- United States

- /

- Electric Utilities

- /

- NYSE:NRG

NRG Energy (NYSE:NRG) Drops From Multiple Russell Indexes In June 2025

Reviewed by Simply Wall St

On June 30, 2025, NRG Energy (NYSE:NRG) was removed from several key Russell indices, signaling potential shifts in market confidence and sparking changes in investor sentiment. Despite this removal, the company recorded a striking 70% increase in its share price over the last quarter. This surge aligns with the broader market's upward trend, where indexes like the S&P 500 and Nasdaq recently hit new highs. Contributing factors for NRG included positive Q1 earnings results, a reaffirmed earnings guidance for 2025, and an ongoing share buyback program. These elements may have counteracted any negative sentiment arising from the index removals.

Be aware that NRG Energy is showing 2 weaknesses in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

The removal of NRG Energy from key Russell indices could initially suggest a dip in investor confidence, yet the company's recent 70% share price rise indicates resilience, bolstered by positive Q1 earnings and continued share buyback initiatives. Despite being removed from indices, these developments may support revenue and earnings forecasts, though challenges like regulatory shifts and supply chain issues could still pose risks.

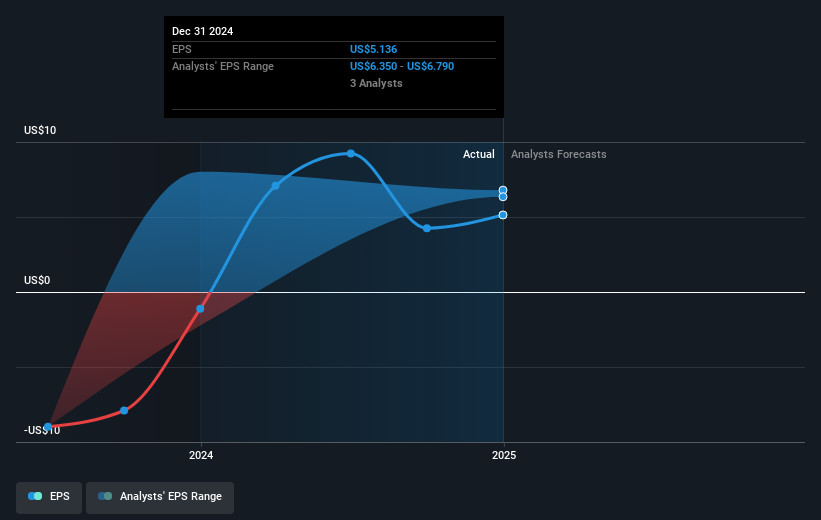

Over the past five years, NRG's total shareholder return, including dividends, reached a very large increase of 481.93%. This long-term performance reflects its ability to generate consistent returns, despite earnings having experienced negative growth of 29.7% per year during this period. Compared to the last year's metrics, NRG surpassed the overall US Market returns of 13.7% and the US Electric Utilities industry return of 18.1%, showcasing its strong recent recovery from past earnings declines.

In relation to revenue and earnings expectations, analysts anticipate a 5.8% annual revenue growth over the next three years. However, the consensus price target of US$115.81 is slightly below the current share price of US$117.01, indicating that the stock is nearly aligned with market expectations. The potential impact of recent events must be assessed in light of the high level of analyst disagreement on future earnings, which ranges from US$1.2 billion to US$1.7 billion by 2028.

Examine NRG Energy's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRG Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRG

NRG Energy

Operates as an energy and home services company in the United States and Canada.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives