- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Northern Trust (NasdaqGS:NTRS) Proposes 7% Dividend Increase Pending Board Approval

Reviewed by Simply Wall St

Northern Trust (NasdaqGS:NTRS) has proposed a 7% increase in its quarterly cash dividend, reflecting its intent to enhance shareholder returns. Over the last quarter, the company's stock price surged 30%. This upward trend aligns with its strong first-quarter earnings report, which showed significant rises in net interest income and net income, enhancing investor confidence. Additionally, rumors of a potential acquisition by The Bank of New York Mellon and strategic client partnerships may have positively influenced the stock's performance. Meanwhile, broader market indices like the S&P 500 and Nasdaq also experienced upward momentum, providing a supportive backdrop for Northern Trust's growth.

Northern Trust has 2 risks (and 1 which is significant) we think you should know about.

The proposed 7% increase in Northern Trust's quarterly dividend may further strengthen shareholder confidence and enhance total shareholder returns, building on the recent 30% surge in its share price. Over a longer term of five years, the company's total return, including dividends, was 92.20%, illustrating substantial growth. In contrast, the U.S. Capital Markets industry returned 34.2% over the past year, indicating Northern Trust's outperformance on a shorter time frame.

This recent dividend development aligns with Northern Trust's strategies to capitalize on alternative investments and family office services, potentially driving future revenue and earnings. The announced dividend hike underscores Northern Trust’s cash flow strength, which could mitigate impacts from anticipated challenges like market volatility and regulatory changes. Analysts forecast revenue to decline by 0.9% per year and earnings to dip by 11.8% annually over the next three years, suggesting potential challenges ahead, despite the optimism reflected in the dividend increase.

The share price movement, while positive in the short term, is currently below the analyst consensus target of US$109.54, leaving room for possible reevaluation. The combination of strong dividend actions and strategic expansions, along with fluctuations in the share price, illustrates the complexity of navigating market expectations, making it essential for investors to monitor ongoing developments closely.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

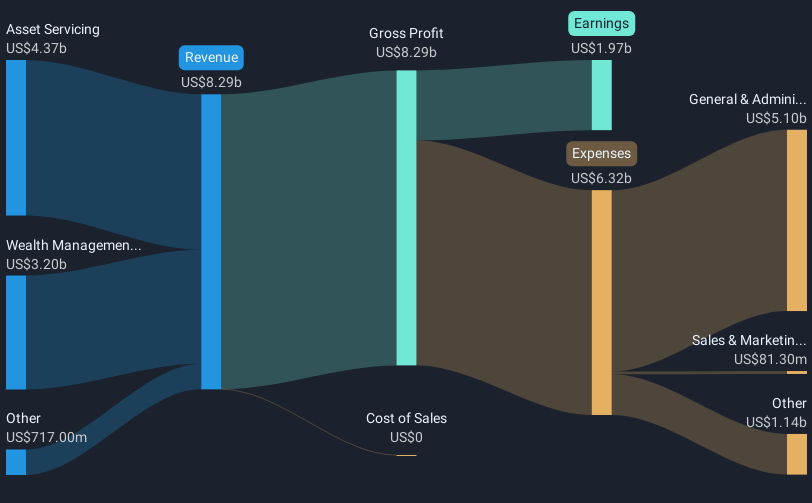

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives