- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Enhances Video Intelligence And CAD Systems For AI-Driven Innovation

Reviewed by Simply Wall St

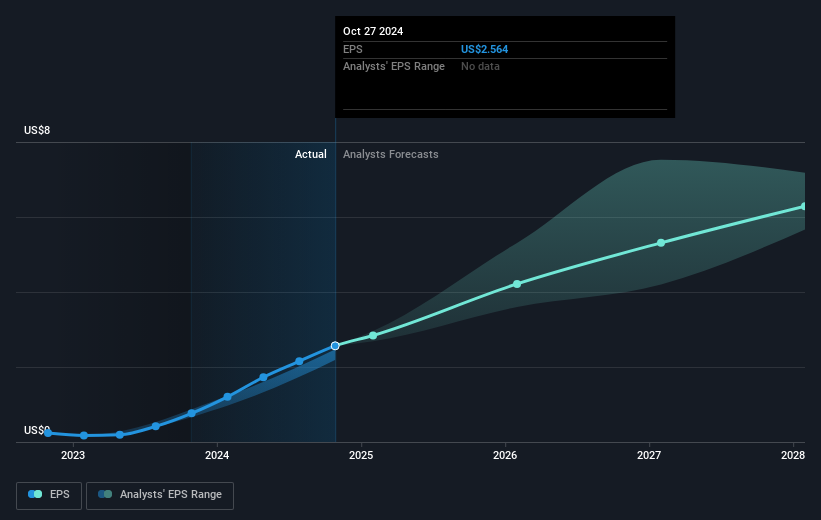

NVIDIA (NVDA) recently integrated Omniverse technologies with PTC and collaborated with onsemi on advanced AI data center power solutions. The company experienced a robust share price increase of 61% over the last quarter. This spike coincides with successful integrations, such as Avathon's adoption of NVIDIA's Video Search and Summarization capabilities, enhancing industrial efficiencies. Furthermore, strong earnings reports and strategic developments have likely amplified market optimism. While broader market trends exhibited moderate growth sparked by positive corporate earnings, NVIDIA’s specific alliances and technological advancements may have added buoyancy, positioning it advantageously in the AI and tech sectors.

Be aware that NVIDIA is showing 1 risk in our investment analysis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent integration of Omniverse technologies and collaboration on AI data center power solutions could bolster NVIDIA's narrative of expanding its AI presence, particularly in the automotive sector through partnerships with companies like Toyota and Uber. These developments align with the company's strategic focus on AI model scaling and data center growth, potentially enhancing revenue and margin forecasts. The successful integration efforts demonstrate NVIDIA's operational efficiency and may contribute positively to their projected financial performance.

Over the past five years, NVIDIA's shareholders have experienced a very large total return of 1468.33%, illustrating strong long-term growth. In the past year alone, NVIDIA outperformed the US semiconductor industry with an impressive performance, surpassing the industry's 1-year return of 48.8%. This robust performance underscores the company's position within the tech sector.

With the current share price at US$175.51, it's significantly higher than the previous valuation mentioned in the narrative, indicating investor confidence in recent strategic initiatives. However, it remains close to the consensus price target of US$180.35, suggesting limited upside according to some analysts. Despite this, NVIDIA's innovations and partnerships in AI and other tech sectors could influence upward revisions of revenue and earnings forecasts, justifying the share price movement. Investors should carefully weigh these developments and financial metrics when assessing the potential impact of recent news on NVIDIA's future performance.

The valuation report we've compiled suggests that NVIDIA's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives