- Switzerland

- /

- Real Estate

- /

- SWX:ALLN

Read This Before You Buy Allreal Holding AG (VTX:ALLN) Because Of Its P/E Ratio

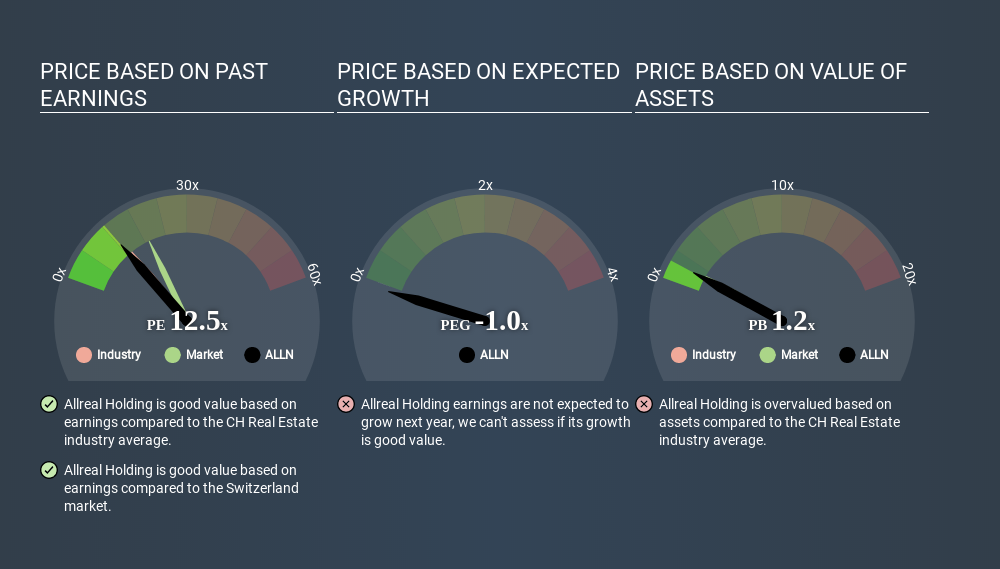

This article is written for those who want to get better at using price to earnings ratios (P/E ratios). We'll apply a basic P/E ratio analysis to Allreal Holding AG's (VTX:ALLN), to help you decide if the stock is worth further research. What is Allreal Holding's P/E ratio? Well, based on the last twelve months it is 12.82. That means that at current prices, buyers pay CHF12.82 for every CHF1 in trailing yearly profits.

View our latest analysis for Allreal Holding

How Do I Calculate A Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Allreal Holding:

P/E of 12.82 = CHF189.400 ÷ CHF14.777 (Based on the year to December 2019.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High P/E Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each CHF1 the company has earned over the last year. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

Does Allreal Holding Have A Relatively High Or Low P/E For Its Industry?

The P/E ratio essentially measures market expectations of a company. As you can see below Allreal Holding has a P/E ratio that is fairly close for the average for the real estate industry, which is 13.6.

Allreal Holding's P/E tells us that market participants think its prospects are roughly in line with its industry. So if Allreal Holding actually outperforms its peers going forward, that should be a positive for the share price. Further research into factors such as insider buying and selling, could help you form your own view on whether that is likely.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. When earnings grow, the 'E' increases, over time. And in that case, the P/E ratio itself will drop rather quickly. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Notably, Allreal Holding grew EPS by a whopping 46% in the last year. And it has bolstered its earnings per share by 18% per year over the last five years. So we'd generally expect it to have a relatively high P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. That means it doesn't take debt or cash into account. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Is Debt Impacting Allreal Holding's P/E?

Allreal Holding's net debt is 65% of its market cap. If you want to compare its P/E ratio to other companies, you should absolutely keep in mind it has significant borrowings.

The Bottom Line On Allreal Holding's P/E Ratio

Allreal Holding trades on a P/E ratio of 12.8, which is below the CH market average of 18.9. The company has a meaningful amount of debt on the balance sheet, but that should not eclipse the solid earnings growth. If it continues to grow, then the current low P/E may prove to be unjustified.

Investors have an opportunity when market expectations about a stock are wrong. If the reality for a company is not as bad as the P/E ratio indicates, then the share price should increase as the market realizes this. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

But note: Allreal Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SWX:ALLN

Allreal Holding

Through its subsidiaries, engages in real estate business in Switzerland.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion