- United States

- /

- Electric Utilities

- /

- NYSE:POR

Portland General Electric (NYSE:POR) Has A Somewhat Strained Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Portland General Electric Company (NYSE:POR) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Portland General Electric

How Much Debt Does Portland General Electric Carry?

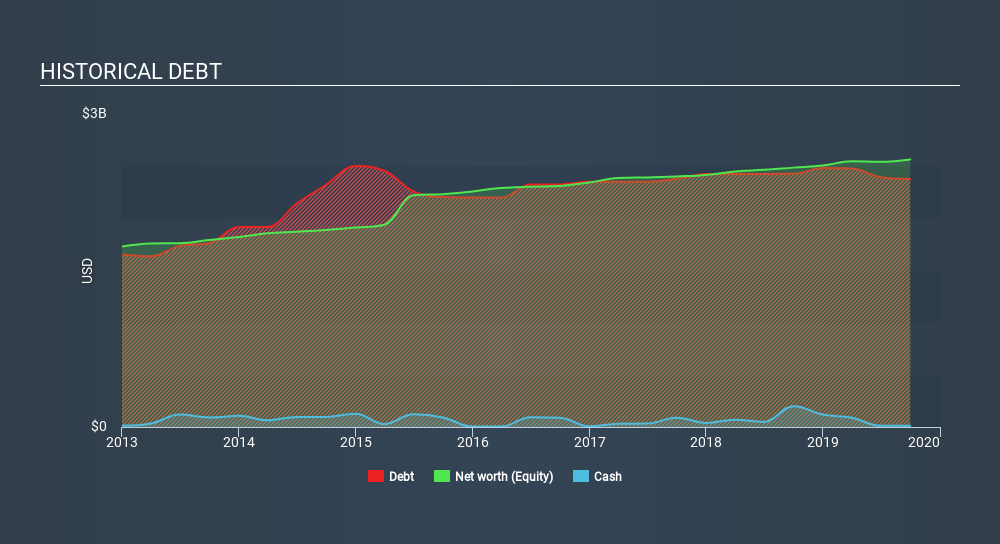

The image below, which you can click on for greater detail, shows that at September 2019 Portland General Electric had debt of US$2.38b, up from US$2.4k in one year. And it doesn't have much cash, so its net debt is about the same.

How Healthy Is Portland General Electric's Balance Sheet?

The latest balance sheet data shows that Portland General Electric had liabilities of US$514.0m due within a year, and liabilities of US$5.08b falling due after that. On the other hand, it had cash of US$11.0m and US$234.0m worth of receivables due within a year. So it has liabilities totalling US$5.35b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of US$5.00b, we think shareholders really should watch Portland General Electric's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Portland General Electric's debt to EBITDA ratio (3.3) suggests that it uses some debt, its interest cover is very weak, at 2.4, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Another concern for investors might be that Portland General Electric's EBIT fell 10% in the last year. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Portland General Electric can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Portland General Electric created free cash flow amounting to 13% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

To be frank both Portland General Electric's level of total liabilities and its track record of covering its interest expense with its EBIT make us rather uncomfortable with its debt levels. And even its conversion of EBIT to free cash flow fails to inspire much confidence. We should also note that Electric Utilities industry companies like Portland General Electric commonly do use debt without problems. Overall, it seems to us that Portland General Electric's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Given our hesitation about the stock, it would be good to know if Portland General Electric insiders have sold any shares recently. You click here to find out if insiders have sold recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:POR

Portland General Electric

An integrated electric utility company, engages in the generation, wholesale purchase, transmission, distribution, and retail sale of electricity in the state of Oregon.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives