- India

- /

- Construction

- /

- NSEI:OMINFRAL

Om Metals Infraprojects Limited's (NSE:OMMETALS) Subdued P/E Might Signal An Opportunity

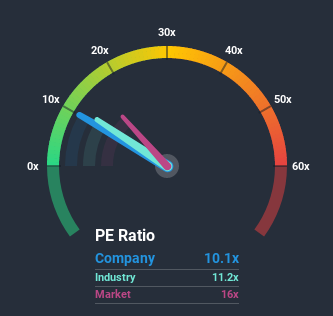

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 17x, you may consider Om Metals Infraprojects Limited (NSE:OMMETALS) as an attractive investment with its 10.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

We'd have to say that with no tangible growth over the last year, Om Metals Infraprojects' earnings have been unimpressive. It might be that many expect the uninspiring earnings performance to accelerate to the downside, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Om Metals Infraprojects

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Om Metals Infraprojects would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Regardless, EPS has managed to lift by a handy 29% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

It's interesting to note that the rest of the market is similarly expected to grow by 11% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Om Metals Infraprojects is trading at a P/E lower than the market. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Om Metals Infraprojects' P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Om Metals Infraprojects revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about these 5 warning signs we've spotted with Om Metals Infraprojects (including 1 which makes us a bit uncomfortable).

If you're unsure about the strength of Om Metals Infraprojects' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you decide to trade Om Metals Infraprojects, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:OMINFRAL

Om Infra

Engages in the design, detail engineering, manufacture, supply, installation, testing, and commissioning of hydro mechanical equipment for hydroelectric power and irrigation projects in India and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion