Middle Eastern Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

In the face of regional tensions and fluctuating oil prices, Middle Eastern markets have shown resilience, buoyed by hopes of a U.S. Federal Reserve rate cut. As investors navigate these dynamic conditions, dividend stocks continue to be an appealing option for those seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi National Bank (SASE:1180) | 5.84% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.51% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.73% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.38% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.45% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.02% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.04% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 6.66% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.88% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.01% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our Top Middle Eastern Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

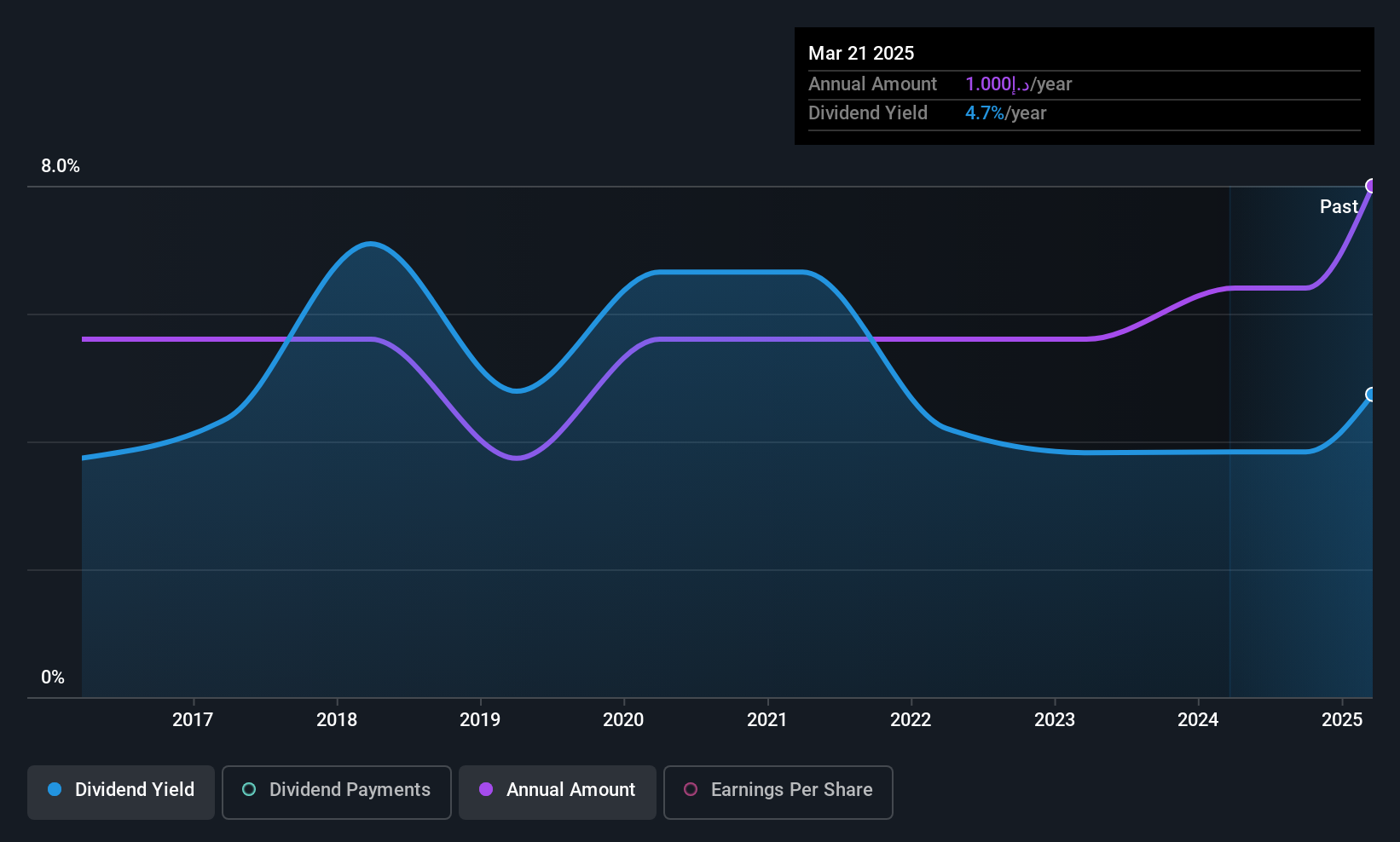

Dubai Refreshment (P.J.S.C.) (DFM:DRC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Refreshment (P.J.S.C.) bottles and sells Pepsi Cola International products in the United Arab Emirates and internationally, with a market cap of AED1.94 billion.

Operations: Dubai Refreshment (P.J.S.C.) generates revenue of AED850.52 million from its operations in canning, bottling, distribution, and trading of soft drinks and related beverage products.

Dividend Yield: 4.7%

Dubai Refreshment (P.J.S.C.) offers a dividend covered by both earnings and cash flows, with payout ratios of 63% and 42.5%, respectively. However, its dividend yield of 4.65% is below the top quartile in the AE market, and historical dividends have been volatile. Recent financial results show growth, with Q2 sales increasing to AED 238.44 million from AED 216.61 million year-over-year, indicating potential for future stability in payouts despite past inconsistencies.

- Dive into the specifics of Dubai Refreshment (P.J.S.C.) here with our thorough dividend report.

- The valuation report we've compiled suggests that Dubai Refreshment (P.J.S.C.)'s current price could be quite moderate.

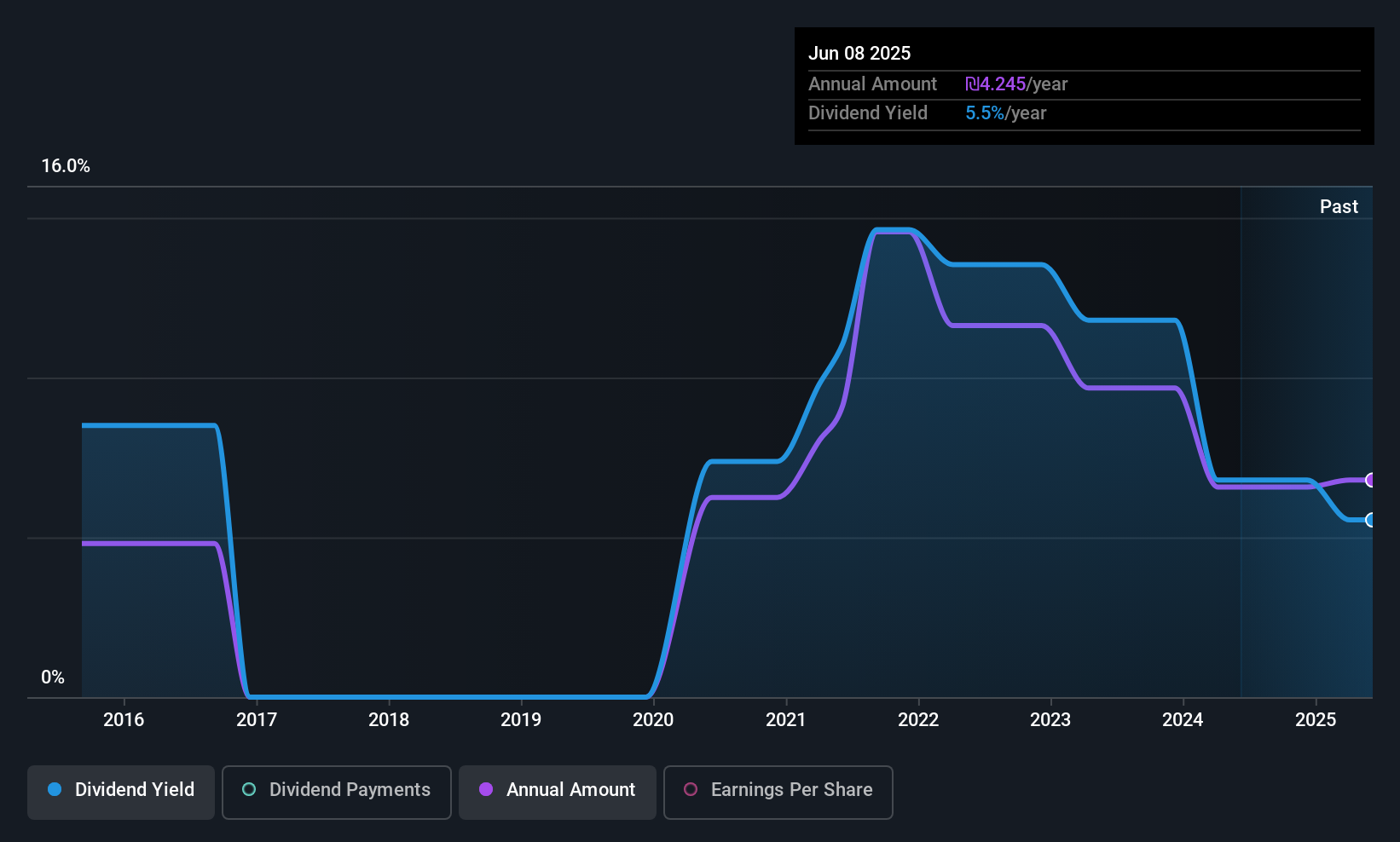

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Atreyu Capital Markets Ltd, operating through its subsidiaries, offers investment management services in Israel and has a market cap of ₪1.18 billion.

Operations: Atreyu Capital Markets Ltd generates revenue through its subsidiaries by providing investment management services in Israel.

Dividend Yield: 5.3%

Atreyu Capital Markets' dividend is supported by earnings and cash flows, with payout ratios of 61.7% and 84.7%, respectively. Despite a modest yield of 5.3%, below Israel's top quartile, dividends have grown over the past decade but remain unstable due to volatility exceeding annual drops of 20%. Recent financials show revenue growth to ILS 27.54 million in Q2 from ILS 24.65 million year-over-year, reflecting potential for improved consistency in future payouts.

- Unlock comprehensive insights into our analysis of Atreyu Capital Markets stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Atreyu Capital Markets is priced higher than what may be justified by its financials.

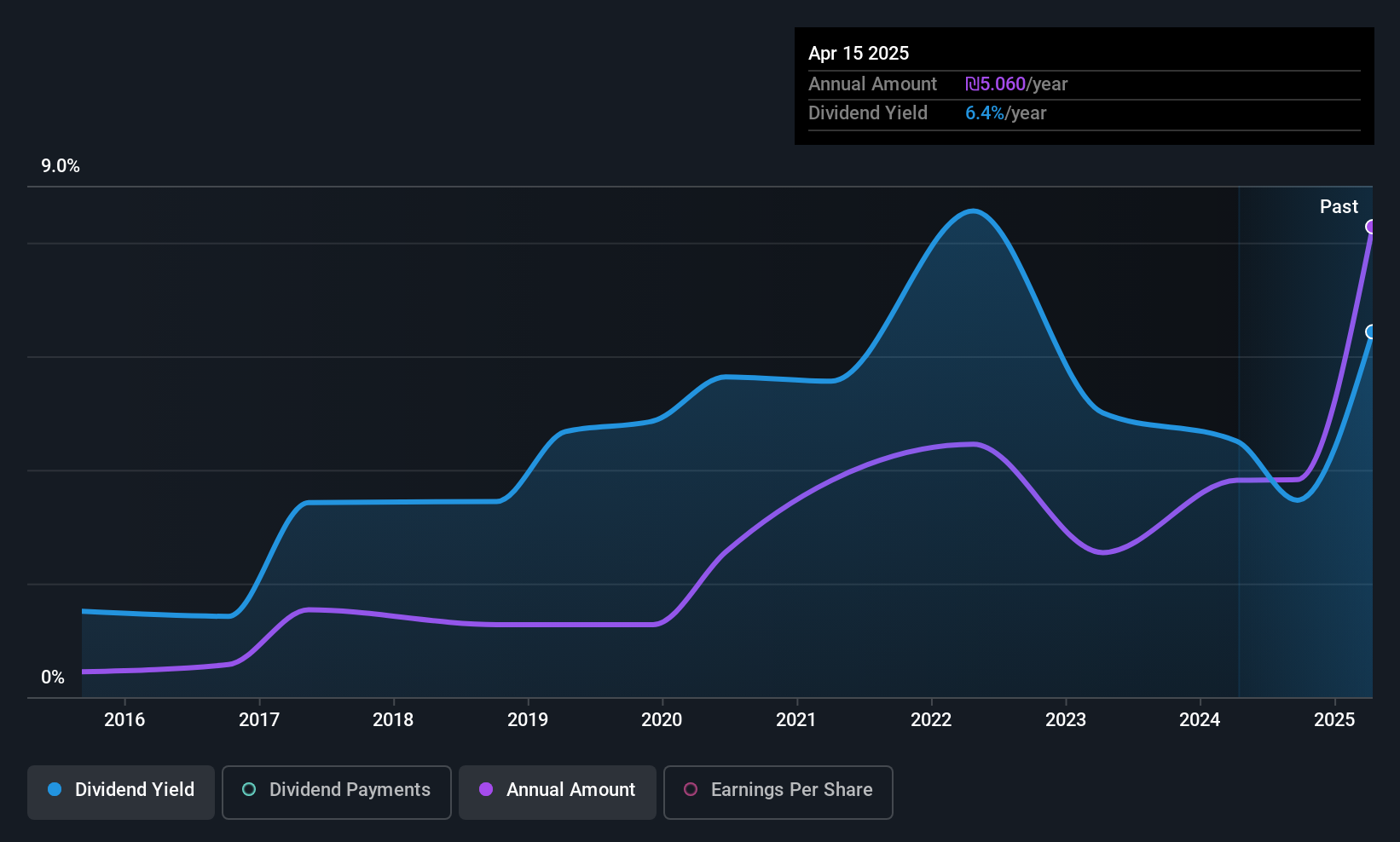

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Palram Industries (1990) Ltd manufactures and sells thermoplastic sheets, panel systems, and finished products both in Israel and internationally, with a market cap of ₪1.97 billion.

Operations: Palram Industries (1990) Ltd generates revenue through the production and sale of thermoplastic sheets, panel systems, and finished products across domestic and international markets.

Dividend Yield: 6.6%

Palram Industries' dividends are covered by earnings and cash flows, with payout ratios of 60.7% and 42%, respectively. Despite a top-tier yield of 6.62% in the IL market, dividend payments have been volatile over the past decade. Recent earnings show a decline, with Q2 sales at ILS 473.54 million down from ILS 494.37 million year-over-year, and net income decreasing to ILS 53.34 million from ILS 65.81 million, indicating potential challenges in maintaining stable payouts.

- Click to explore a detailed breakdown of our findings in Palram Industries (1990)'s dividend report.

- Our valuation report here indicates Palram Industries (1990) may be undervalued.

Summing It All Up

- Dive into all 67 of the Top Middle Eastern Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PLRM

Palram Industries (1990)

Manufactures and sells thermoplastic sheets, and panel systems, and finished products in Israel and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives