Could TOD'S S.p.A. (BIT:TOD) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

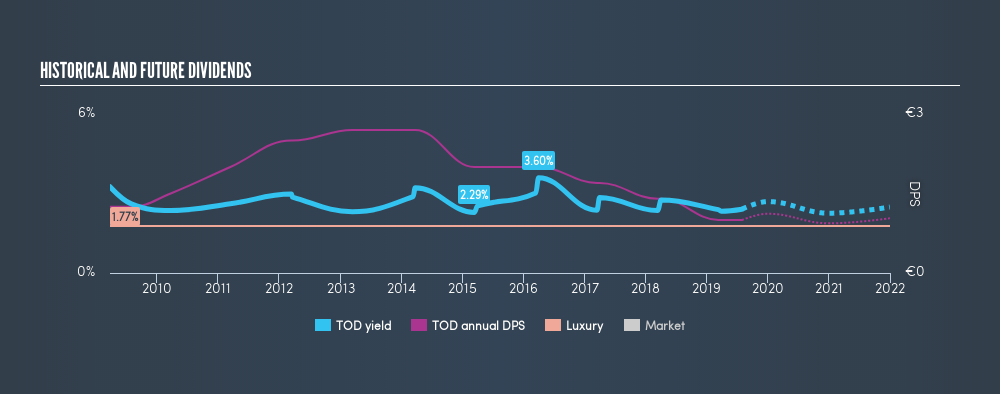

A slim 2.4% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, TOD'S could have potential. Some simple analysis can reduce the risk of holding TOD'S for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, TOD'S paid out 70% of its profit as dividends. A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Unfortunately, while TOD'S pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of TOD'S's dividend payments. The dividend has been cut by more than 20% on at least one occasion historically. During the past ten-year period, the first annual payment was €1.25 in 2009, compared to €1.00 last year. This works out to be a decline of approximately 2.2% per year over that time. TOD'S's dividend has been cut sharply at least once, so it hasn't fallen by 2.2% every year, but this is a decent approximation of the long term change.

We struggle to make a case for buying TOD'S for its dividend, given that payments have shrunk over the past ten years.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though TOD'S's EPS have declined at around 20% a year. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and TOD'S's earnings per share, which support the dividend, have been anything but stable.

Conclusion

To summarise, shareholders should always check that TOD'S's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, the company has a payout ratio that was within an average range for most dividend stocks, but it paid out virtually all of its generated cash flow. Second, earnings per share have been essentially flat, and its history of dividend payments is chequered - having cut its dividend at least once in the past. In this analysis, TOD'S doesn't shape up too well as a dividend stock. We'd find it hard to look past the flaws, and would not be inclined to think of it as a reliable dividend-payer.

Given that earnings are not growing, the dividend does not look nearly so attractive. Businesses can change though, and we think it would make sense to see what analysts are forecasting for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BIT:TOD

TOD'S

TOD'S S.p.A., together with its subsidiaries, creates, produces, and distributes shoes, leather goods and accessories, and apparel in Italy, rest of Europe, the Americas, Greater China, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion