- United States

- /

- Residential REITs

- /

- NYSE:NXRT

NexPoint Residential Trust (NYSE:NXRT) Shareholders Have Enjoyed An Impressive 101% Share Price Gain

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. For instance the NexPoint Residential Trust, Inc. (NYSE:NXRT) share price is 101% higher than it was three years ago. That sort of return is as solid as granite. We note the stock price is up 3.3% in the last seven days.

View 4 warning signs we detected for NexPoint Residential Trust

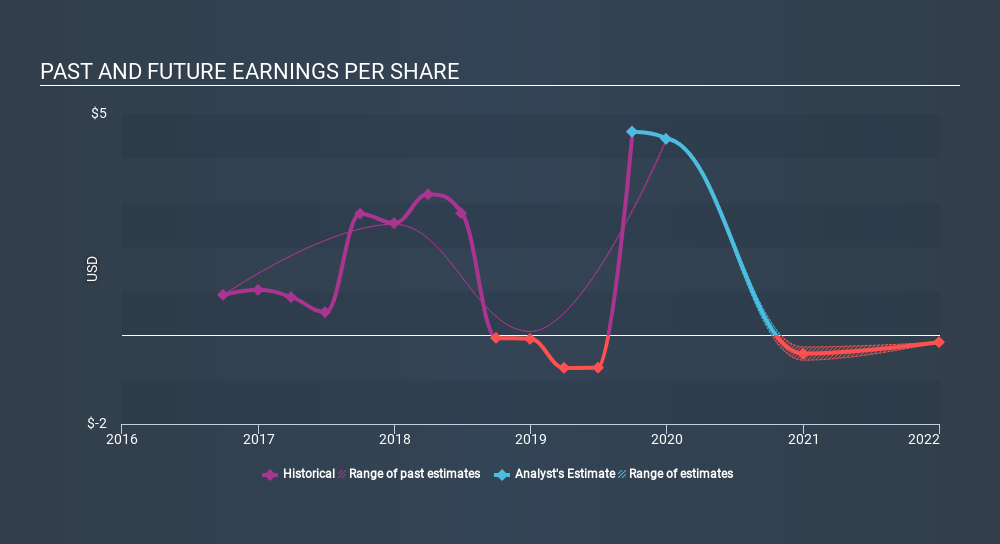

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

NexPoint Residential Trust became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of NexPoint Residential Trust, it has a TSR of 122% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

NexPoint Residential Trust shareholders have gained 29% over twelve months (even including dividends) . This isn't far from the market return of 29%. It has to be noted that the recent return falls short of the 31% shareholders have gained each year, over the last three years. Share price gains are anything but steady, so it's a positive to see that the longer term returns are reasonable. It's always interesting to track share price performance over the longer term. But to understand NexPoint Residential Trust better, we need to consider many other factors. For example, we've discovered 4 warning signs for NexPoint Residential Trust (of which 1 is major) which any shareholder or potential investor should be aware of.

NexPoint Residential Trust is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:NXRT

NexPoint Residential Trust

NexPoint Residential Trust is a publicly traded REIT, with its shares listed on the New York Stock Exchange under the symbol "NXRT," primarily focused on acquiring, owning and operating well-located middle-income multifamily properties with "value-add" potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and Southwestern United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives