- United Arab Emirates

- /

- Insurance

- /

- ADX:EIC

Middle Eastern Dividend Stocks To Watch In June 2025

Reviewed by Simply Wall St

As Middle Eastern markets navigate the complexities of tariff uncertainties and fluctuating oil prices, investor sentiment remains fragile yet cautiously optimistic. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking to balance risk with steady returns.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Emaar Properties PJSC (DFM:EMAAR) | 7.58% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.55% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.85% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.20% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.13% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.40% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.91% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.30% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.94% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.52% | ★★★★★☆ |

Click here to see the full list of 71 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Emirates Insurance Company P.J.S.C (ADX:EIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Insurance Company P.J.S.C. operates in the general insurance and reinsurance sectors across the United Arab Emirates, the United States, and Europe, with a market cap of AED1.10 billion.

Operations: Emirates Insurance Company P.J.S.C. generates revenue primarily through its underwriting activities, amounting to AED2.31 billion, and investments totaling AED82.53 million.

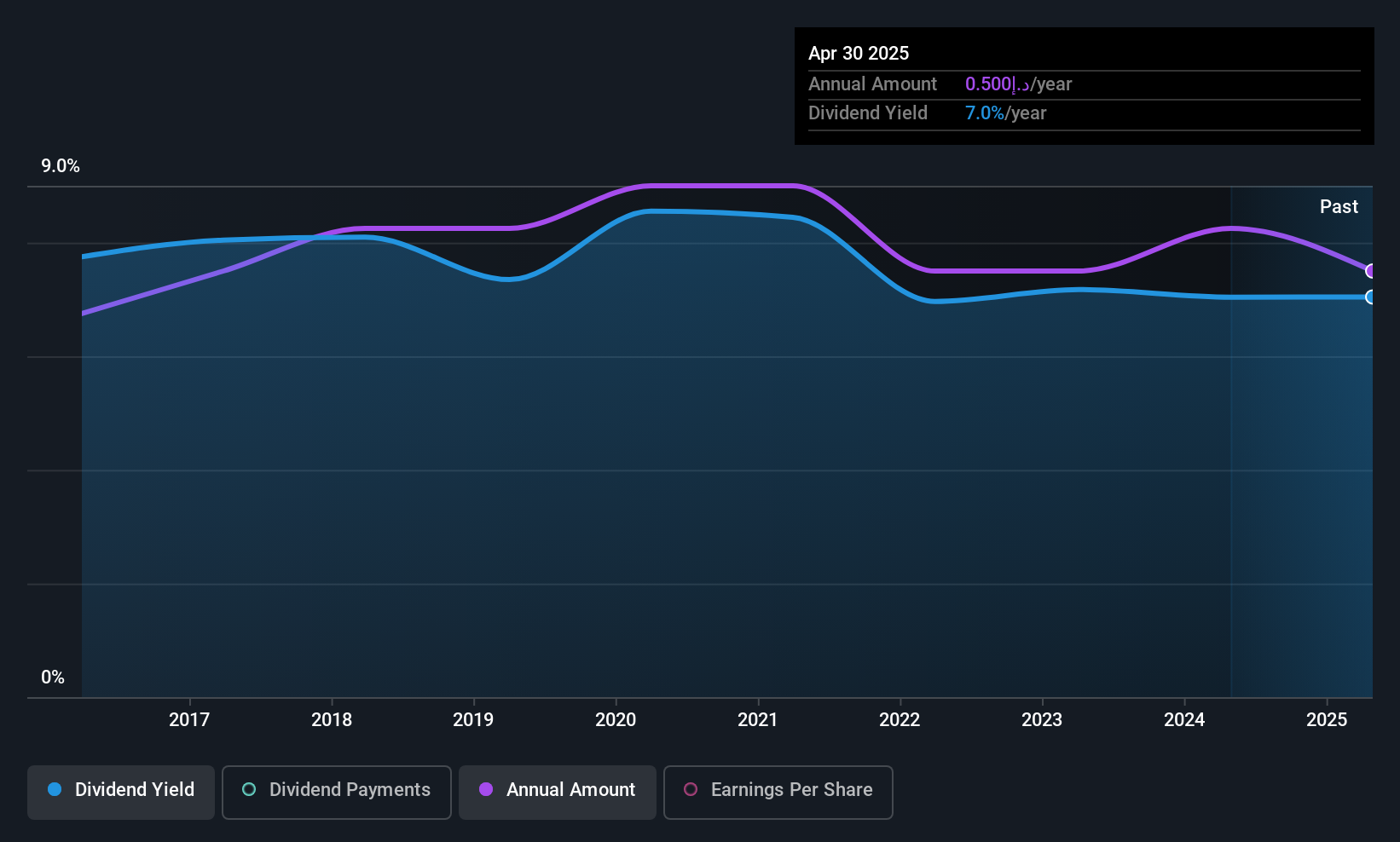

Dividend Yield: 6.8%

Emirates Insurance Company P.J.S.C. presents a mixed picture for dividend investors. The company recently announced a decrease in cash dividends to 50 Fils per share, totaling AED 75 million, reflecting challenges in maintaining previous payout levels. Despite a competitive dividend yield of 6.85%, the sustainability is questionable as dividends are not covered by free cash flows and have been unreliable over the past decade. Earnings have also declined, with Q1 net income dropping to AED 33.8 million from AED 40.77 million year-on-year.

- Dive into the specifics of Emirates Insurance Company P.J.S.C here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Emirates Insurance Company P.J.S.C shares in the market.

NewMed Energy - Limited Partnership (TASE:NWMD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NewMed Energy - Limited Partnership is involved in the exploration, development, production, and sale of petroleum, natural gas, and condensate across Israel, Jordan, and Egypt with a market cap of ₪17.47 billion.

Operations: NewMed Energy - Limited Partnership generates its revenue primarily from the exploration and production of oil and gas, amounting to $973.10 million.

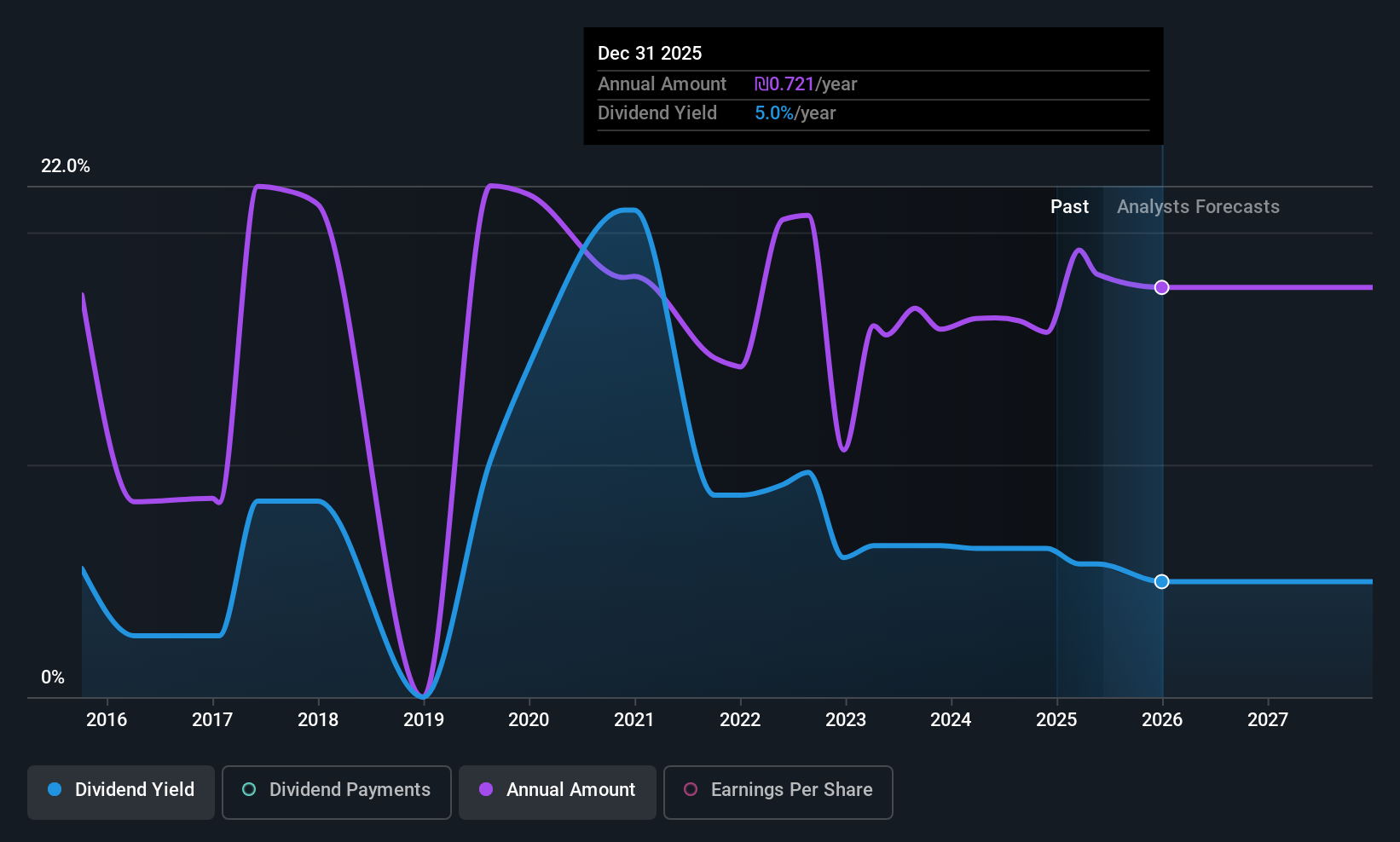

Dividend Yield: 5%

NewMed Energy - Limited Partnership faces challenges for dividend investors. Despite a 5.03% dividend yield, below the IL market's top tier, dividends are well covered by earnings and cash flows with payout ratios of 49.5% and 54%, respectively. However, dividends have been volatile over the past decade despite growth in payments. Recent Q1 results show revenue increased to US$245.6 million, but net income slightly decreased to US$116.4 million year-on-year, indicating potential pressure on future payouts.

- Click here to discover the nuances of NewMed Energy - Limited Partnership with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that NewMed Energy - Limited Partnership is priced higher than what may be justified by its financials.

Rimoni Industries (TASE:RIMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rimoni Industries Ltd. specializes in designing, engineering, and manufacturing molds and precise injection molding and assemblies for various sectors including medical, automotive, agricultural, high-tech, and consumer industries in Israel with a market cap of ₪428.68 million.

Operations: Rimoni Industries Ltd. generates its revenue through the production of molds and precision injection molding and assemblies, serving sectors such as medical, automotive, agricultural, high-tech, and consumer industries in Israel.

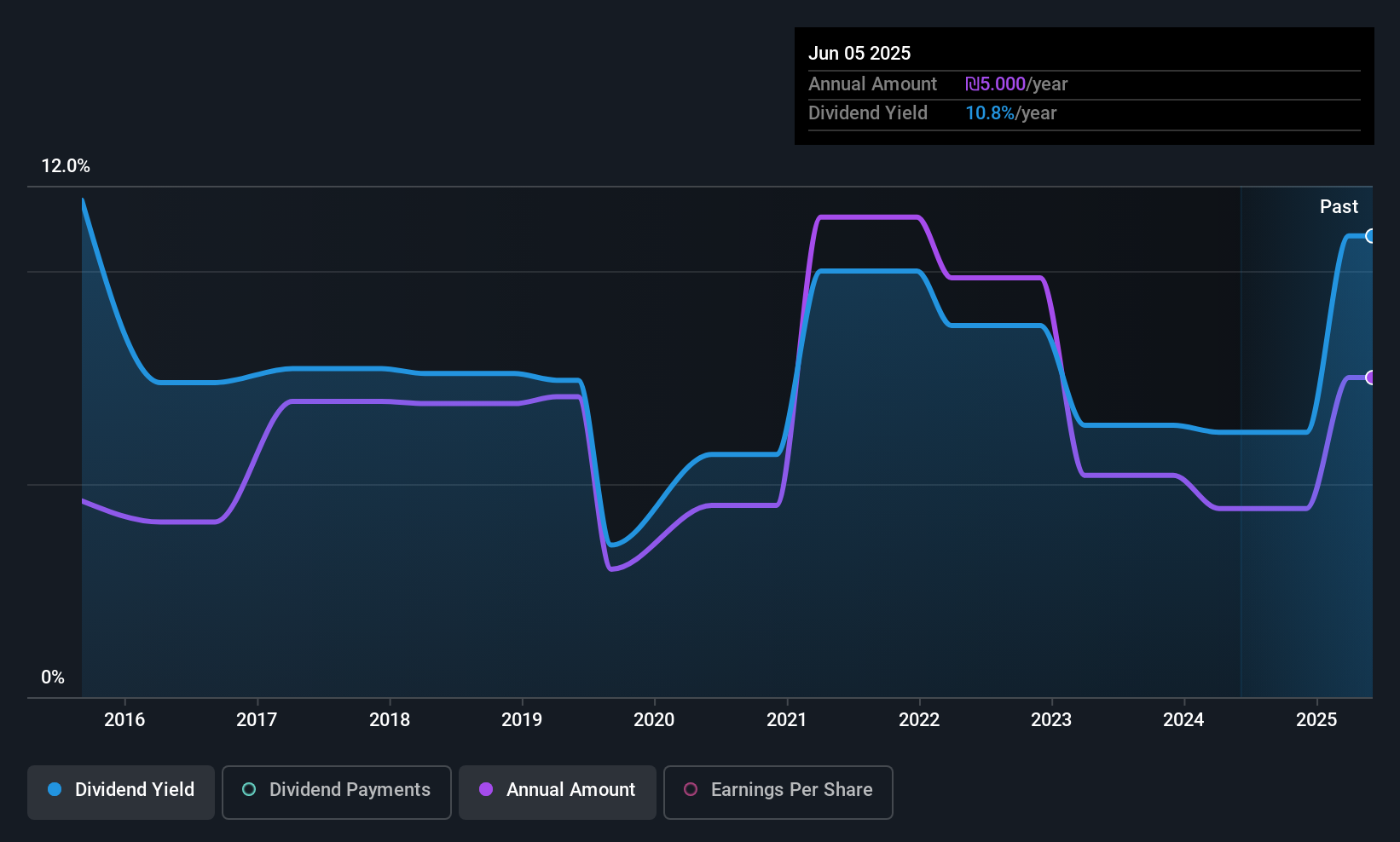

Dividend Yield: 9.8%

Rimoni Industries' dividend yield of 9.8% ranks among the top in the IL market, yet its sustainability is questionable due to a high payout ratio of 100.6%, indicating dividends are not well covered by earnings. Despite recent Q1 earnings growth with net income rising to ILS 10.92 million, dividends have been volatile and unreliable over the past decade, often experiencing significant drops and lacking consistent growth, raising concerns for long-term investors seeking stability.

- Take a closer look at Rimoni Industries' potential here in our dividend report.

- The analysis detailed in our Rimoni Industries valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Investigate our full lineup of 71 Top Middle Eastern Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Insurance Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:EIC

Emirates Insurance Company P.J.S.C

Engages in writing general insurance and reinsurance in the United Arab Emirates, the United States, and Europe.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives