- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Joins Dell And Trend Micro For AI-Powered Security Solutions

Reviewed by Simply Wall St

NVIDIA (NasdaqGS:NVDA) has recently partnered with Trend Micro and Dell Technologies to provide AI-powered security solutions, which align well with the ongoing demand for advanced tech solutions in increasingly complex IT environments. This collaboration may have complemented NVIDIA's 22.63% price increase over the last quarter, alongside its strong earnings report showing a major sales surge. Concurrently, strategic alliances with Sofinnova Partners and Firebird underline NVIDIA’s push into diverse sectors, strengthening its position in the AI and computing space. The company’s strategically-timed dividends and planned investment in PsiQuantum may have further added momentum to the stock's upward trajectory.

Be aware that NVIDIA is showing 1 weakness in our investment analysis.

The recent collaboration between NVIDIA, Trend Micro, and Dell Technologies is poised to enhance NVIDIA's AI-powered security offerings, potentially boosting future revenue streams. This partnership aligns with NVIDIA's expanding presence in advanced technology sectors, reinforcing its position in AI and computing. Considering NVIDIA's alliances with companies like Toyota and Uber to expand its AI footprint in the automotive sector, the company's ongoing partnerships suggest a multifaceted approach to capturing new markets and solidifying existing ones.

Over the past five years, NVIDIA's total shareholder return has been very large at 1430.11%, reflecting substantial long-term growth. However, when compared to the US market over the last year, NVIDIA underperformed, despite a shorter-term uptick in its stock price. This underperformance is part of the broader context involving industry trends and market conditions.

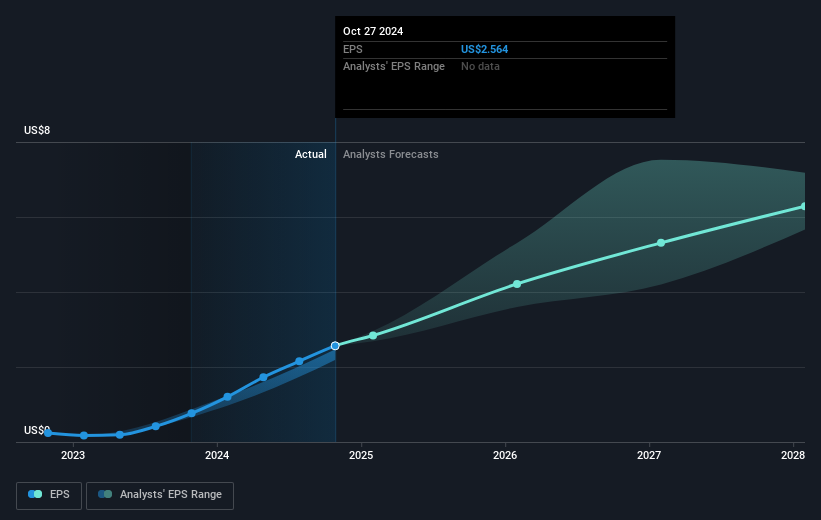

The recent partnership and product innovations suggest a positive impact on NVIDIA's revenue and earnings forecasts. Analysts expect significant revenue expansions, driven by NVIDIA's focus on AI models and its Blackwell architecture, which are anticipated to bolster its data center revenues and enhance its margins. However, regulatory challenges and potential export limitations could hinder geographic diversification efforts and stability in revenue streams.

The recent 22.63% share price increase highlights positive sentiment and aligns with a strategic shift in business focus. With a current share price of US$113.54, NVIDIA is priced below the consensus analyst target of US$163.12, indicating room for upward movement if future expectations materialize as analysts predict. This potential for growth, combined with operational efficiency in ramping production, positions NVIDIA as a competitive player in evolving tech markets.

Learn about NVIDIA's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion