Middle Eastern Market Insights: 3 Penny Stocks Under US$20M Market Cap

Reviewed by Simply Wall St

As most Gulf markets retreat ahead of a pivotal U.S. Senate vote on President Trump's tax bill, investors are approaching the Middle Eastern stock landscape with caution. Despite the vintage feel of the term "penny stocks," these smaller or newer companies can still offer intriguing opportunities for growth at lower price points. This article explores three penny stocks that stand out for their financial strength and potential to deliver impressive returns amidst current market conditions.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.625 | ₪12.06M | ✅ 1 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.10 | SAR1.64B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.11 | AED2.71B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.51 | ₪316.54M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.11 | AED2.22B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.87 | TRY2.01B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.14 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.55 | AED10.76B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.826 | AED502.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.583 | ₪192.03M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

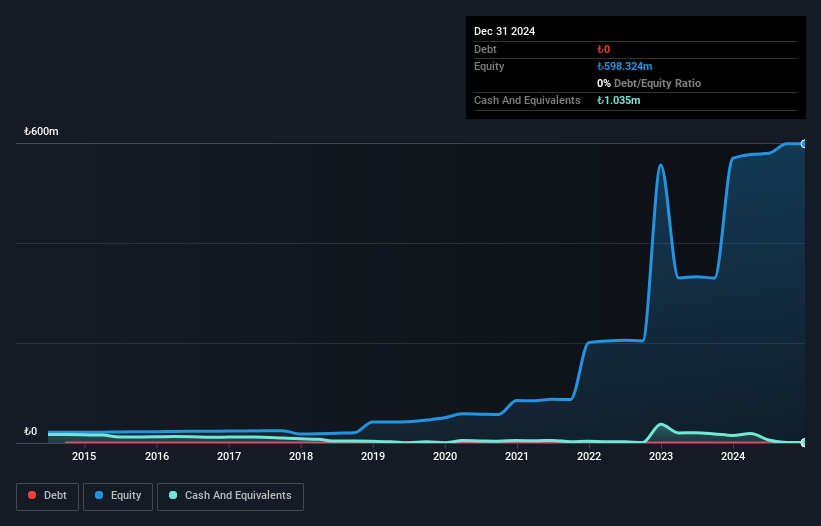

Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hub Girisim Sermayesi Yatirim Ortakligi A.S. is a venture capital investment company with a market capitalization of TRY453.60 million, focusing on investing in innovative and high-growth potential businesses.

Operations: Hub Girisim Sermayesi Yatirim Ortakligi A.S. does not report specific revenue segments, focusing instead on its role as a venture capital investment firm targeting innovative and high-growth potential businesses.

Market Cap: TRY453.6M

Hub Girisim Sermayesi Yatirim Ortakligi A.S., with a market cap of TRY453.60 million, is a pre-revenue venture capital firm focusing on high-growth potential businesses. Despite being debt-free and having short-term assets exceeding liabilities, the company faces financial challenges with less than a year of cash runway and increasing losses over the past five years at 40.9% annually. Recent earnings reported sales of TRY1.87 million for Q1 2025 but also showed an increased net loss to TRY311.11 million from TRY107.59 million the previous year, highlighting ongoing profitability issues amidst its investment focus.

- Jump into the full analysis health report here for a deeper understanding of Hub Girisim Sermayesi Yatirim Ortakligi.

- Learn about Hub Girisim Sermayesi Yatirim Ortakligi's historical performance here.

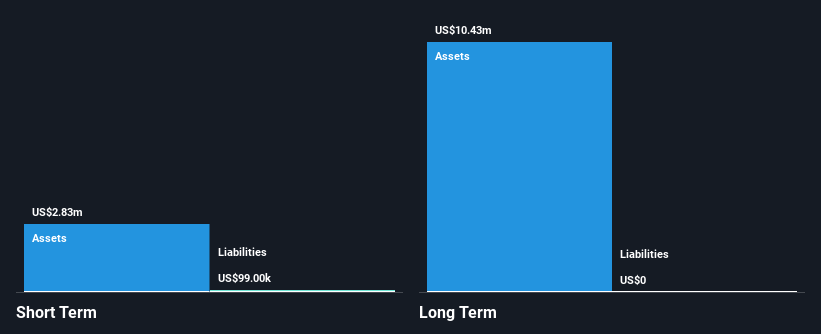

Big Tech 50 R&D-Limited Partnership (TASE:BIGT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Tech 50 R&D-Limited Partnership focuses on investing in technology companies in Israel and has a market cap of ₪20.33 million.

Operations: Big Tech 50 R&D-Limited Partnership does not have any positive revenue segments to report.

Market Cap: ₪20.33M

Big Tech 50 R&D-Limited Partnership, with a market cap of ₪20.33 million, is a debt-free entity focused on technology investments in Israel. It remains pre-revenue, generating less than US$1 million annually and facing increasing losses over the past five years at an annual rate of 50.4%. Despite these challenges, it maintains sufficient cash runway for more than three years based on current free cash flow trends. The company recently announced an annual dividend of ILS 0.4806 per share payable in July 2025, reflecting its commitment to shareholder returns despite profitability issues and negative return on equity (-43.11%).

- Unlock comprehensive insights into our analysis of Big Tech 50 R&D-Limited Partnership stock in this financial health report.

- Gain insights into Big Tech 50 R&D-Limited Partnership's historical outcomes by reviewing our past performance report.

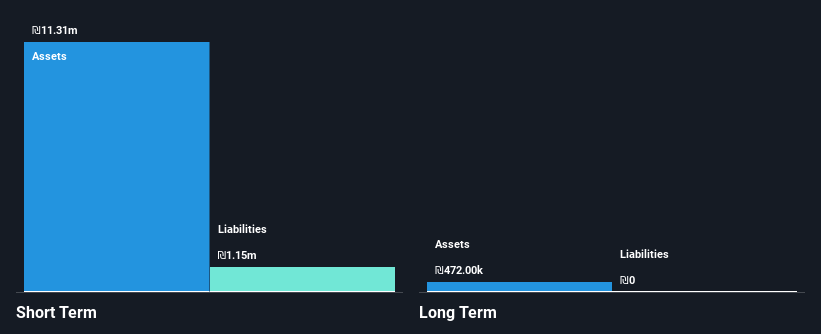

SavorEat (TASE:SVRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SavorEat Ltd. is a company that produces cellulose-based meat substitutes designed to replicate the eating experience of traditional meat, with a market cap of ₪7.04 million.

Operations: SavorEat Ltd. has not reported any revenue segments.

Market Cap: ₪7.04M

SavorEat Ltd., with a market cap of ₪7.04 million, is currently pre-revenue, producing less than US$1 million annually. The company is debt-free and has enough cash runway for over a year based on current free cash flow trends. Its recent strategic collaboration with The Moseley Group aims to support the U.S. launch of its AI-powered Robot-Chef 2.0 platform, marking significant progress in its commercialization efforts. Despite high volatility in share price and increasing losses at an annual rate of 15.2%, SavorEat's partnerships enhance its market entry capabilities and operational execution in North America.

- Dive into the specifics of SavorEat here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into SavorEat's track record.

Turning Ideas Into Actions

- Discover the full array of 78 Middle Eastern Penny Stocks right here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SVRT

SavorEat

A cellulose-based meat substitute, provides identical eating experience to that of meat.

Flawless balance sheet slight.

Market Insights

Community Narratives