- United States

- /

- Pharma

- /

- NasdaqCM:RGC

Regencell Bioscience Holdings (NasdaqCM:RGC) Announces 38:1 Stock Split Effective June 2025

Reviewed by Simply Wall St

Regencell Bioscience Holdings (NasdaqCM:RGC) recently announced a significant 38:1 stock split with an additional stock dividend, effective June 16, 2025. This announcement has played a key role in the company's extraordinary share price increase of approximately 4006% over the past quarter. While the broader market faced fluctuations due to geopolitical tensions, particularly with oil prices reacting to Middle East conflicts, Regencell's impressive rise contrasts sharply with these events. In a quarter where market movements were influenced by global uncertainties, RGC's internal strategies and announcements have evidently set it apart from broader market dynamics.

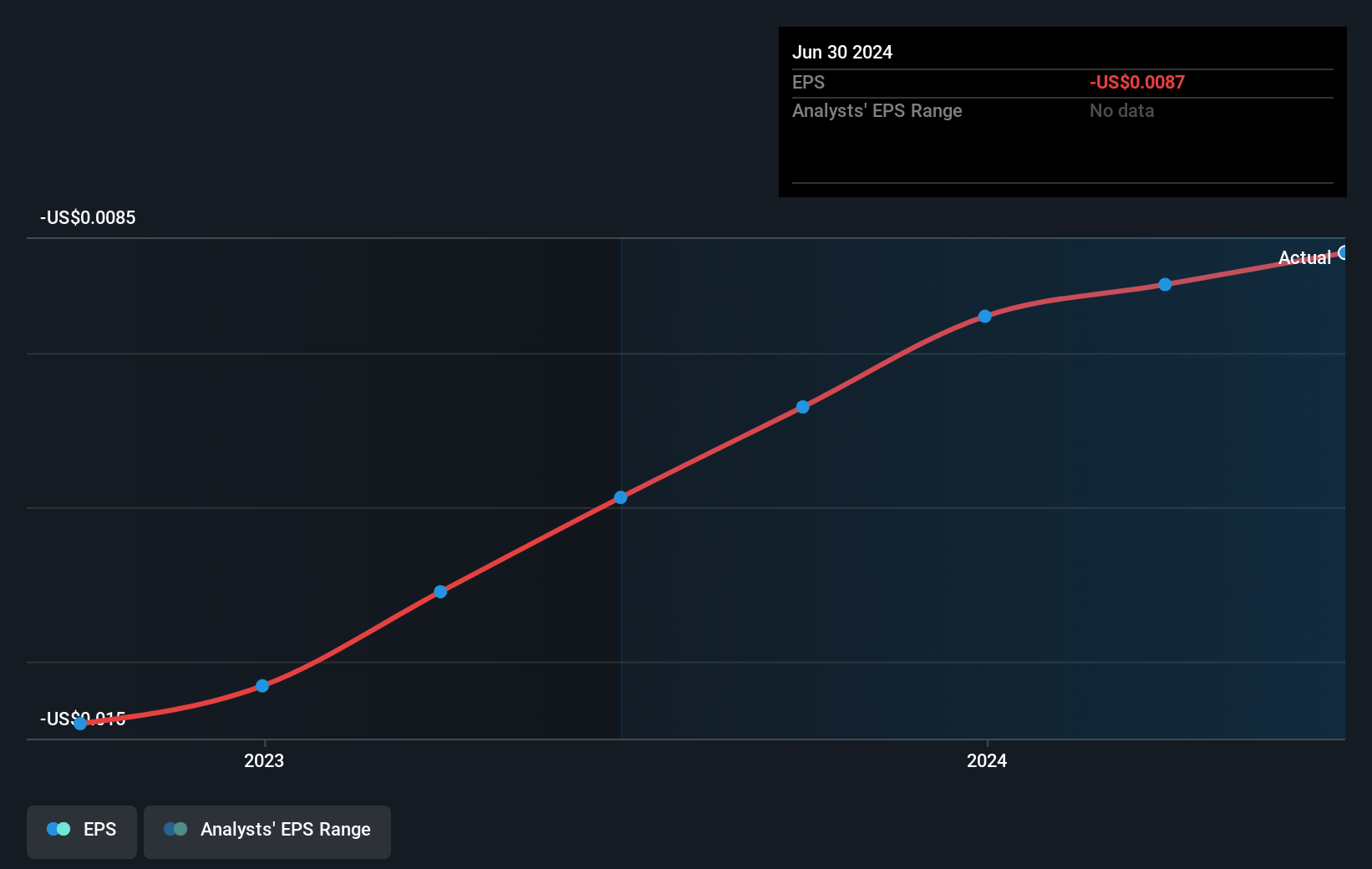

Examining Regencell Bioscience Holdings' performance over the last year, the company's total shareholder return, including share price appreciation and dividends, reached a very large percentage. This contrasts with the broader market's 10.4% return and the -10% return in the US Pharmaceuticals industry over the same period. Such a remarkable gain is partly attributed to the recent 38:1 stock split and stock dividend, which fueled significant investor interest and sharply elevated share prices in relation to earnings improvement.

Despite recent positive news, Regencell remains unprofitable, with earnings and revenue figures indicating ongoing challenges. The substantial share price increase has not translated into equally impressive financial metrics, as reflected by the lack of data regarding fair value estimates or revenue forecasts. The recent actions may impact future earnings forecasts, but further analysis is necessary to determine their long-term financial effect. Without a clear price target consensus, interpreting the price movement relative to expected valuations remains speculative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGC

Regencell Bioscience Holdings

Operates as a Traditional Chinese medicine (TCM) bioscience company in Hong Kong.

Adequate balance sheet slight.

Market Insights

Community Narratives