- United States

- /

- Electric Utilities

- /

- NYSE:OKLO

Oklo (NYSE:OKLO) Subsidiary Advances Radioisotope Facility Plans at Idaho National Laboratory

Reviewed by Simply Wall St

Oklo (NYSE:OKLO) recently commenced site characterization for a new facility at the Idaho National Laboratory, marking a significant advancement in its expansion plans. This momentum in the development of advanced nuclear facilities contributed to a price movement of 124% over the last quarter. The introduction of $400 million in follow-on equity offerings could have fortified investor confidence. Also, securing a Notice of Intent to award a clean power project from DLA Energy underscored the company's strategic inroads in energy resilience. Despite geopolitical tensions affecting broader markets, Oklo’s advancements seemed to enhance its stand-out performance.

We've identified 4 warning signs for Oklo (1 is a bit unpleasant) that you should be aware of.

Over the past three years, Oklo Inc.’s shares achieved a very large total return of 547.78%, showcasing significant investor momentum beyond short-term fluctuations. In comparison, the company also outperformed the US Electric Utilities industry, which delivered a return of 15.2% over the past year. This substantial outperformance reflects investors' growing confidence in Oklo's initiatives, including its new facility at the Idaho National Laboratory and ongoing expansion efforts.

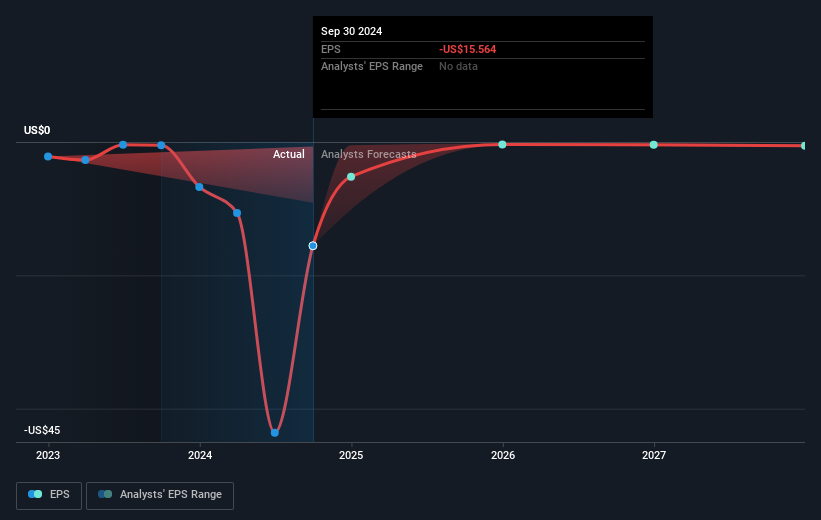

The introduction of a US$400 million follow-on equity offering could indicate strengthened investor trust, which may influence future revenue and earnings forecasts. However, Oklo remains forecast to be unprofitable over the next three years. Despite the current volatility in its share price, which has seen a 124% increase in the last quarter, the price sits below the consensus analyst price target of US$58.15. This creates a perspective of potential upside, though continued operational and financial milestones will be critical for aligning market expectations with investor sentiment.

Understand Oklo's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKLO

Oklo

Develops advanced fission power plants to provide clean, reliable, and affordable energy at scale to the customers in the United States.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives