- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Oklo (OKLO) Advances With New U.S. Nuclear Regulatory Approval

Reviewed by Simply Wall St

Recently, Oklo (OKLO) has caught the investment spotlight with a 48% price increase over the past quarter, underpinned by vital developments. The company announced a memorandum of understanding with ABB to advance electrification and automation. Additionally, receiving acceptance from the U.S. Nuclear Regulatory Commission for a new licensing framework enhances the potential operational agility for its Aurora powerhouses. Meanwhile, the market backdrop saw technology stocks struggle and indexes retreat slightly from record highs, potentially offsetting Oklo's strategic momentum. Nonetheless, Oklo's proactive initiatives position it favorably against the mixed signals in broader market performances.

We've identified 6 weaknesses for Oklo (2 shouldn't be ignored) that you should be aware of.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

Over the past year, Oklo's shares have soared by a very large percentage, marking a significant longer-term achievement for the company. In comparison, Oklo's 1-year total shareholder return exceeded the US Electric Utilities industry's return of 9.8% and the US market's return of 17.2%. This impressive performance highlights Oklo's potential resilience and appeal to investors despite broader industry challenges.

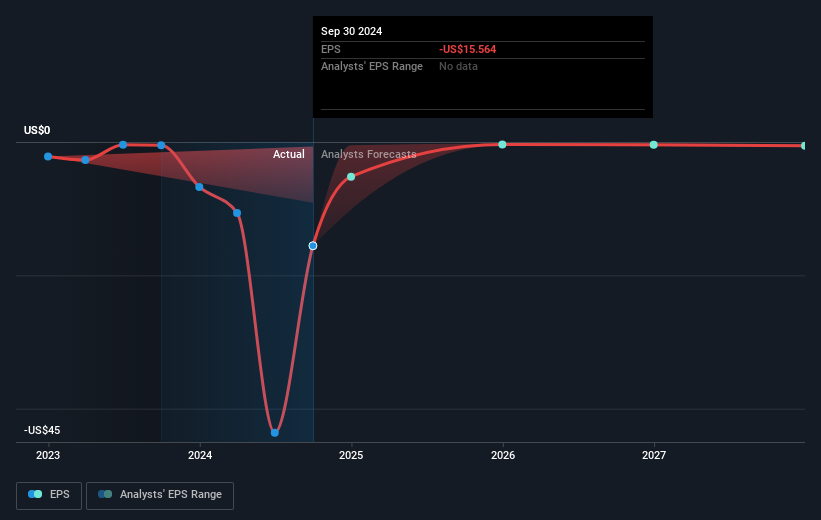

While Oklo's recent announcements and regulatory advancements promise future operational successes, its current revenue remains nonexistent, with forecasts expecting continued unprofitability over the next 3 years. This scenario puts pressure on earnings forecasts and does not immediately translate into favorable revenue outlooks. Meanwhile, the company's current share price of US$77.89 exceeds the analyst consensus price target of US$70.95, indicating a potential overvaluation. Despite strategic partnerships and promising regulatory developments, the market's anticipation of future results appears high, setting a challenging benchmark for Oklo as it strives to meet investor expectations.

Understand Oklo's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet with medium-low risk.

Similar Companies

Market Insights

Community Narratives