- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Nova Measuring Instruments Ltd. Just Reported And Analysts Have Been Lifting Their Price Targets

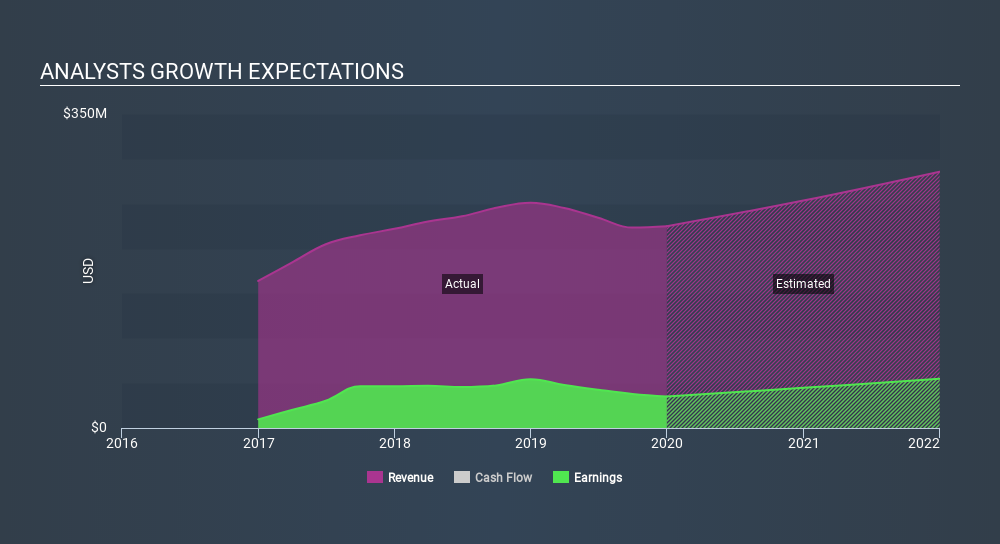

Nova Measuring Instruments Ltd. (NASDAQ:NVMI) just released its yearly report and things are looking bullish. Results were good overall, with revenues beating analyst predictions by 2.2% to hit US$225m. Statutory earnings per share (EPS) came in at US$1.23, some 3.1% above what analysts had expected. Analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what analysts' statutory forecasts suggest is in store for next year.

Check out our latest analysis for Nova Measuring Instruments

After the latest results, the four analysts covering Nova Measuring Instruments are now predicting revenues of US$253.6m in 2020. If met, this would reflect a solid 13% improvement in sales compared to the last 12 months. Statutory earnings per share are expected to bounce 23% to US$1.55. In the lead-up to this report, analysts had been modelling revenues of US$259.4m and earnings per share (EPS) of US$1.64 in 2020. It's pretty clear that analyst sentiment has fallen after the latest results, leading to lower revenue forecasts and a small dip in earnings per share estimates.

The average price target climbed 10% to US$45.50 despite the reduced earnings forecasts, suggesting that this earnings impact could be a positive for the stock, once it passes. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Nova Measuring Instruments at US$47.00 per share, while the most bearish prices it at US$44.00. Still, with such a tight range of estimates, it suggests analysts have a pretty good idea of what they think the company is worth.

Further, we can compare these estimates to past performance, and see how Nova Measuring Instruments forecasts compare to the wider market's forecast performance. Next year brings more of the same, according to analysts, with revenue forecast to grow 13%, in line with its 15% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 8.8% per year. So although Nova Measuring Instruments is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider market.

The Bottom Line

The biggest concern with the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Nova Measuring Instruments. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider market. Analysts also upgraded their price target, suggesting that analysts believe the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Nova Measuring Instruments analysts - going out to 2021, and you can see them free on our platform here.

You can also see our analysis of Nova Measuring Instruments's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sale of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Kratos Defense & Security Solutions (KTOS): Scaling "Attritable" Dominance in a New Era of Aerial Conflict.

BWX Technologies (BWXT): Powering the Nuclear Renaissance from Naval Depths to Medical Frontiers.

Merck & Co. (MRK): Scaling the "Post-Keytruda Hill" Through Diversified Blockbusters.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks