- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NFLX) Premieres Epic K-Wave Thriller "Trigger" As Global Content Expands

Reviewed by Simply Wall St

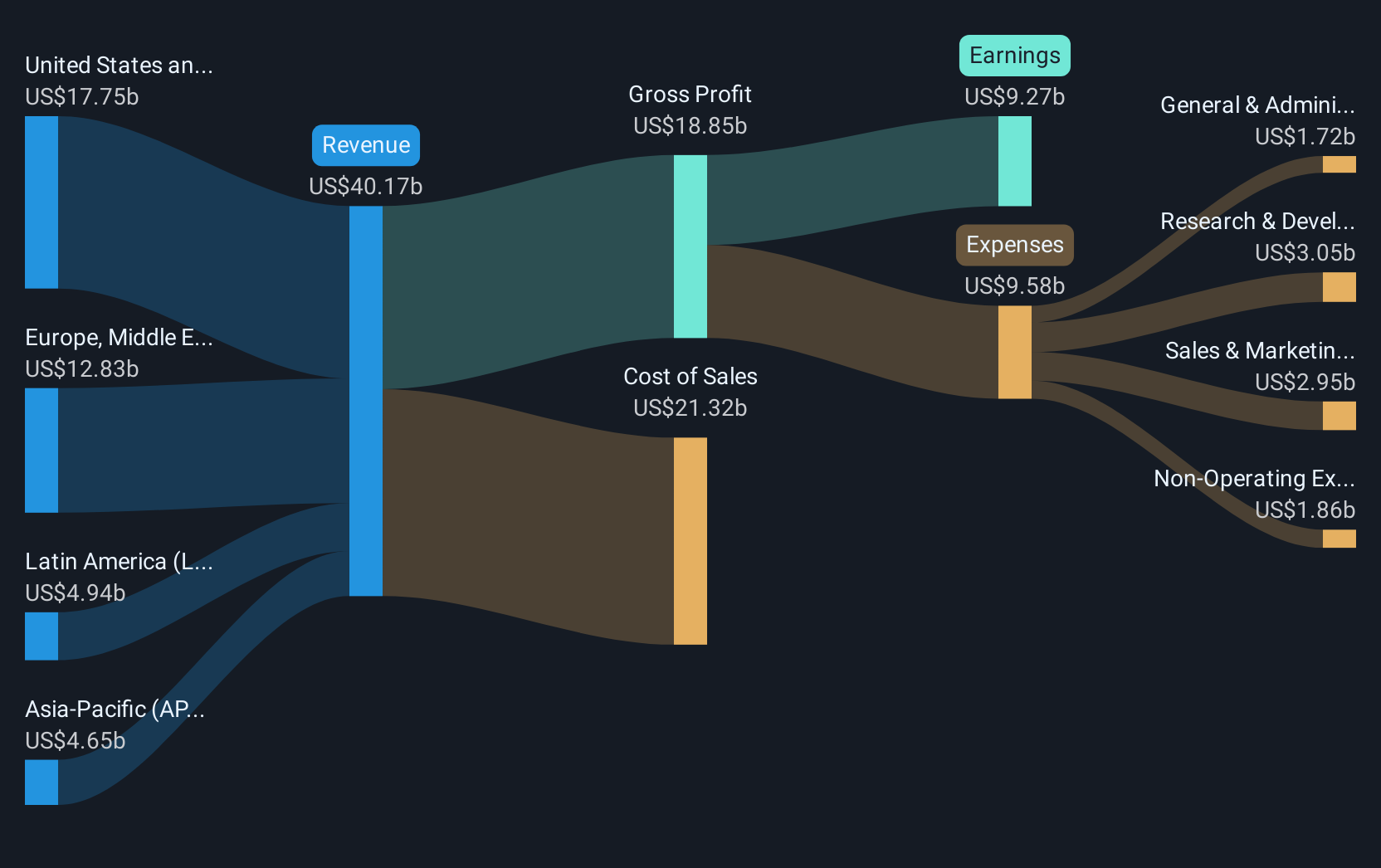

Netflix (NFLX) recently exhibited a price move of 7% over the last quarter, influenced by significant activity in the market and company developments. Major market indices, such as the S&P 500 and the Nasdaq, reached new highs, indicating a generally positive market sentiment. Netflix's global premiere of "Trigger," alongside KWave Media's first original collaboration, captured international attention, adding weight to the company’s expansion initiatives. Furthermore, Netflix's Q2 earnings report, showing increased sales and net income, likely bolstered investor confidence. These factors, amid rising tech stocks and record-setting indices, contributed to Netflix's overall market performance.

Buy, Hold or Sell Netflix? View our complete analysis and fair value estimate and you decide.

The recent developments at Netflix, including the global release of "Trigger" and its collaboration with KWave Media, are poised to enhance their market presence, potentially strengthening future revenue streams and earnings. The introduction of proprietary ad tech and international partnerships serves as a catalyst for expanding monetization and market reach. These strategic moves are likely to positively influence the consensus revenue and earnings forecasts, with expectations that the company will improve margins through bolstered subscriber engagement and operational efficiencies.

Over the past three years, Netflix's total shareholder returns amounted to a very large percentage, reflecting a substantial increase in shareholder value. This significant growth positions Netflix favorably within the tech industry, as its one-year total return outperformed the broader US Entertainment industry, which itself delivered a strong performance this past year.

In context of share price, the recent market activity places Netflix at US$1180.76 with a consensus price target of US$1330.97. The current share price remains at a discount to this target by approximately 12.72%, suggesting that there may still be some upside potential according to analysts' estimates. Investors should consider the alignment of current market price and the fundamentals outlined in earnings reports and strategic initiatives when evaluating future potential.

Learn about Netflix's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives