- United States

- /

- Pharma

- /

- NasdaqGM:RETA

Reata Pharmaceuticals's (NASDAQ:RETA) Wonderful 454% Share Price Increase Shows How Capitalism Can Build Wealth

For us, stock picking is in large part the hunt for the truly magnificent stocks. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. For example, the Reata Pharmaceuticals, Inc. (NASDAQ:RETA) share price is up a whopping 454% in the last three years, a handsome return for long term holders. On top of that, the share price is up 13% in about a quarter.

Check out our latest analysis for Reata Pharmaceuticals

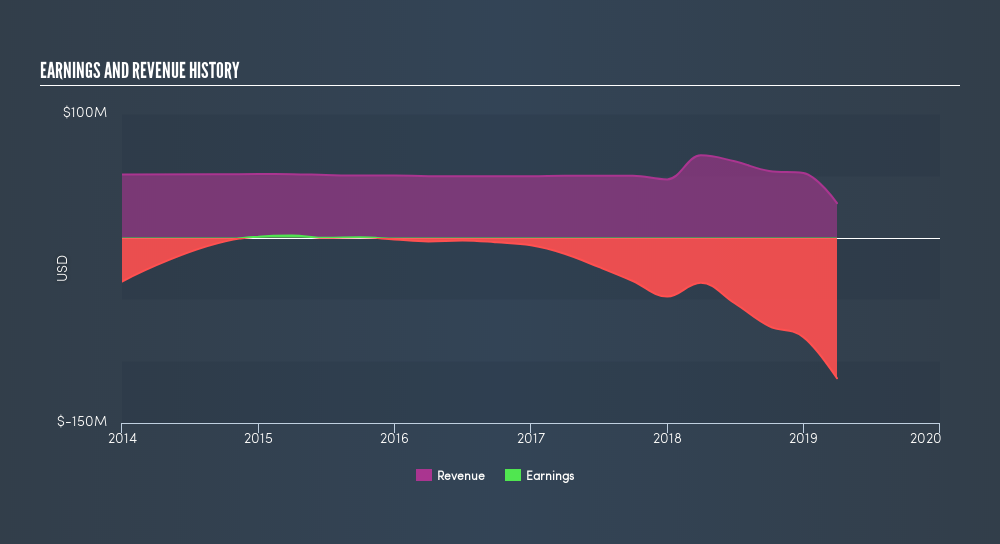

Because Reata Pharmaceuticals is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Reata Pharmaceuticals saw its revenue shrink by 1.5% per year. This is in stark contrast to the strong share price growth of 77%, compound, per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Reata Pharmaceuticals will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Reata Pharmaceuticals rewarded shareholders with a total shareholder return of 13% over the last year. The TSR has been even better over three years, coming in at 77% per year. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Reata Pharmaceuticals by clicking this link.

Reata Pharmaceuticals is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:RETA

Reata Pharmaceuticals

Reata Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, identifies, develops, and commercializes novel therapeutics for patients with serious or life-threatening diseases.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives