- India

- /

- Energy Services

- /

- NSEI:ALPHAGEO

Read This Before Buying Alphageo (India) Limited (NSE:ALPHAGEO) For Its Dividend

Dividend paying stocks like Alphageo (India) Limited (NSE:ALPHAGEO) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

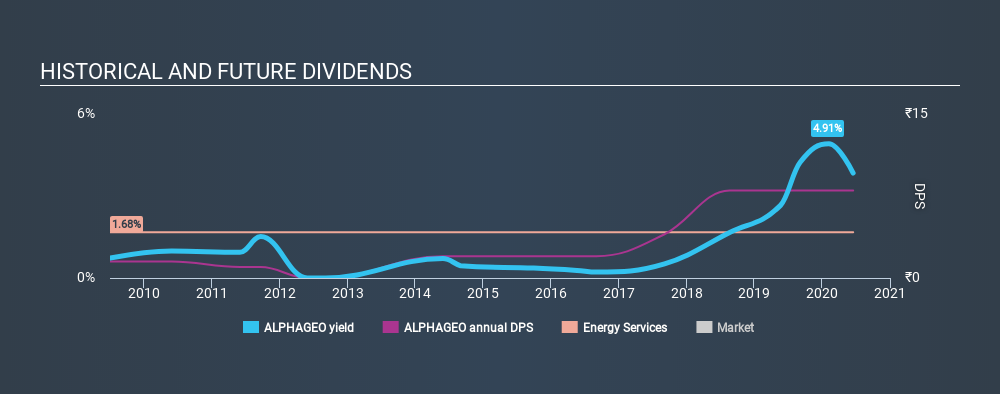

A high yield and a long history of paying dividends is an appealing combination for Alphageo (India). It would not be a surprise to discover that many investors buy it for the dividends. Remember though, due to the recent spike in its share price, Alphageo (India)'s yield will look lower, even though the market may now be factoring in an improvement in its long-term prospects. Some simple analysis can reduce the risk of holding Alphageo (India) for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 18% of Alphageo (India)'s profits were paid out as dividends in the last 12 months. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Last year, Alphageo (India) paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

While the above analysis focuses on dividends relative to a company's earnings, we do note Alphageo (India)'s strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Alphageo (India)'s latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Alphageo (India)'s dividend payments. The dividend has been cut on at least one occasion historically. During the past ten-year period, the first annual payment was ₹1.50 in 2010, compared to ₹8.00 last year. This works out to be a compound annual growth rate (CAGR) of approximately 18% a year over that time. Alphageo (India)'s dividend payments have fluctuated, so it hasn't grown 18% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

Alphageo (India) has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, but it might be worth considering if the business has turned a corner.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Alphageo (India)'s earnings per share have been essentially flat over the past five years. Flat earnings per share are acceptable for a time, but over the long term, the purchasing power of the company's dividends could be eroded by inflation.

Conclusion

To summarise, shareholders should always check that Alphageo (India)'s dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Firstly, the company has a conservative payout ratio, although we'd note that its cashflow in the past year was substantially lower than its reported profit. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. In summary, Alphageo (India) has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are a number of better ideas out there.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 5 warning signs for Alphageo (India) that investors need to be conscious of moving forward.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:ALPHAGEO

Alphageo (India)

Provides geophysical seismic data acquisition, processing, and interpretation services for exploration of hydrocarbons and minerals in India.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives