- United States

- /

- Insurance

- /

- NYSE:OSCR

Oscar Health (OSCR) Reports US$228 Million Q2 Loss After Last Year's Profit

Reviewed by Simply Wall St

Oscar Health (OSCR) recently announced significant financial challenges with a net loss of USD 228 million for the second quarter, a marked decline from last year's net income. Despite this, the company's stock price increased 2% over the past week. This price movement unfolds amidst a generally rising market, as major indexes such as the S&P 500 and Nasdaq Composite recorded gains. Oscar’s financial difficulties, reflected in their earnings report, could have influenced the stock negatively; however, the broader market momentum may have offered some support, counterbalancing potential downward pressures from the latest earnings revelations.

You should learn about the 2 risks we've spotted with Oscar Health.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

The recent news of Oscar Health's financial challenges might impact the ongoing narrative that highlights its expansion into new markets and AI integration as pathways to efficiency and growth. While the company's net loss for the quarter signals challenges, its stock's weekly rise suggests market optimism, potentially due to broader market conditions or investor confidence in its strategic plans. Moreover, over the past three years, Oscar's total shareholder return, including dividends, surged by 121.30%, suggesting a strong past performance that provides a broader context for evaluating its recent price movements.

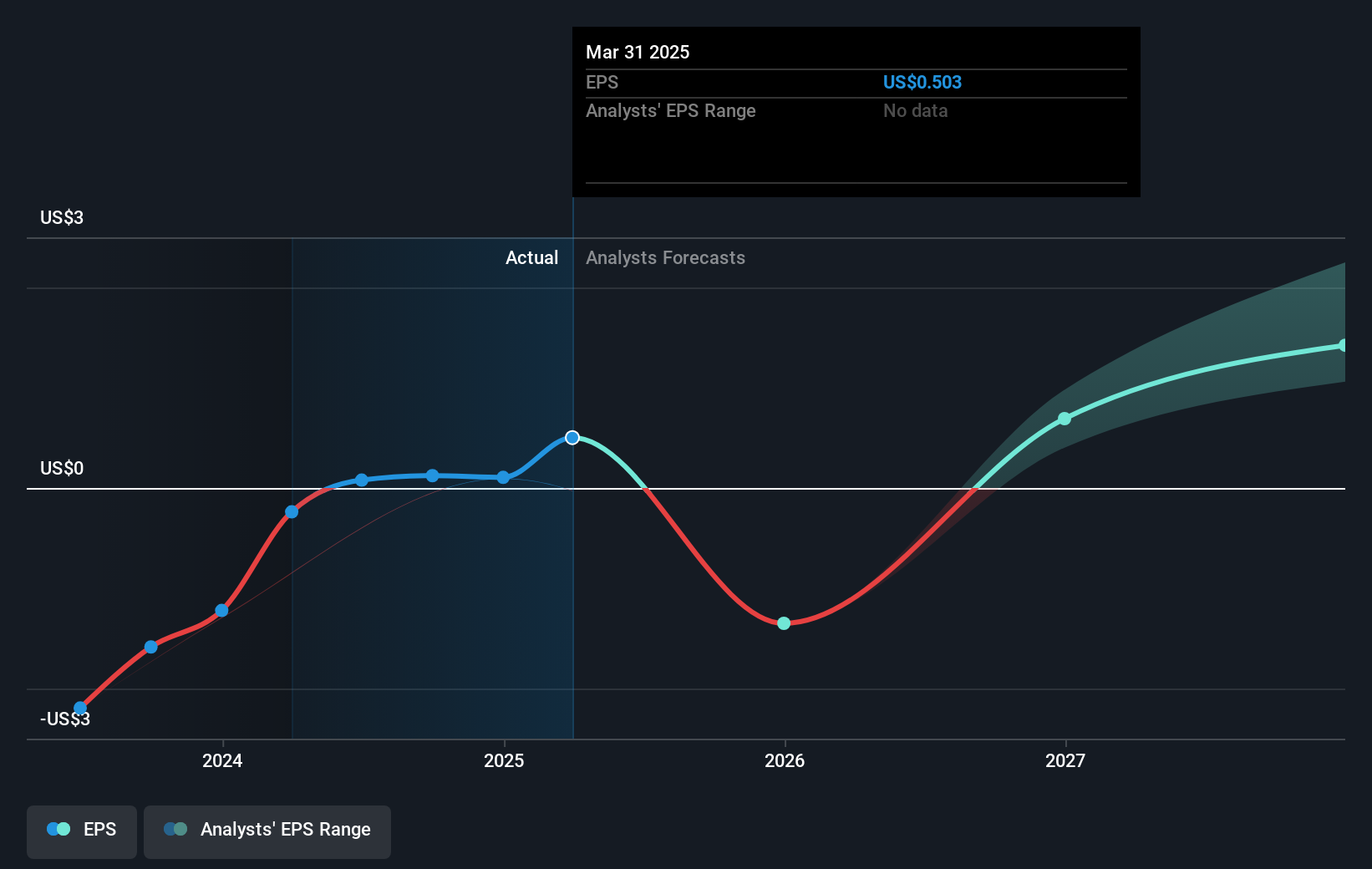

In contrast to its longer-term gains, Oscar Health underperformed relative to the US Insurance industry over the past year, which achieved returns of 8.5%. This divergence may partly reflect market expectations on Oscar's ability to overcome regulatory and cost challenges outlined in analysts’ forecasts. These issues could influence revenue and earnings expectations, adding risk to assumptions about future growth and profitability.

The current share price of US$14.34, sitting above the consensus price target of US$14.24, indicates a potential overvaluation by the market, considering the associated risks. The price target suggests that analysts, on average, see limited upside, reflecting concerns around achieving the anticipated annual revenue growth of 7% and improvements in profit margins. The unfolding financial news and its future impact underline the importance of closely monitoring Oscar Health's strategic maneuvers and operational efficiency efforts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives