- Israel

- /

- Healthcare Services

- /

- TASE:NVLG

Middle Eastern Penny Stocks Spotlight: Airtouch Solar And 2 More To Consider

Reviewed by Simply Wall St

As Gulf markets show gains amid progress in U.S. trade deals, the Middle Eastern stock landscape is capturing attention with its potential for growth. For investors looking beyond well-known companies, penny stocks present intriguing possibilities, often representing smaller or newer enterprises with untapped potential. Despite being an older term, penny stocks remain a relevant investment area where strong financial health can lead to unexpected opportunities; here we spotlight three such stocks that combine balance sheet resilience with promising prospects.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.458 | ₪15.47M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.22 | SAR1.69B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.09 | AED2.71B | ✅ 1 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.599 | ₪323.45M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.11 | AED2.2B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.94 | TRY2.09B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.06 | AED404.25M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.62 | AED11.23B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.802 | AED498.77M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.569 | ₪190.99M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Airtouch Solar (TASE:ARTS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Airtouch Solar Ltd offers autonomous water-free robotic cleaning solutions for solar panels and has a market cap of ₪27.27 million.

Operations: The company's revenue is derived from its Industrial Automation & Controls segment, amounting to ₪45.32 million.

Market Cap: ₪27.27M

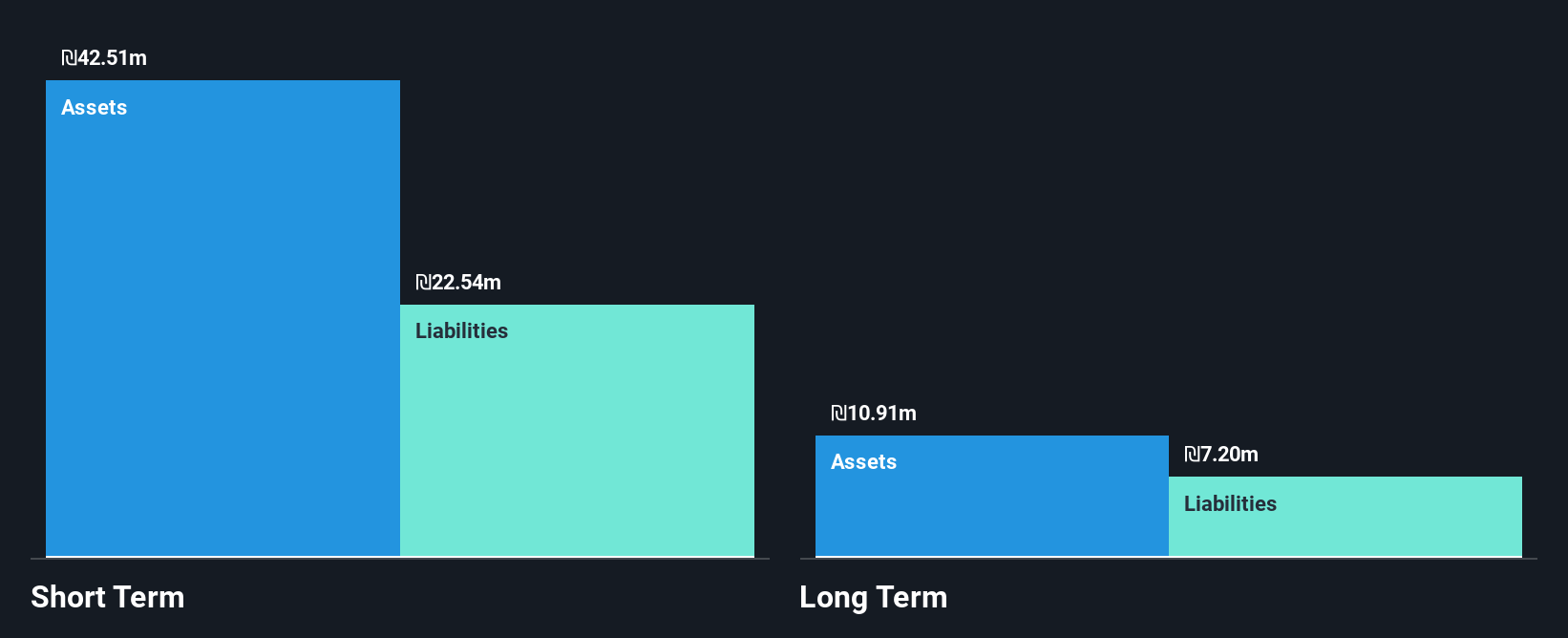

Airtouch Solar Ltd, with a market cap of ₪27.27 million and revenue from its Industrial Automation & Controls segment reaching ₪45.32 million, showcases strengths in asset management as its short-term assets (₪42.5M) exceed both short and long-term liabilities. The company remains unprofitable, with a negative return on equity (-23.04%), facing increased losses over the past five years at an 11% annual rate. Despite high volatility compared to most IL stocks, Airtouch Solar benefits from an experienced board and management team while maintaining more cash than debt, ensuring a stable cash runway for over three years under current conditions.

- Click here to discover the nuances of Airtouch Solar with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Airtouch Solar's track record.

Avrot Industries (TASE:AVRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avrot Industries Ltd specializes in the lining and coating of steel pipes in Israel, with a market capitalization of ₪199.61 million.

Operations: Avrot Industries generates revenue through three main segments: plastic pipe manufacturing (₪41.70 million), coating and wrapping of steel pipes (₪73.13 million), and subcontractor activities in water and sewage infrastructure (₪22.81 million).

Market Cap: ₪199.61M

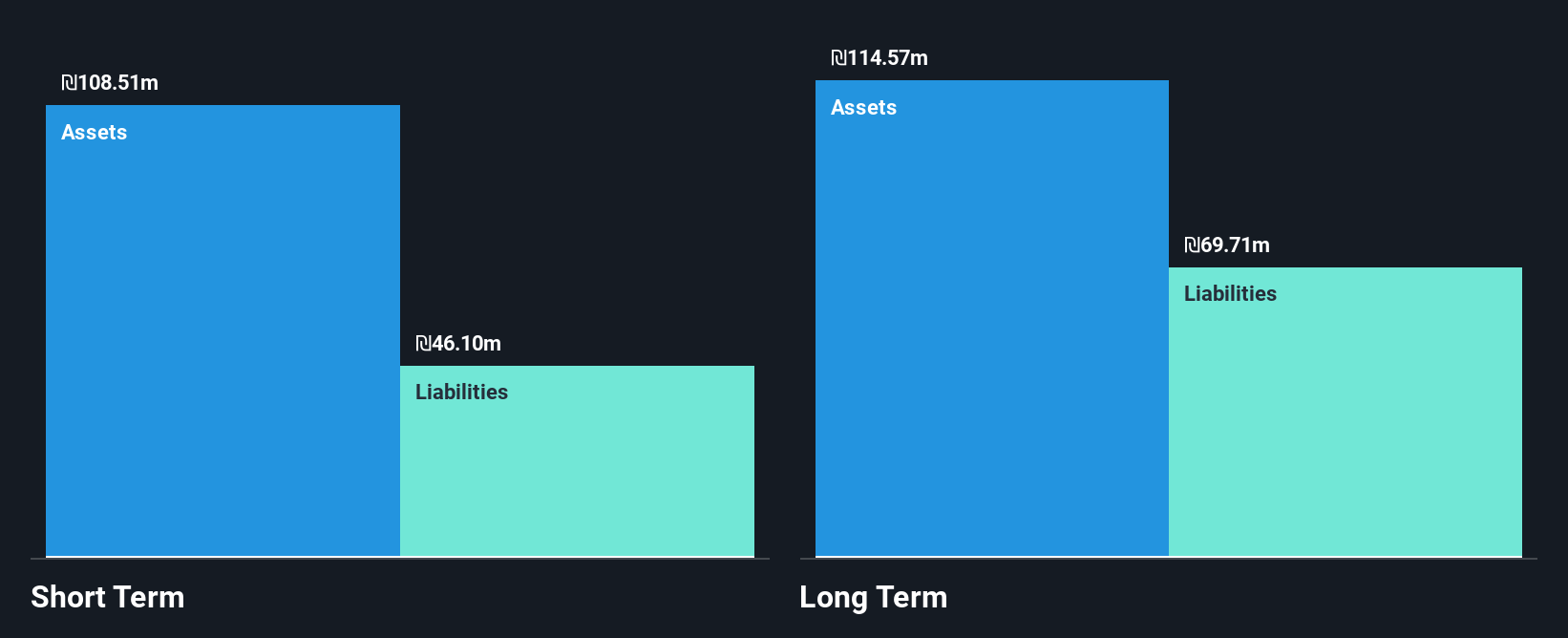

Avrot Industries, with a market cap of ₪199.61 million, demonstrates robust financial health in the penny stock domain. The company generates revenue from plastic pipe manufacturing (₪41.70 million), coating and wrapping of steel pipes (₪73.13 million), and subcontractor activities in water and sewage infrastructure (₪22.81 million). Avrot's earnings growth over the past year is impressive at 84.2%, significantly outpacing industry averages, while its debt to equity ratio has improved dramatically from 127.2% to 12.1% over five years, indicating effective debt management and operational efficiency despite a low return on equity of 2.6%.

- Navigate through the intricacies of Avrot Industries with our comprehensive balance sheet health report here.

- Gain insights into Avrot Industries' historical outcomes by reviewing our past performance report.

Novolog (Pharm-Up 1966) (TASE:NVLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Novolog (Pharm-Up 1966) Ltd operates as a healthcare services provider in Israel with a market cap of ₪740.72 million.

Operations: The company generates revenue from its Logistics Division with ₪1.85 billion, the Health Services Division contributing ₪198.38 million, and the Digital Division adding ₪26.63 million.

Market Cap: ₪740.72M

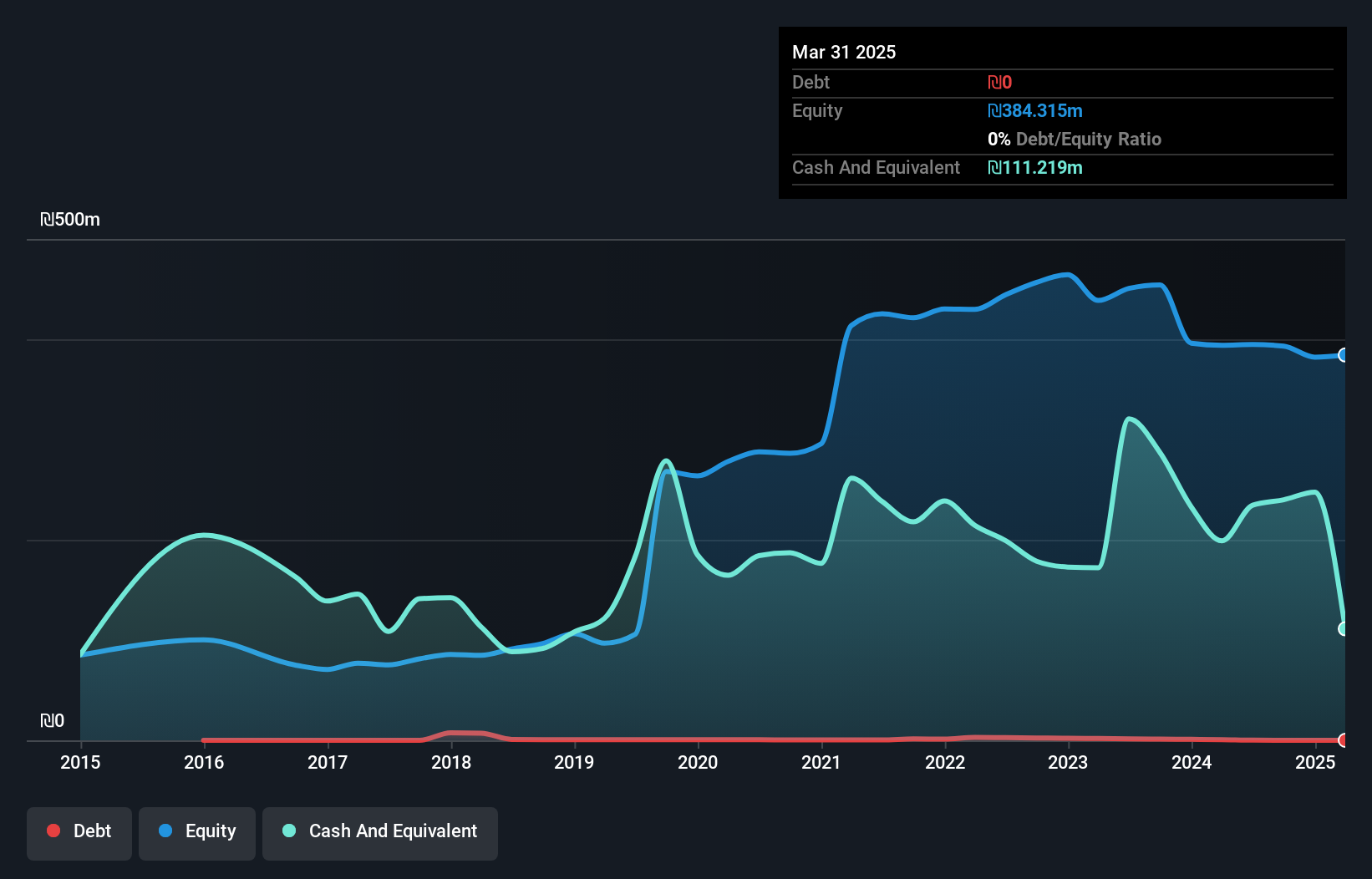

Novolog (Pharm-Up 1966) Ltd, with a market cap of ₪740.72 million, operates as a healthcare services provider in Israel. The company reported first-quarter sales of ₪506.85 million but experienced a decline in net income to ₪1.01 million from the previous year, impacted by a significant one-off loss of ₪10.4 million. Despite becoming profitable this year and being debt-free, Novolog's return on equity remains low at 7.5%. Its short-term assets slightly fall short of covering its short-term liabilities, while long-term liabilities are well covered by its asset base; however, dividends are not well supported by free cash flows.

- Dive into the specifics of Novolog (Pharm-Up 1966) here with our thorough balance sheet health report.

- Understand Novolog (Pharm-Up 1966)'s track record by examining our performance history report.

Make It Happen

- Take a closer look at our Middle Eastern Penny Stocks list of 77 companies by clicking here.

- Contemplating Other Strategies? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novolog (Pharm-Up 1966) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NVLG

Excellent balance sheet low.

Market Insights

Community Narratives