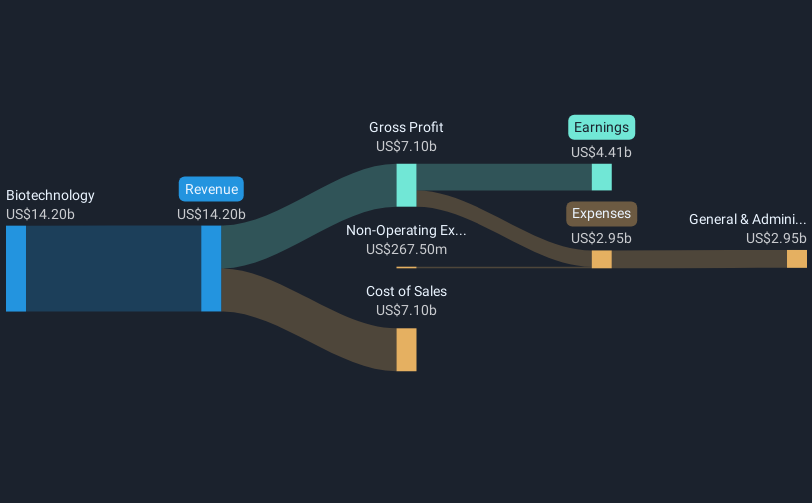

Over the longer term, however, Regeneron's shares have not fared as well, posting a total return decline of 2.06% over the past five years. In contrast, over the past year alone, Regeneron's performance, with earnings and revenue growth forecasts of 7.44% and 5.9% per year respectively, has lagged both the broader U.S. market and the biotech industry, which returned 11.3% and a decline of 10.4% respectively. These comparisons underscore the competitive and regulatory pressures Regeneron faces, which could constrict growth despite a promising pipeline.

Analysts' consensus projects a price target of US$790.88, significantly higher than the current share price of US$558.52, suggesting an intrinsic value not fully recognized by the market. If the company’s strategic initiatives, such as the licensing of the Gibson SOLA™ platform, deliver on their potential benefits, we may anticipate a more positive impact on future revenue and earnings. Nevertheless, the price-to-earnings ratio required to meet bullish analyst targets sits above industry averages, indicating heightened expectations. As projections for revenue and earnings growth are met, it could warrant a reevaluation of the share price in light of future profitability and expansion capabilities.

Learn about Regeneron Pharmaceuticals' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives