- Israel

- /

- Electronic Equipment and Components

- /

- TASE:ININ

Middle Eastern Penny Stocks Under US$40M Market Cap

Reviewed by Simply Wall St

The Middle Eastern market has recently seen mixed performances, with Dubai's main share index reaching a 17-year high amidst fluctuating indices across the Gulf. Penny stocks, though considered an outdated term, continue to represent intriguing investment opportunities, particularly in smaller or newer companies that offer potential growth at lower price points. When these stocks are supported by strong financial health and solid fundamentals, they can present compelling opportunities for investors looking beyond the major players in the market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.625 | ₪12.06M | ✅ 1 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.10 | SAR1.64B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.612 | ₪323.7M | ✅ 3 ⚠️ 2 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY3.42 | TRY940.5M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.13 | AED2.24B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.86 | TRY2B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.14 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.57 | AED10.89B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.825 | AED501.81M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.524 | ₪187.64M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

BioLight Life Sciences (TASE:BOLT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BioLight Life Sciences Ltd. is an ophthalmic company focused on the discovery, development, and commercialization of products for eye conditions, with a market cap of ₪23.08 million.

Operations: BioLight Life Sciences Ltd. has not reported any specific revenue segments.

Market Cap: ₪23.08M

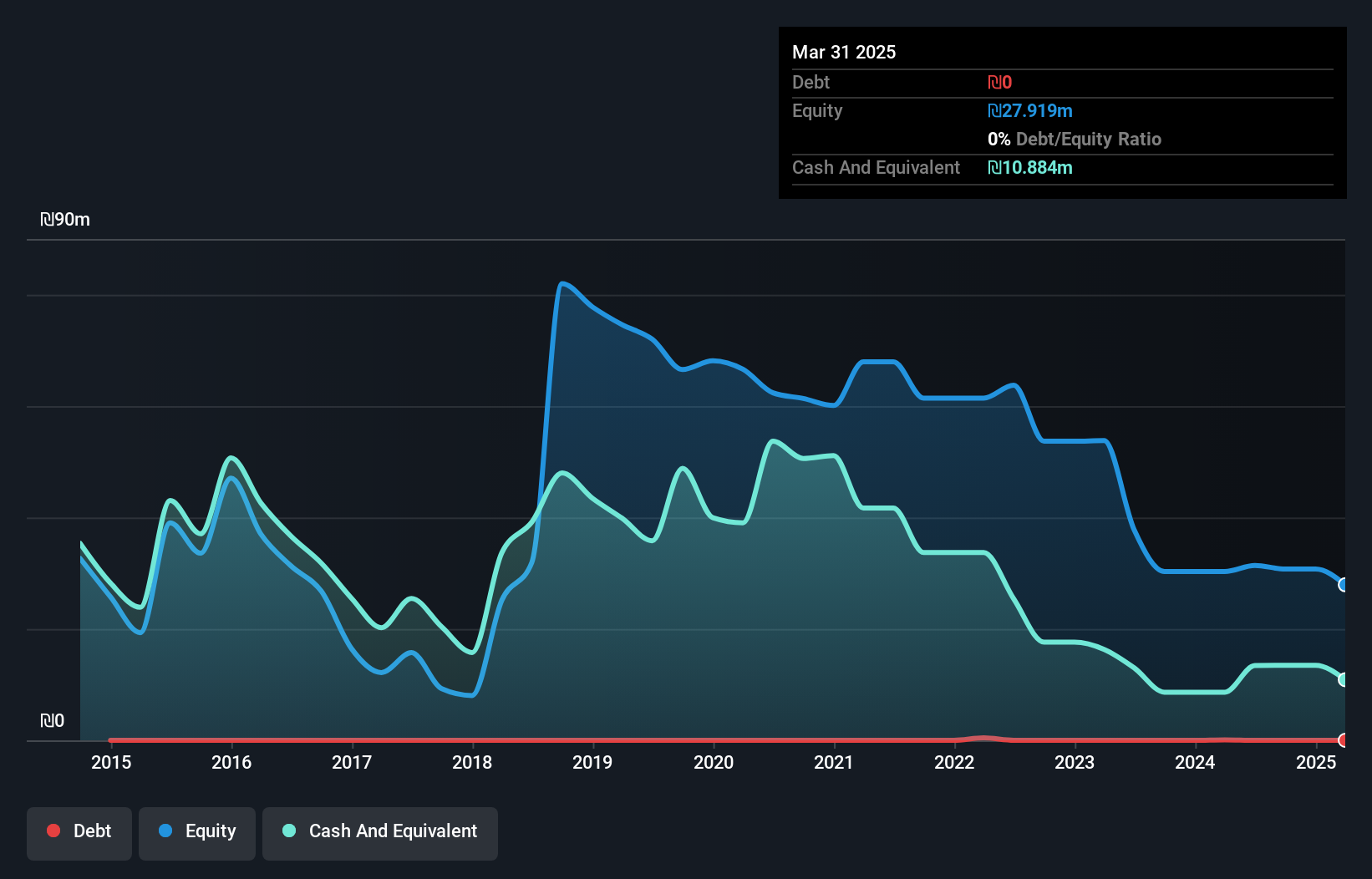

BioLight Life Sciences Ltd., with a market cap of ₪23.08 million, operates as a pre-revenue company, generating less than US$1 million in revenue. Despite being debt-free and having experienced management and board members, the company faces financial challenges with less than a year of cash runway based on current free cash flow. Recent earnings results highlight significant losses, reporting a net loss of ₪2.42 million for Q1 2025 compared to net income the previous year. While short-term assets exceed liabilities, ongoing unprofitability remains an issue as earnings have declined by 19.1% annually over five years.

- Get an in-depth perspective on BioLight Life Sciences' performance by reading our balance sheet health report here.

- Evaluate BioLight Life Sciences' historical performance by accessing our past performance report.

Inter Industries Plus (TASE:ININ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inter Industries Plus Ltd., along with its subsidiaries, operates in the energy and infrastructure sectors in Israel with a market cap of ₪1.20 billion.

Operations: The company generates revenue through two main segments: Projects, contributing ₪387.72 million, and Trade and Services, adding ₪316.56 million.

Market Cap: ₪120.01M

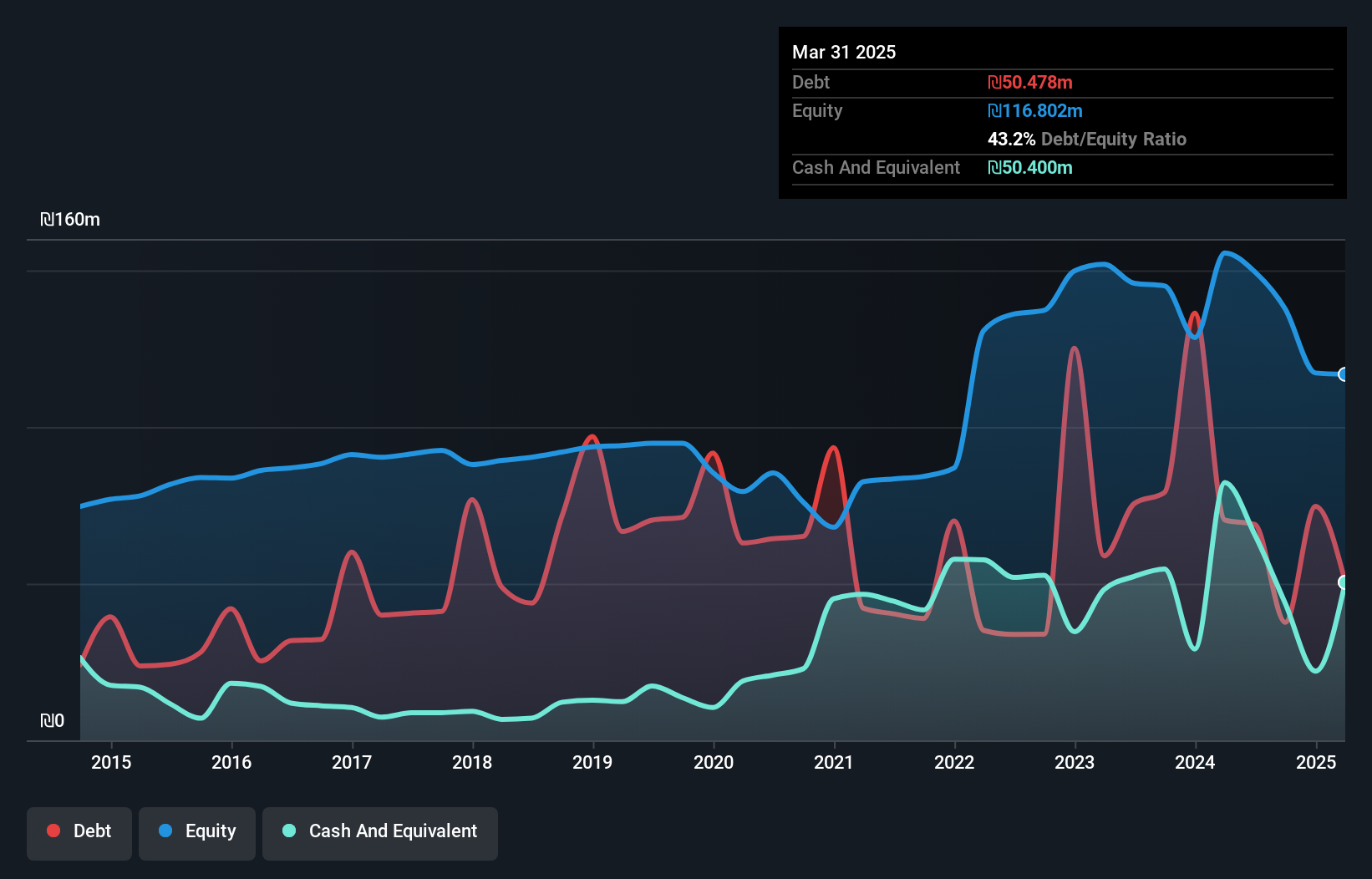

Inter Industries Plus Ltd., with a market cap of ₪1.20 billion, operates in the energy and infrastructure sectors and faces financial challenges despite generating significant revenue from its Projects (₪387.72 million) and Trade and Services (₪316.56 million) segments. Recent earnings revealed a net loss of ₪0.802 million for Q1 2025, reversing from a profit the previous year, highlighting ongoing unprofitability with negative return on equity (-34.51%). However, the company maintains strong liquidity as short-term assets exceed liabilities, has reduced debt levels over five years, and possesses a substantial cash runway exceeding three years based on current free cash flow trends.

- Unlock comprehensive insights into our analysis of Inter Industries Plus stock in this financial health report.

- Gain insights into Inter Industries Plus' past trends and performance with our report on the company's historical track record.

PlantArc Bio (TASE:PLNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PlantArc Bio Ltd. is an Ag-Bio company focused on crop protection and yield enhancement, with a market cap of ₪7.17 million.

Operations: The company generates revenue from its Agricultural Biotech segment, amounting to ₪4.40 million.

Market Cap: ₪7.17M

PlantArc Bio Ltd., with a market cap of ₪7.17 million, is pre-revenue, generating only ₪4.40 million from its Agricultural Biotech segment. Despite being unprofitable, the company has reduced losses over the past five years by 0.9% annually and remains debt-free for this period. It boasts a strong liquidity position with short-term assets of ₪10.4 million surpassing both short and long-term liabilities significantly, ensuring a cash runway exceeding three years if current free cash flow trends persist. Both management and board are experienced, with average tenures of 4.8 and 4.3 years respectively, providing stability in leadership amidst financial challenges.

- Take a closer look at PlantArc Bio's potential here in our financial health report.

- Gain insights into PlantArc Bio's historical outcomes by reviewing our past performance report.

Key Takeaways

- Investigate our full lineup of 78 Middle Eastern Penny Stocks right here.

- Ready For A Different Approach? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ININ

Inter Industries Plus

Engages in the energy and infrastructure businesses in Israel.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives