Mineral Midrange S.A.'s (WSE:MND) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

Mineral Midrange (WSE:MND) has had a rough week with its share price down 17%. However, the company's fundamentals look pretty decent, and long-term financials are usually aligned with future market price movements. Particularly, we will be paying attention to Mineral Midrange's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Mineral Midrange

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Mineral Midrange is:

35% = zł350k ÷ zł995k (Based on the trailing twelve months to December 2019).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every PLN1 worth of equity, the company was able to earn PLN0.35 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learnt that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Mineral Midrange's Earnings Growth And 35% ROE

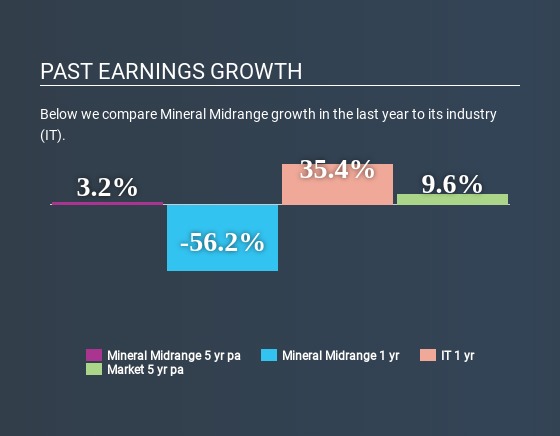

First thing first, we like that Mineral Midrange has an impressive ROE. Additionally, the company's ROE is higher compared to the industry average of 19% which is quite remarkable. However, for some reason, the higher returns aren't reflected in Mineral Midrange's meagre five year net income growth average of 3.2%. This is interesting as the high returns should mean that the company has the ability to generate high growth but for some reason, it hasn't been able to do so. We reckon that a low growth, when returns are quite high could be the result of certain circumstances like low earnings retention or or poor allocation of capital.

Next, on comparing with the industry net income growth, we found that Mineral Midrange's reported growth was lower than the industry growth of 12% in the same period, which is not something we like to see.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Mineral Midrange is trading on a high P/E or a low P/E, relative to its industry.

Is Mineral Midrange Making Efficient Use Of Its Profits?

Mineral Midrange doesn't pay any dividend, meaning that potentially all of its profits are being reinvested in the business. However, this doesn't explain the low earnings growth the company has seen. So there could be some other explanation in that regard. For instance, the company's business may be deteriorating.

Conclusion

On the whole, we do feel that Mineral Midrange has some positive attributes. However, given the high ROE and high profit retention, we would expect the company to be delivering strong earnings growth, but that isn't the case here. This suggests that there might be some external threat to the business, that's hampering its growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 5 risks we have identified for Mineral Midrange.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:MND

Flawless balance sheet with solid track record.

Market Insights

Community Narratives