As global markets navigate the complexities of economic shifts, including a weakening U.S. labor market and fluctuating interest rates, investors are increasingly exploring diverse opportunities across different regions. Penny stocks, often associated with smaller or newer companies, continue to captivate attention due to their affordability and potential for growth when supported by robust financials. This article highlights several noteworthy Asian penny stocks that exemplify these characteristics, offering insights into their potential as hidden gems in today's market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.88 | THB3.83B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.94 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.67 | HK$1.03B | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.50 | HK$2.08B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.93 | SGD376.92M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.88 | THB2.93B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.18 | SGD12.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.97 | THB1.43B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.98 | THB10.06B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 981 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Nickel Asia (PSE:NIKL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel Asia Corporation is involved in the mining and exploration of nickel saprolite, limonite ore, limestone, and quarry materials in the Philippines with a market capitalization of ₱46.81 billion.

Operations: Nickel Asia's revenue is primarily derived from its mining operations, with significant contributions from Mining - TMC (₱9.36 billion), Mining - RTN (₱6.62 billion), and Mining - HMC (₱2.65 billion), supplemented by its power segment through Power - EPI (₱1.08 billion) and services from RTN/TMC/CDTN (₱1.06 billion).

Market Cap: ₱46.81B

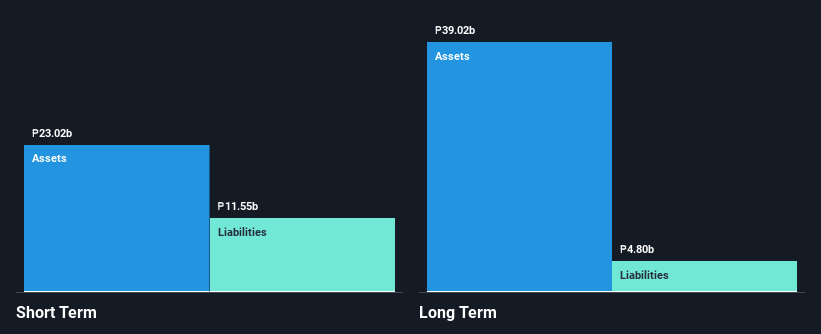

Nickel Asia Corporation, with a market capitalization of ₱46.81 billion, has shown resilience despite challenges in the metals and mining sector. Recent earnings results indicate revenue growth to ₱8.86 billion for Q2 2025, up from ₱6.63 billion a year ago, though profit margins have declined slightly from 13.8% to 10.5%. The company's financial health is supported by short-term assets exceeding liabilities and more cash than total debt, indicating strong liquidity management. However, negative earnings growth over the past year and an unstable dividend track record highlight potential volatility for investors in this penny stock segment.

- Get an in-depth perspective on Nickel Asia's performance by reading our balance sheet health report here.

- Assess Nickel Asia's future earnings estimates with our detailed growth reports.

Frontage Holdings (SEHK:1521)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Frontage Holdings Corporation is a contract research organization offering laboratory and related services to pharmaceutical, biotechnology, and agrochemical companies, with a market cap of HK$2.92 billion.

Operations: Frontage Holdings generates revenue from its operations in North America and Europe amounting to $197.38 million, and from the People's Republic of China totaling $55.63 million.

Market Cap: HK$2.92B

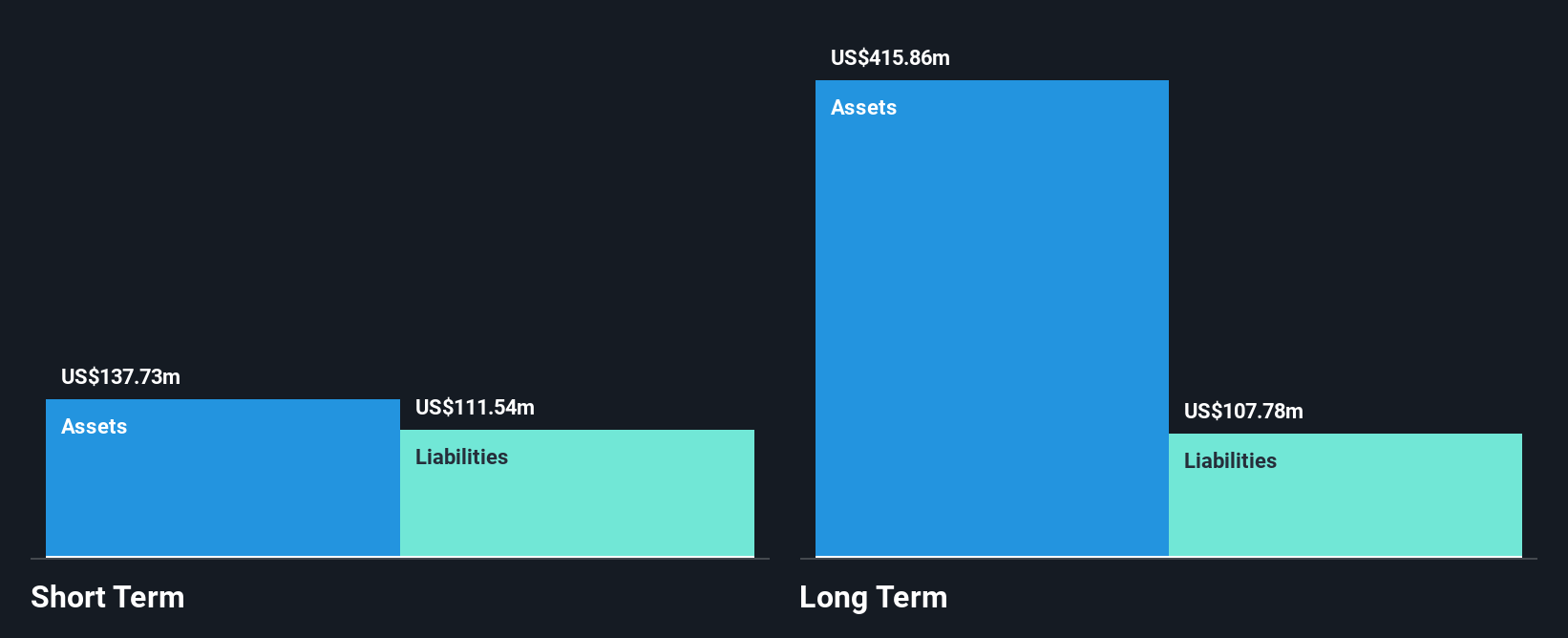

Frontage Holdings, with a market cap of HK$2.92 billion, reported half-year sales of US$126.58 million, slightly down from the previous year. Despite this decline, it achieved a net income of US$2.93 million compared to a loss previously. The company's debt is well-covered by operating cash flow at 51.1%, and short-term assets exceed both short- and long-term liabilities, reflecting sound liquidity management. However, its return on equity remains low at 1.1%, with profit margins decreasing from 2.3% to 1.5%. Recent executive changes could impact strategic direction as it expands globally in the CRO industry.

- Navigate through the intricacies of Frontage Holdings with our comprehensive balance sheet health report here.

- Understand Frontage Holdings' earnings outlook by examining our growth report.

Sunshine Insurance Group (SEHK:6963)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sunshine Insurance Group Company Limited offers a range of insurance products and related services in the People’s Republic of China, with a market cap of HK$46.35 billion.

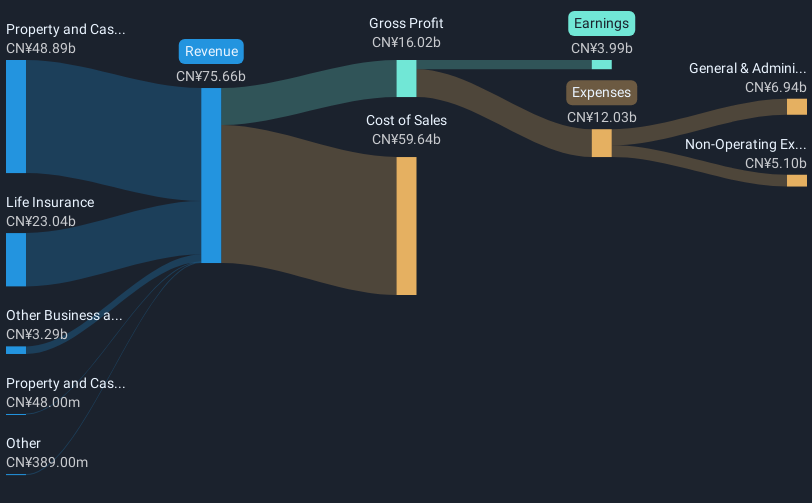

Operations: The company generates revenue primarily from its Life Insurance segment at CN¥24.46 billion and Property and Casualty Insurance, with Sunshine P&C contributing CN¥51.36 billion and Sunshine Surety adding CN¥111 million.

Market Cap: HK$46.35B

Sunshine Insurance Group, with a market cap of HK$46.35 billion, demonstrates solid financial health supported by its robust revenue streams from Life and Property & Casualty Insurance segments. The company reported a net income of CN¥3.39 billion for the first half of 2025, reflecting improved profit margins from the previous year. Its debt is well-managed, covered by operating cash flow at 122.2%, while short-term assets far exceed short-term liabilities indicating strong liquidity. Recent board changes may influence governance positively as experienced directors take key roles in committees focusing on risk management and remuneration strategies.

- Click here to discover the nuances of Sunshine Insurance Group with our detailed analytical financial health report.

- Explore Sunshine Insurance Group's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Take a closer look at our Asian Penny Stocks list of 981 companies by clicking here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6963

Sunshine Insurance Group

Provides various insurance products and related services in the People’s Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives