- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Partners With TeleTracking To Transform Healthcare Operations

Reviewed by Simply Wall St

Palantir Technologies (NasdaqGS:PLTR) has experienced a significant price move with a 41% increase over the last quarter. This bullish trend aligns with broader market optimism, as the S&P 500 reached 6,000 points for the first time since February, fueled by a strong May jobs report and easing of tariff concerns. A key development for Palantir was its strategic partnership with TeleTracking Technologies, aimed at transforming decision-making in healthcare, which likely bolstered investor confidence. Other collaborations, including those with Bain & Company and Divergent Technologies, along with positive earnings reports, may have supported the company's upward trajectory.

We've spotted 2 warning signs for Palantir Technologies you should be aware of.

Over the past three years, Palantir Technologies has achieved a total return of 1281.45%, reflecting a very large appreciation in shareholder value. In relation to the US software industry over the last year, Palantir's performance surpassed the industry's return of 21.9%. Similarly, it outperformed the broader US market, which delivered an 11% return in the same period.

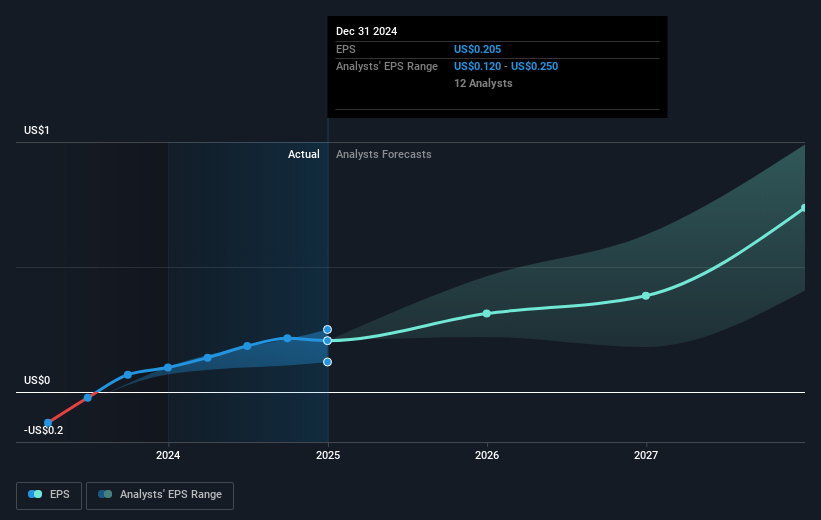

The recently announced partnerships and positive financial updates are likely to influence revenue and earnings forecasts, with increased collaborative efforts potentially driving future growth. The full-year revenue guidance for 2025 has been increased to a range between US$3.89 billion and US$3.902 billion, indicating robust business expectations. Earnings are forecasted to grow by 30.57% per year, which could be partly attributed to these strategic alliances.

Despite this impressive growth, Palantir's current price reflects a premium compared to its consensus analyst price target of US$100.19. This situation presents a discount of 16.45% from the target, suggesting that the market may have already priced in much of Palantir’s projected growth, requiring careful consideration of its valuation relative to future prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives