- Israel

- /

- Medical Equipment

- /

- TASE:EMTC-M

Middle Eastern Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced mixed performances, with Gulf bourses showing varied results due to uncertainties around U.S. tariffs and fluctuating oil prices. Despite these challenges, investors continue to explore opportunities in smaller or newer companies that may offer surprising value. Penny stocks, while often seen as a relic of past trading days, can still present significant opportunities when backed by strong financials; this article will highlight three such stocks demonstrating potential for long-term growth.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.625 | ₪12.06M | ✅ 1 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.15 | SAR1.66B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.07 | AED2.69B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.477 | ₪314.23M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.09 | AED2.22B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.97 | TRY2.12B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.06 | AED353.43M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.54 | AED10.76B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.833 | AED492.08M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.64 | ₪196.26M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ege Seramik Sanayi ve Ticaret (IBSE:EGSER)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ege Seramik Sanayi ve Ticaret A.S. is engaged in the production and sale of ceramic floor and wall tiles globally, with a market capitalization of TRY2.21 billion.

Operations: The company generates revenue of TRY2.69 billion from its building products segment.

Market Cap: TRY2.21B

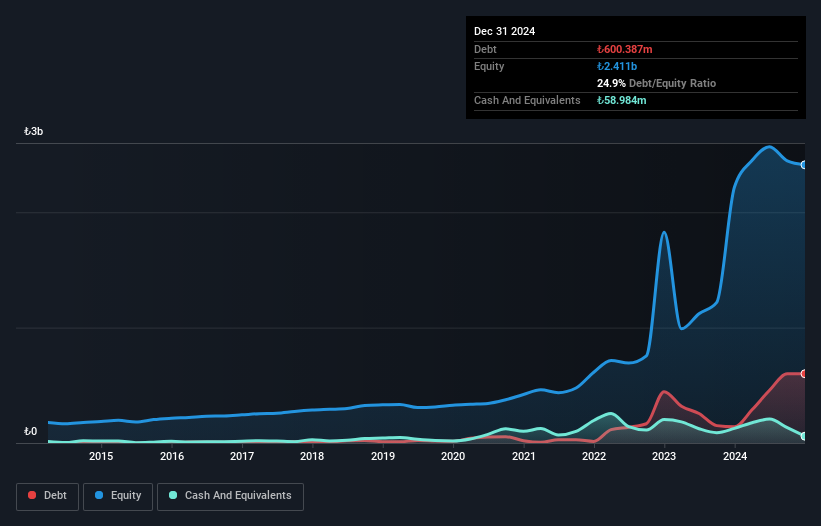

Ege Seramik Sanayi ve Ticaret A.S. operates in the ceramic tile industry with a market cap of TRY2.21 billion and recent quarterly sales of TRY920.32 million, though it remains unprofitable with a net loss of TRY294.08 million for Q1 2025. Despite stable weekly volatility and satisfactory net debt to equity ratio at 34.9%, the company faces challenges, including an increasing debt to equity ratio over five years and declining earnings by 57% annually over the same period. Short-term assets exceed liabilities, but cash runway is limited to less than a year without improvement in free cash flow trends.

- Click to explore a detailed breakdown of our findings in Ege Seramik Sanayi ve Ticaret's financial health report.

- Gain insights into Ege Seramik Sanayi ve Ticaret's past trends and performance with our report on the company's historical track record.

Elbit Medical Technologies (TASE:EMTC-M)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elbit Medical Technologies Ltd is an investment holding company involved in the research, development, production, and marketing of therapeutic medical systems globally, with a market cap of ₪20.86 million.

Operations: No specific revenue segments are reported for this investment holding company focused on therapeutic medical systems.

Market Cap: ₪20.86M

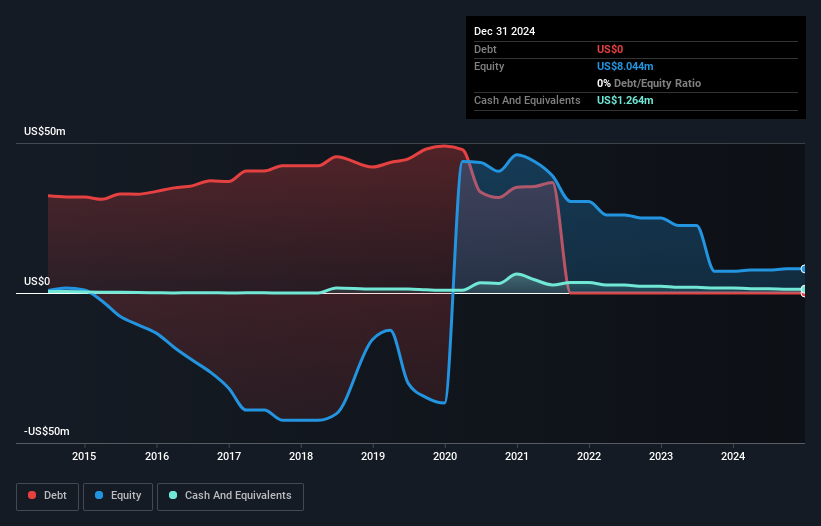

Elbit Medical Technologies Ltd, with a market cap of ₪20.86 million, has recently transitioned to profitability despite being pre-revenue. The company is debt-free and benefits from having no long-term liabilities. Its short-term assets of US$1.3M comfortably cover its short-term liabilities of US$144K, indicating solid financial footing in the near term. However, the company's share price has experienced high volatility over the past three months, and its weekly volatility increased from 14% to 20% over the past year. With a low Return on Equity at 10.3%, it trades at a favorable Price-To-Earnings ratio of 7.5x compared to the IL market average of 15.7x.

- Jump into the full analysis health report here for a deeper understanding of Elbit Medical Technologies.

- Evaluate Elbit Medical Technologies' historical performance by accessing our past performance report.

HomeBiogas (TASE:HMGS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: HomeBiogas LTD develops, produces, and markets biogas systems that convert organic waste into clean energy for various global customers with a market cap of ₪32.31 million.

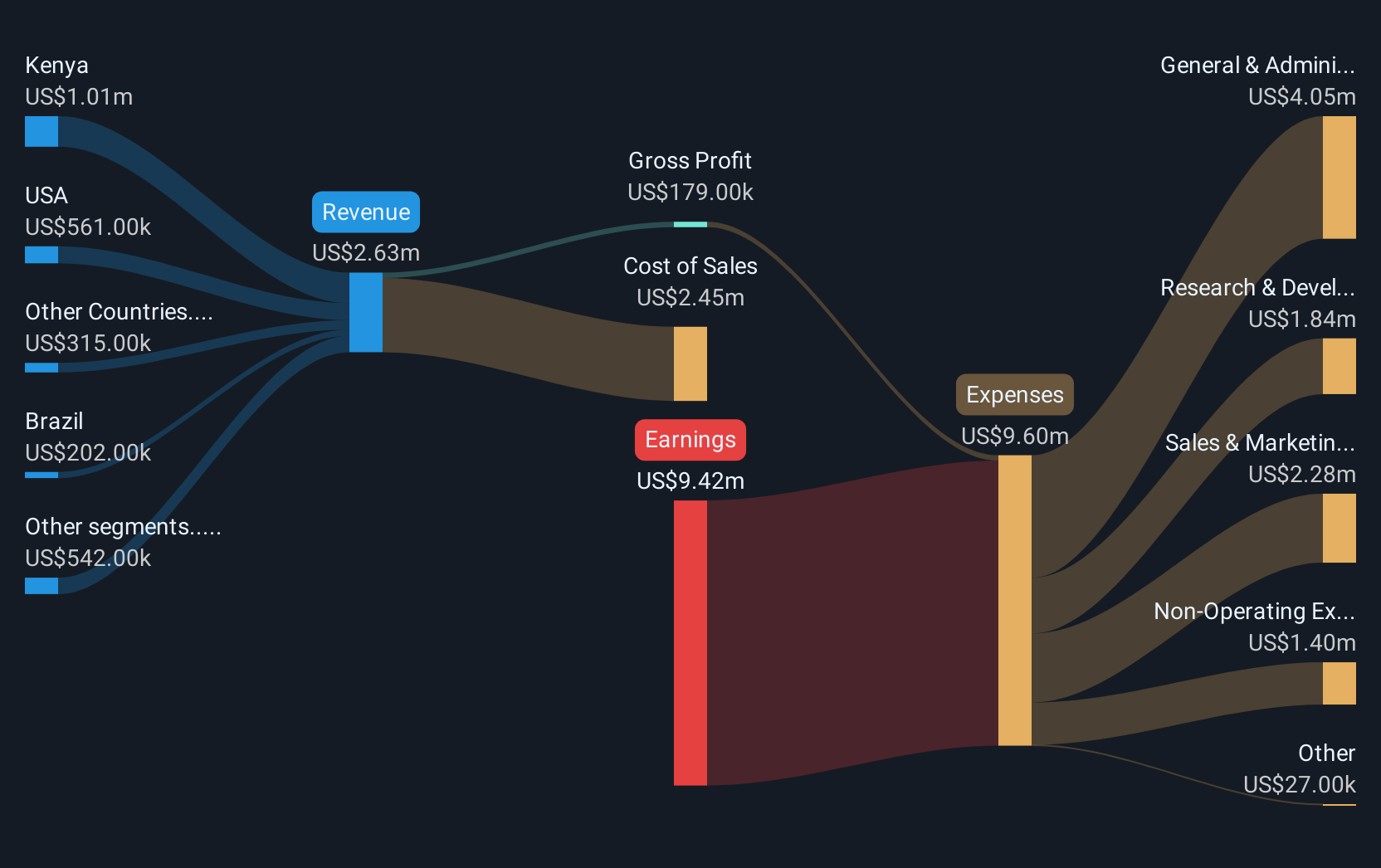

Operations: The company's revenue primarily comes from its development, production, and marketing activities related to biogas systems, generating $2.63 million.

Market Cap: ₪32.31M

HomeBiogas LTD, with a market cap of ₪32.31 million, focuses on converting organic waste into clean energy through its biogas systems, generating US$2.63 million in revenue. The company is currently unprofitable and has seen an increase in losses over the past five years by 22.7% annually. Despite having no debt and short-term assets of $5.8M covering both short- and long-term liabilities, it faces challenges with less than a year of cash runway based on current free cash flow trends. The share price has been highly volatile recently, though weekly volatility has decreased from previous levels.

- Take a closer look at HomeBiogas' potential here in our financial health report.

- Examine HomeBiogas' past performance report to understand how it has performed in prior years.

Taking Advantage

- Navigate through the entire inventory of 78 Middle Eastern Penny Stocks here.

- Looking For Alternative Opportunities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elbit Medical Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:EMTC-M

Elbit Medical Technologies

An investment holding company, engages in the research, development, production, and marketing of therapeutic medical systems in the United States, Europe, and internationally.

Flawless balance sheet slight.

Market Insights

Community Narratives