- Israel

- /

- Medical Equipment

- /

- TASE:PULS

Middle Eastern Penny Stocks To Watch: 3 Picks Under US$100M Market Cap

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced subdued activity, influenced by global tariff tensions and cautious investor sentiment. Despite these challenges, the region continues to present opportunities for investors willing to explore smaller companies with potential for growth. Penny stocks, while an older term, remain relevant as they can offer surprising value when supported by strong financials. In this article, we explore three such stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.399 | ₪14.85M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.16 | SAR1.66B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.09 | AED2.71B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.043 | ₪284.35M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.15 | AED2.34B | ✅ 4 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.95 | TRY2.1B | ✅ 2 ⚠️ 1 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.19 | AED368.44M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.77 | AED11.78B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.80 | AED486.6M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.605 | ₪193.66M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Formet Metal ve Cam Sanayi (IBSE:FORMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Formet Metal ve Cam Sanayi A.S. is a Turkish company specializing in the manufacture and sale of steel doors, with a market capitalization of TRY2.13 billion.

Operations: The company generates revenue primarily from its Building Products segment, amounting to TRY631.26 million.

Market Cap: TRY2.13B

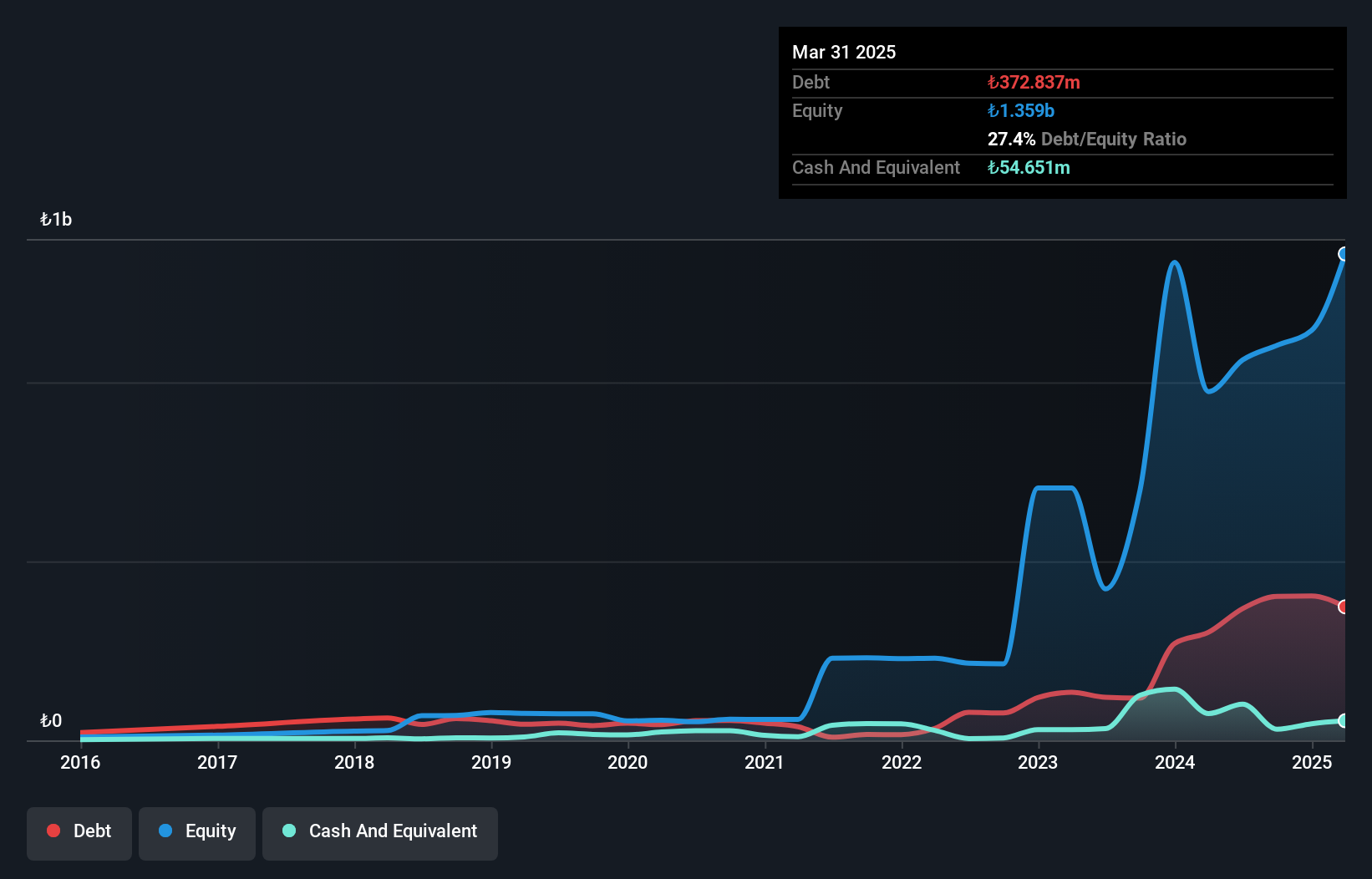

Formet Metal ve Cam Sanayi A.S. has shown financial improvement, becoming profitable this year with a net income of TRY98.41 million for Q1 2025, reversing a loss from the previous year. The company's short-term assets surpass both its short and long-term liabilities, indicating strong liquidity. Its debt to equity ratio has decreased significantly over five years to 27.4%, reflecting better financial management. However, earnings have been impacted by large one-off items and the stock remains highly volatile with notable recent fluctuations in share price. The board's lack of experience may be a concern for potential investors seeking stability in governance.

- Get an in-depth perspective on Formet Metal ve Cam Sanayi's performance by reading our balance sheet health report here.

- Evaluate Formet Metal ve Cam Sanayi's historical performance by accessing our past performance report.

Loras Holding (IBSE:LRSHO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Loras Holding A.S. operates in the food, construction, real estate investment, machinery, and energy sectors in Turkey with a market cap of TRY3.67 billion.

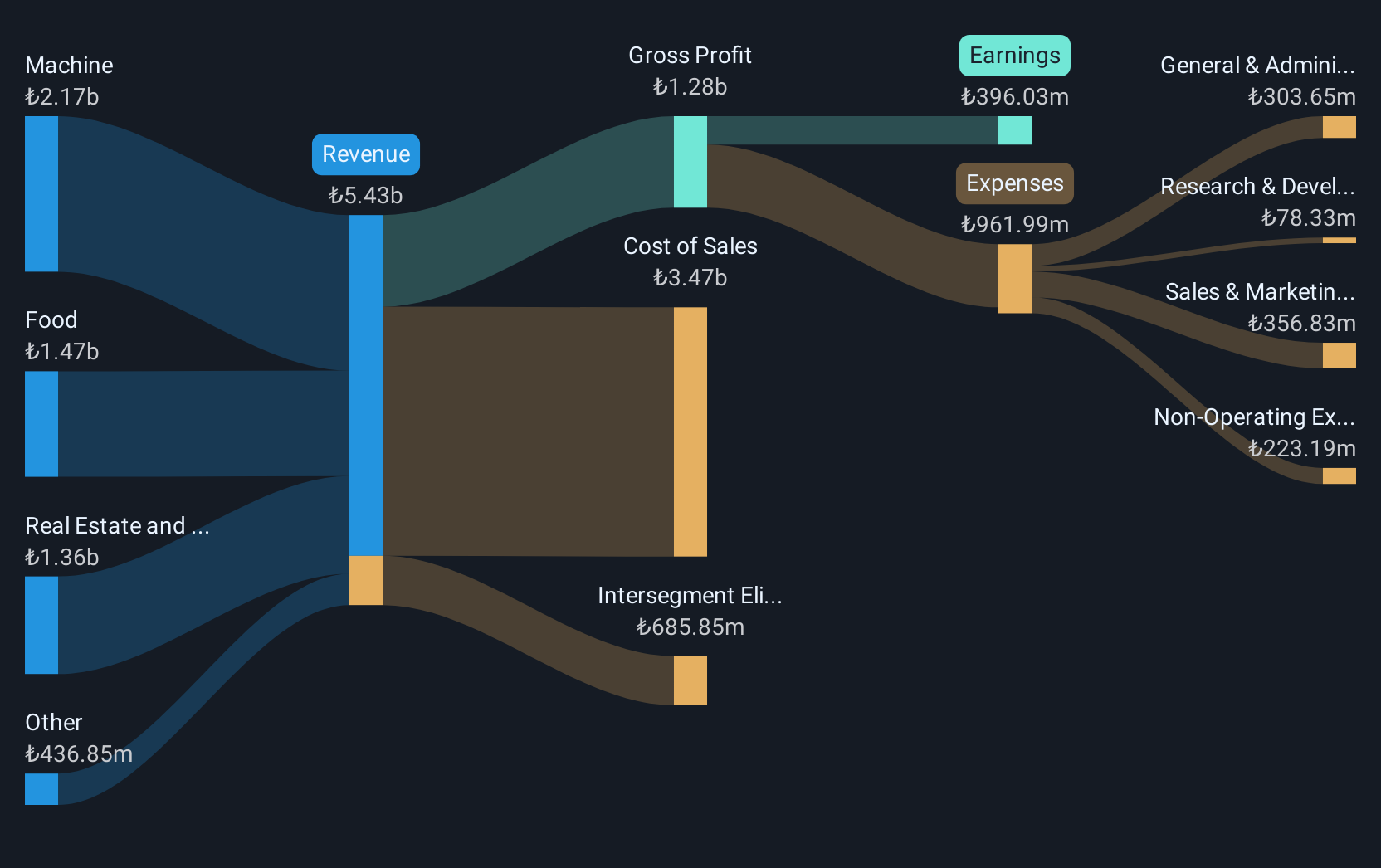

Operations: The company's revenue is primarily derived from its machine segment at TRY2.17 billion, followed by food at TRY1.47 billion, and real estate and construction at TRY1.36 billion.

Market Cap: TRY3.67B

Loras Holding A.S. has a diversified revenue stream, with significant contributions from its machine (TRY2.17 billion), food (TRY1.47 billion), and real estate and construction segments (TRY1.36 billion). Despite a satisfactory net debt to equity ratio of 0.3%, the company faced challenges with a large one-off loss impacting recent earnings, resulting in negative growth over the past year and reduced profit margins from 36% to 8.3%. While short-term assets cover liabilities comfortably, increased volatility in share price and lower return on equity at 1.2% may concern investors seeking stability in penny stocks within the region.

- Click here and access our complete financial health analysis report to understand the dynamics of Loras Holding.

- Gain insights into Loras Holding's historical outcomes by reviewing our past performance report.

Pulsenmore (TASE:PULS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulsenmore Ltd. provides self-scan ultrasound devices for remote clinical diagnosis and screening, with a market cap of ₪133.21 million.

Operations: The company's revenue is derived entirely from its X-Ray Equipment segment, amounting to ₪9.66 million.

Market Cap: ₪133.21M

Pulsenmore Ltd. faces challenges as it delists from OTC Equity due to inactivity, highlighting its volatility and limited market engagement. Despite having no debt and a strong cash position with short-term assets of ₪132.4M exceeding liabilities, the company remains unprofitable with negative return on equity at -37.92%. Earnings have declined significantly over the past five years, while revenue from its X-Ray Equipment segment is modest at ₪9.66 million. The experienced board and management team provide stability, but the lack of meaningful revenue growth and high share price volatility pose risks for investors in penny stocks within this sector.

- Click here to discover the nuances of Pulsenmore with our detailed analytical financial health report.

- Learn about Pulsenmore's historical performance here.

Turning Ideas Into Actions

- Navigate through the entire inventory of 76 Middle Eastern Penny Stocks here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PULS

Pulsenmore

Engages in the provision of self-scan ultrasound devices for remote clinical diagnosis and screening.

Flawless balance sheet slight.

Market Insights

Community Narratives