- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Strengthens Partner Network With Vertex Collaboration For Tax Automation

Reviewed by Simply Wall St

Vertex Inc.'s inclusion in Oracle's Enhanced Partner Program highlights a significant development, as this collaboration aims to bolster tax automation within ERP systems. Over the past month, Oracle (NYSE:ORCL) experienced an 18% price increase, a move that aligns with broader market gains influenced by easing inflation concerns and progress in China-US trade talks. Oracle's recent collaborations and product advancements contributed positively to this trend, providing additional weight to the overall upward market trajectory. As the S&P 500 and Nasdaq indices saw continuous gains, Oracle's growth was in step with the favorable market environment.

We've spotted 1 weakness for Oracle you should be aware of.

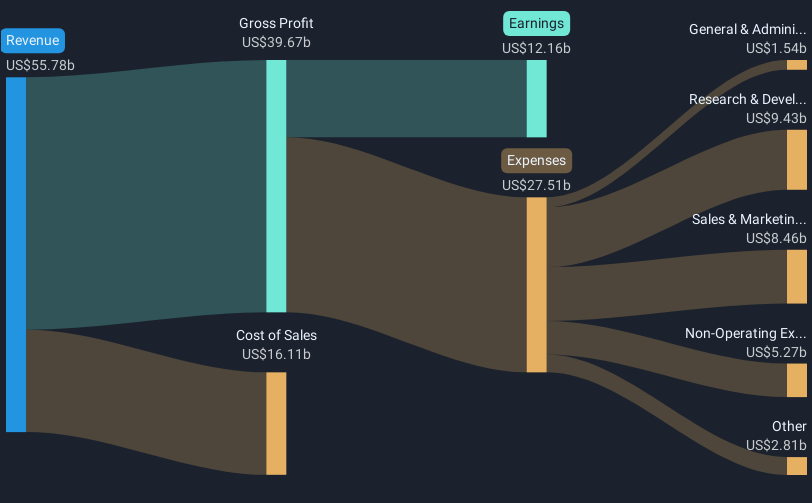

The inclusion of Vertex Inc. in Oracle's Enhanced Partner Program is expected to positively impact Oracle's cloud services revenue and earnings forecasts. This collaboration aims to improve tax automation within ERP systems, potentially increasing client adoption and boosting long-term growth. Oracle's shares have shown robust longer-term performance, with a total return of over 250% over five years, highlighting its strong position in the market. Over the past year, Oracle has outperformed both the S&P 500 and Nasdaq indices, reflecting its resilience and investor confidence amid broader market gains.

The partnership with Vertex Inc. could fuel further revenue growth through enhanced service offerings, aligning with Oracle's cloud region expansion and increased power capacity strategy. This is expected to support analysts' forecasts of a 15.8% annual revenue growth over the next three years, along with improved profit margins. Oracle is trading at approximately US$147.70, with analysts setting a consensus price target of US$180.58, implying a potential upside of about 17.1%. This price movement suggests that current and future strategic initiatives, including the Vertex partnership, are factored into Oracle's growth trajectory, supporting investor optimism regarding its market potential.

Click to explore a detailed breakdown of our findings in Oracle's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives