David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Northgate plc (LON:NTG) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Northgate

How Much Debt Does Northgate Carry?

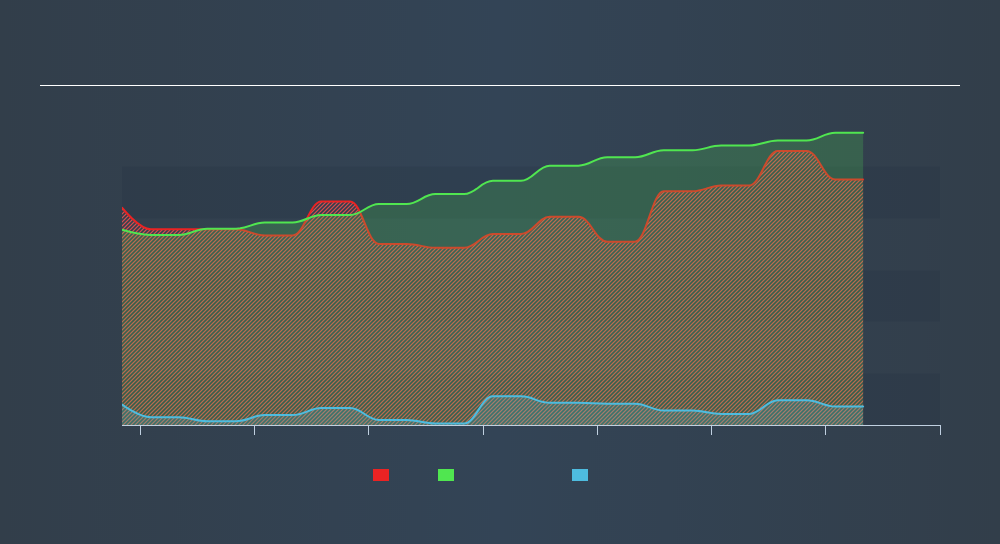

The chart below, which you can click on for greater detail, shows that Northgate had UK£473.6m in debt in April 2019; about the same as the year before. On the flip side, it has UK£35.7m in cash leading to net debt of about UK£437.8m.

How Healthy Is Northgate's Balance Sheet?

According to the last reported balance sheet, Northgate had liabilities of UK£130.2m due within 12 months, and liabilities of UK£434.6m due beyond 12 months. On the other hand, it had cash of UK£35.7m and UK£71.9m worth of receivables due within a year. So it has liabilities totalling UK£457.1m more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of UK£421.9m, we think shareholders really should watch Northgate's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Northgate's net debt is sitting at a very reasonable 1.6 times its EBITDA, while its EBIT covered its interest expense just 5.0 times last year. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. One way Northgate could vanquish its debt would be if it stops borrowing more but conitinues to grow EBIT at around 13%, as it did over the last year. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Northgate's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Considering the last three years, Northgate actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Mulling over Northgate's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. But at least it's pretty decent at growing its EBIT; that's encouraging. Looking at the bigger picture, it seems clear to us that Northgate's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. Given Northgate has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:ZIG

Zigup

Engages in the provision of mobility solutions and automotive services to business and personal customers in the United Kingdom, Spain, and Ireland.

Undervalued average dividend payer.

Market Insights

Community Narratives