- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Partners With DataRobot To Revolutionize AI Agent Workforce Management

Reviewed by Simply Wall St

In recent developments, DataRobot announced the launch of its Agent Workforce Platform, designed in collaboration with NVIDIA (NVDA), which incorporates the NVIDIA AI Enterprise software suite. This event might have positively influenced NVIDIA's 55% price increase over the last quarter. The company's stock movement fits within a broader market trend of increased interest in AI and technology partnerships, despite recent volatility related to President Trump's tariff moves and weak labor market data. While the broader market faced some obstacles, it remains true that NVIDIA's collaborative initiatives contribute to its continued prominence in the tech sector.

Every company has risks, and we've spotted 1 warning sign for NVIDIA you should know about.

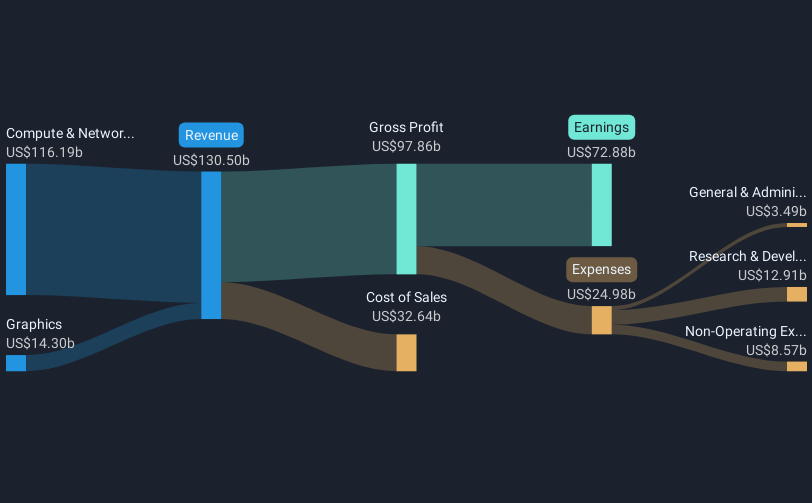

The recent collaboration between DataRobot and NVIDIA, creating the Agent Workforce Platform with NVIDIA's AI Enterprise, underscores the company's commitment to expanding AI applications. This partnership may bolster NVIDIA’s positioning in the AI sector, leveraging growing market interest in AI technologies to potentially enhance its revenue and earnings. Analysts forecast significant growth, projecting NVIDIA's earnings could reach US$162.5 billion by 2028, as enterprise sectors expand infrastructure investments in NVIDIA’s advanced technologies.

Over the past five years, NVIDIA has seen a very large total return of 1474.31%, reflecting substantial growth in a rapidly evolving tech landscape. Despite recent volatility in the broader market and the semiconductor industry facing a -0.6% decrease, NVIDIA's earnings grew an impressive 80.8% over the past year. This performance signals robust growth potential compared to the overall US market, which returned 16.8% during that period.

Currently, NVIDIA’s share price of US$177.87 is close to the analysts' consensus price target of about US$180.35, indicating a belief that the company is reasonably valued. The partnership with DataRobot could further solidify NVIDIA’s revenue streams, potentially leading to upward revisions in price targets as the AI sector continues to develop. However, risks such as regulatory challenges and shifts in geographic revenue stability remain considerations for investors evaluating NVIDIA's future performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives