- United Kingdom

- /

- Airlines

- /

- AIM:JET2

Newsflash: Dart Group PLC (LON:DTG) Analysts Have Been Trimming Their Revenue Forecasts

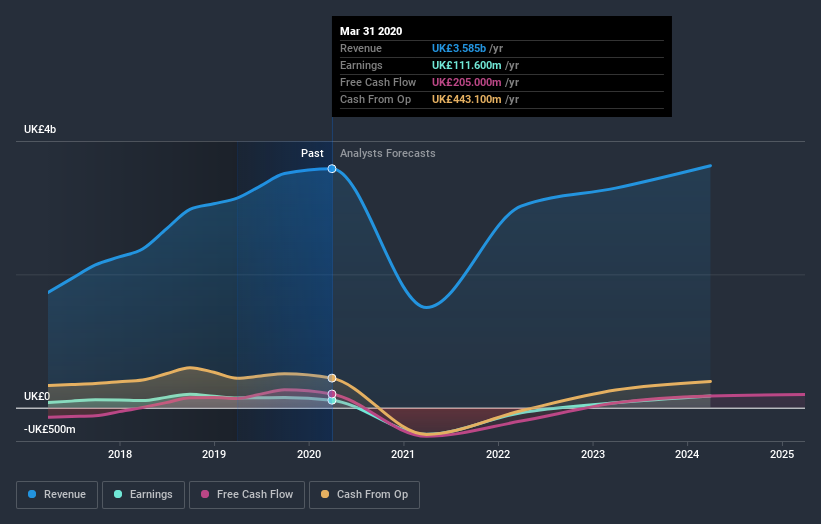

Market forces rained on the parade of Dart Group PLC (LON:DTG) shareholders today, when the analysts downgraded their forecasts for this year. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

Following the latest downgrade, the current consensus, from the four analysts covering Dart Group, is for revenues of UK£1.5b in 2021, which would reflect a painful 58% reduction in Dart Group's sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of UK£2.6b in 2021. The consensus view seems to have become more pessimistic on Dart Group, noting the sizeable cut to revenue estimates in this update.

View our latest analysis for Dart Group

The consensus price target fell 11% to UK£10.13, with the analysts clearly less optimistic about Dart Group's valuation following this update. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Dart Group at UK£10.50 per share, while the most bearish prices it at UK£10.00. This is a very narrow spread of estimates, implying either that Dart Group is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that sales are expected to reverse, with the forecast 58% revenue decline a notable change from historical growth of 24% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 14% next year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Dart Group is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They're also anticipating slower revenue growth than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Dart Group after today.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. See why we're concerned about Dart Group's balance sheet by visiting our risks dashboard for free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

If you decide to trade Dart Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:JET2

Jet2

Engages in the leisure travel business primarily in the United Kingdom.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives