- Israel

- /

- Electronic Equipment and Components

- /

- TASE:ININ

Middle Eastern Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced mixed performances, with Saudi Arabia and Abu Dhabi seeing declines due to disappointing earnings, while Dubai's index has reached a 17-1/2-year high driven by strong corporate results. Penny stocks, despite their somewhat outdated name, remain an intriguing area for investors seeking growth opportunities in smaller or newer companies. These stocks can offer potential upside when backed by solid financials and fundamentals, making them worth watching as hidden gems in the market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.391 | ₪14.76M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.89 | SAR1.56B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.173 | ₪294.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.75 | TRY1.31B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.55 | AED3.1B | ✅ 3 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.27 | AED676.89M | ✅ 0 ⚠️ 4 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.96 | AED12.63B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.787 | AED480.52M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.594 | ₪192.84M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi is a Turkish company specializing in the production and sale of foam sheets, with a market capitalization of TRY1.31 billion.

Operations: The company generates revenue primarily from its Textile Operation, which accounts for TRY12.64 billion, and its Polyurethane Operations, contributing TRY32.54 million.

Market Cap: TRY1.31B

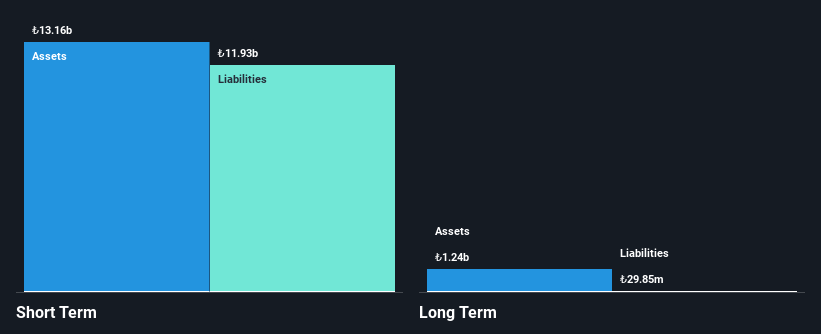

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi has demonstrated substantial earnings growth, with a 127.5% increase over the past year, outpacing the broader Chemicals industry. Its financial health is supported by short-term assets exceeding both short and long-term liabilities, and a satisfactory net debt to equity ratio of 31.5%. Despite high volatility in its share price, the company maintains a high return on equity at 20.8% and offers significant value with a low price-to-earnings ratio of 2.3x compared to the Turkish market average. However, negative operating cash flow remains a concern for covering debt effectively.

- Jump into the full analysis health report here for a deeper understanding of Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi.

- Examine Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's past performance report to understand how it has performed in prior years.

Thob Al Aseel (SASE:4012)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thob Al Aseel Company is involved in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market cap of SAR1.56 billion.

Operations: The company's revenue is primarily derived from thobs, generating SAR407.44 million, and fabrics, contributing SAR124.63 million.

Market Cap: SAR1.56B

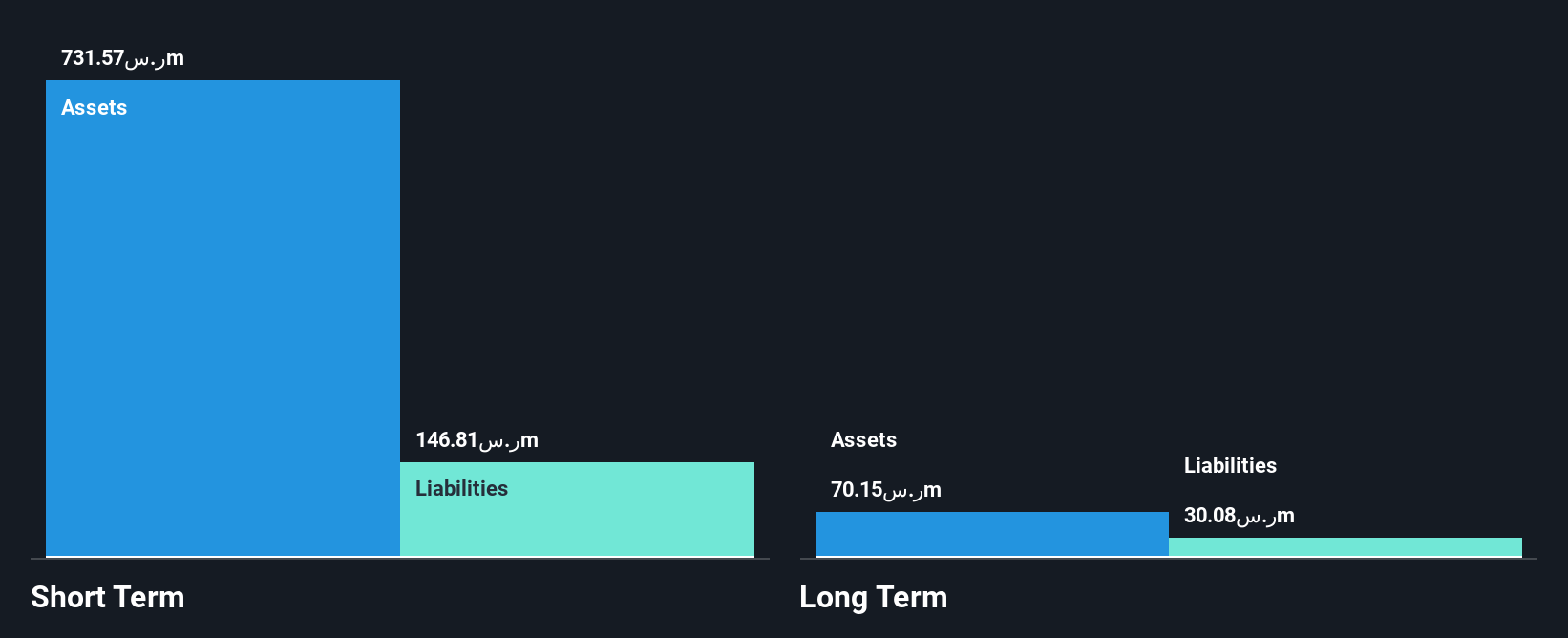

Thob Al Aseel Company, with a market cap of SAR1.56 billion, has shown mixed financial performance recently. Its revenue primarily comes from thobs and fabrics, generating SAR407.44 million and SAR124.63 million respectively. The company's short-term assets significantly exceed both its short-term and long-term liabilities, indicating strong liquidity without any debt concerns. Despite a low return on equity at 17.4% and an inexperienced board with an average tenure of 2.3 years, Thob Al Aseel's earnings growth of 19.8% over the past year surpasses its five-year average growth rate, highlighting potential for continued profitability amidst recent dividend affirmations totaling SAR40 million for the first half of 2025.

- Click to explore a detailed breakdown of our findings in Thob Al Aseel's financial health report.

- Assess Thob Al Aseel's previous results with our detailed historical performance reports.

Inter Industries Plus (TASE:ININ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inter Industries Plus Ltd., with a market cap of ₪101.81 million, operates in the energy and infrastructure sectors in Israel through its subsidiaries.

Operations: The company generates revenue from two main segments: Projects, contributing ₪387.72 million, and Trade and Services, adding ₪316.56 million.

Market Cap: ₪101.81M

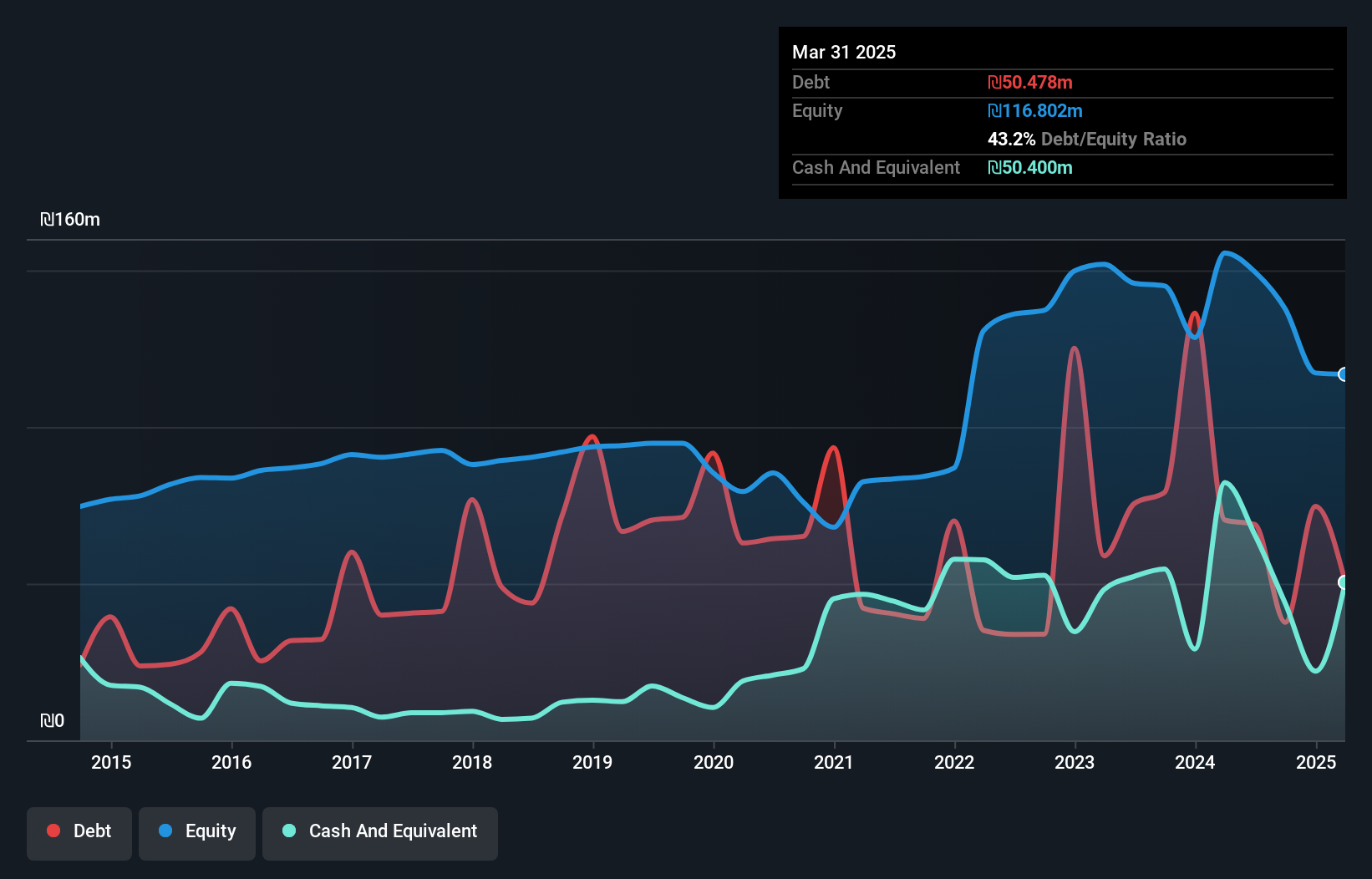

Inter Industries Plus Ltd., with a market cap of ₪101.81 million, operates in Israel's energy and infrastructure sectors, generating revenue from Projects (₪387.72 million) and Trade and Services (₪316.56 million). Despite reporting sales of ₪175.51 million for Q1 2025, the company faced a net loss of ₪0.802 million compared to a profit last year, reflecting its current unprofitability with declining earnings over five years at 15.5% annually. However, it maintains strong liquidity as short-term assets surpass liabilities and has reduced its debt-to-equity ratio significantly over five years to 43.2%, indicating improved financial stability amidst management changes.

- Navigate through the intricacies of Inter Industries Plus with our comprehensive balance sheet health report here.

- Gain insights into Inter Industries Plus' historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Gain an insight into the universe of 77 Middle Eastern Penny Stocks by clicking here.

- Contemplating Other Strategies? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ININ

Inter Industries Plus

Engages in the energy and infrastructure businesses in Israel.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives