- United Arab Emirates

- /

- Consumer Services

- /

- ADX:DRIVE

Middle Eastern Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As the Middle Eastern markets demonstrate resilience, with Dubai's stock index logging a second consecutive session of gains and Abu Dhabi snapping its losing streak, investors are keenly observing the region's economic momentum and oil price fluctuations. In such an environment, dividend stocks can offer stability and income potential, making them an appealing consideration for those looking to navigate these dynamic market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Emaar Properties PJSC (DFM:EMAAR) | 7.60% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.61% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.94% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.23% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.19% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.41% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.89% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.02% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.99% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.94% | ★★★★★☆ |

Click here to see the full list of 70 stocks from our Top Middle Eastern Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, specializes in managing and developing motor vehicle driving training in the United Arab Emirates, with a market cap of AED3.07 billion.

Operations: Emirates Driving Company P.J.S.C. generates revenue primarily from Car and Other Related Services, amounting to AED589.90 million.

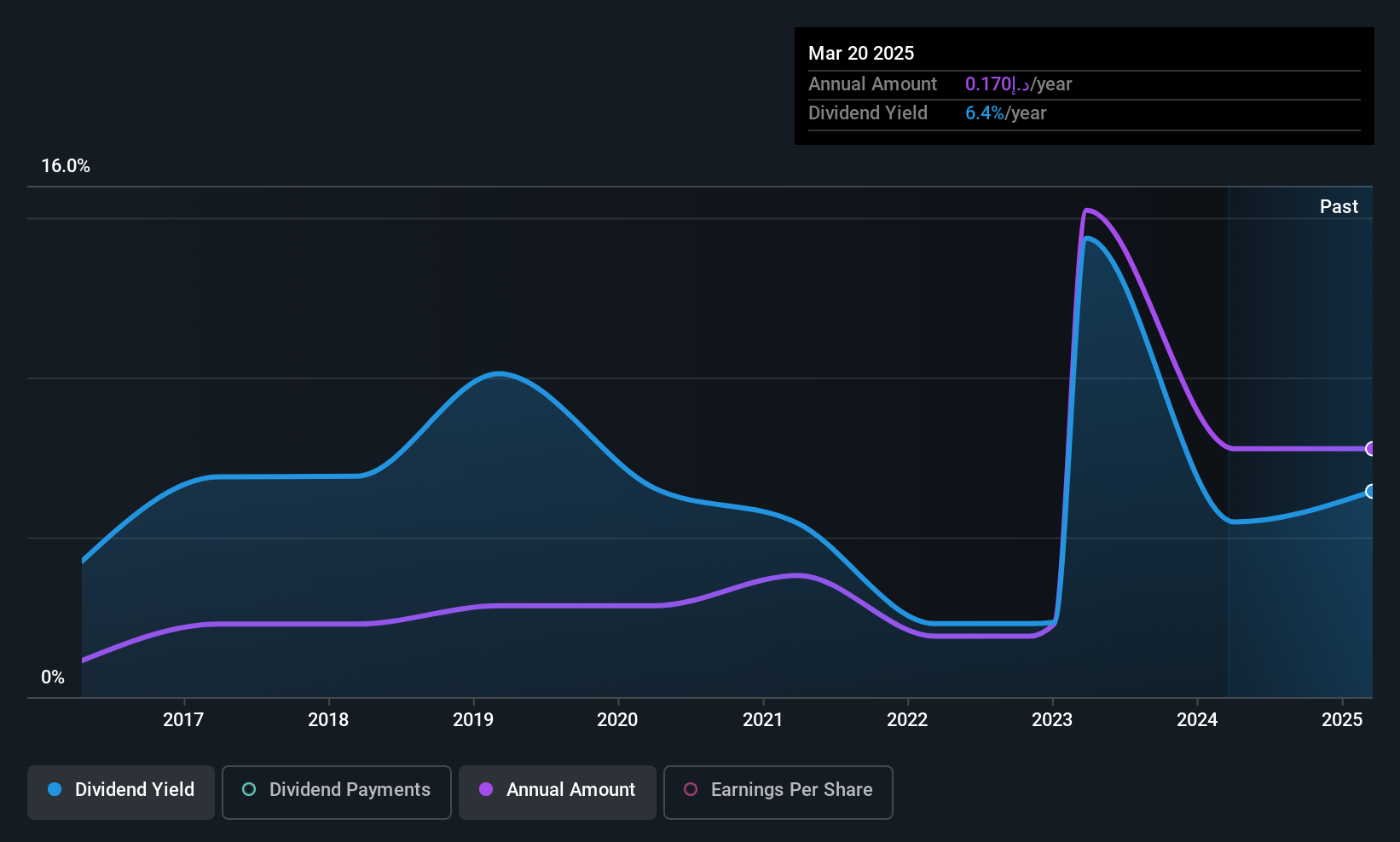

Dividend Yield: 6%

Emirates Driving Company P.J.S.C. has shown volatility in dividend payments over the past decade, with some years experiencing drops of over 20%. Despite this, dividends have grown overall during this period. The company's dividends are covered by earnings and cash flows, with payout ratios of 65.4% and 68%, respectively. However, its dividend yield of 5.96% is below the top quartile in the AE market. Recently, AED 183 million was approved for dividend distribution for fiscal year 2024 at their General Assembly Meeting on March 11th, reflecting a stable financial position despite fluctuating profit margins and earnings growth.

- Click here and access our complete dividend analysis report to understand the dynamics of Emirates Driving Company P.J.S.C.

- In light of our recent valuation report, it seems possible that Emirates Driving Company P.J.S.C is trading behind its estimated value.

Orascom Construction (DIFX:OC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orascom Construction PLC is an engineering and construction contractor specializing in infrastructure, complex industrial, and high-end commercial projects across the United States, the Middle East, Africa, and Central Asia with a market cap of $617.37 million.

Operations: Orascom Construction PLC's revenue is primarily derived from its operations in the Middle East and Africa, contributing $1.77 billion, and the United States, adding $1.57 billion.

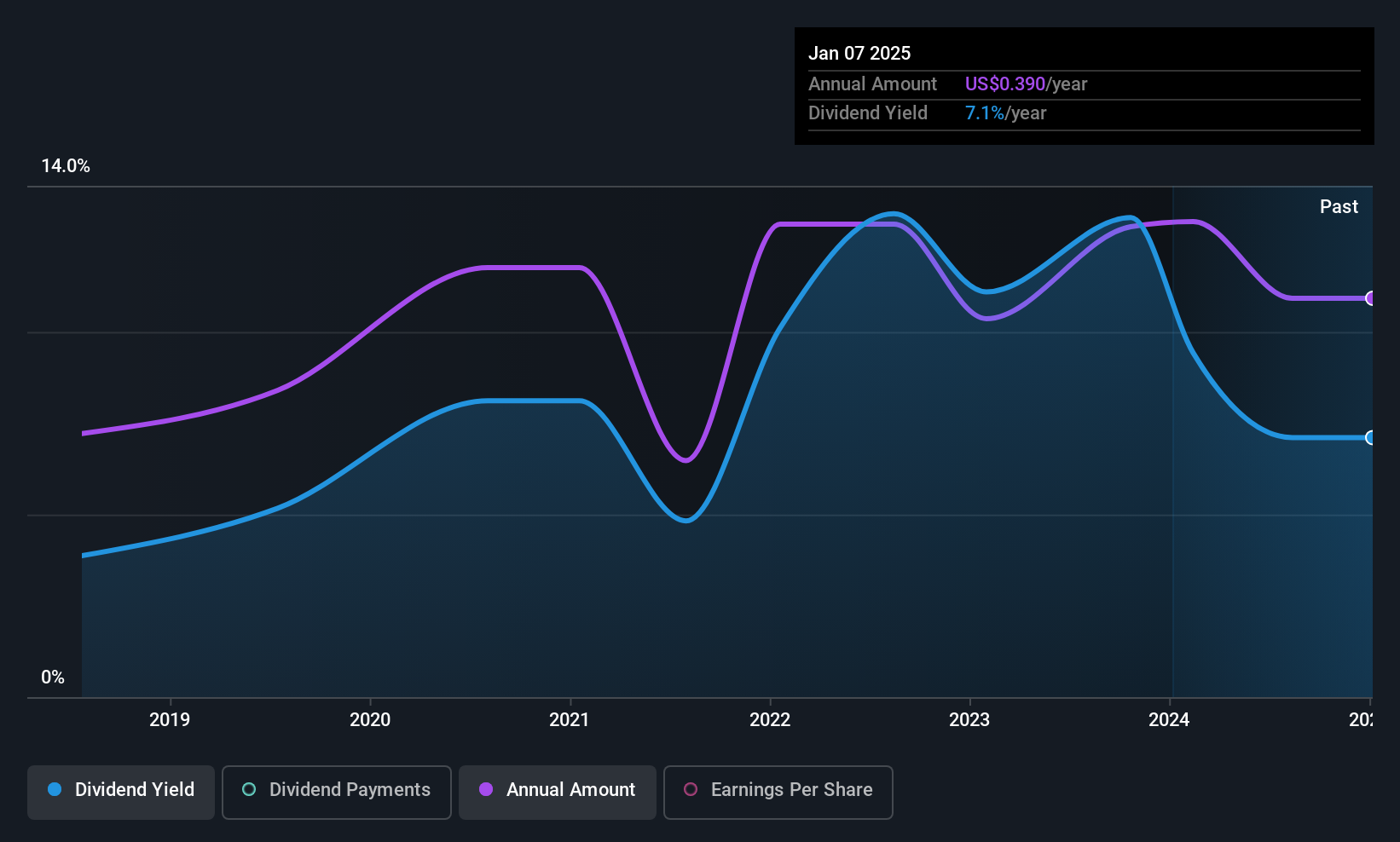

Dividend Yield: 7.0%

Orascom Construction's recent earnings report showed a decline in net income, impacting its dividend reliability. Despite this, the company's dividends are well covered by earnings and cash flows, with payout ratios of 35.4% and 15.5%, respectively. However, its dividend track record remains unstable over the past seven years due to volatility in payments. Trading below estimated fair value, Orascom offers a competitive dividend yield within the top quartile of AE market payers at 6.96%.

- Unlock comprehensive insights into our analysis of Orascom Construction stock in this dividend report.

- According our valuation report, there's an indication that Orascom Construction's share price might be on the cheaper side.

Electrical Industries (SASE:1303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Electrical Industries Company, with a market cap of SAR8.28 billion, operates through its subsidiaries to manufacture, assemble, supply, repair, and maintain various electrical equipment such as transformers and switch gears across the Kingdom of Saudi Arabia and international markets including other Gulf countries, Europe, and Asia.

Operations: Electrical Industries Company's revenue is primarily derived from Manufacturing, Assembly and Supply at SAR1.85 billion, with additional income from Services amounting to SAR105.05 million.

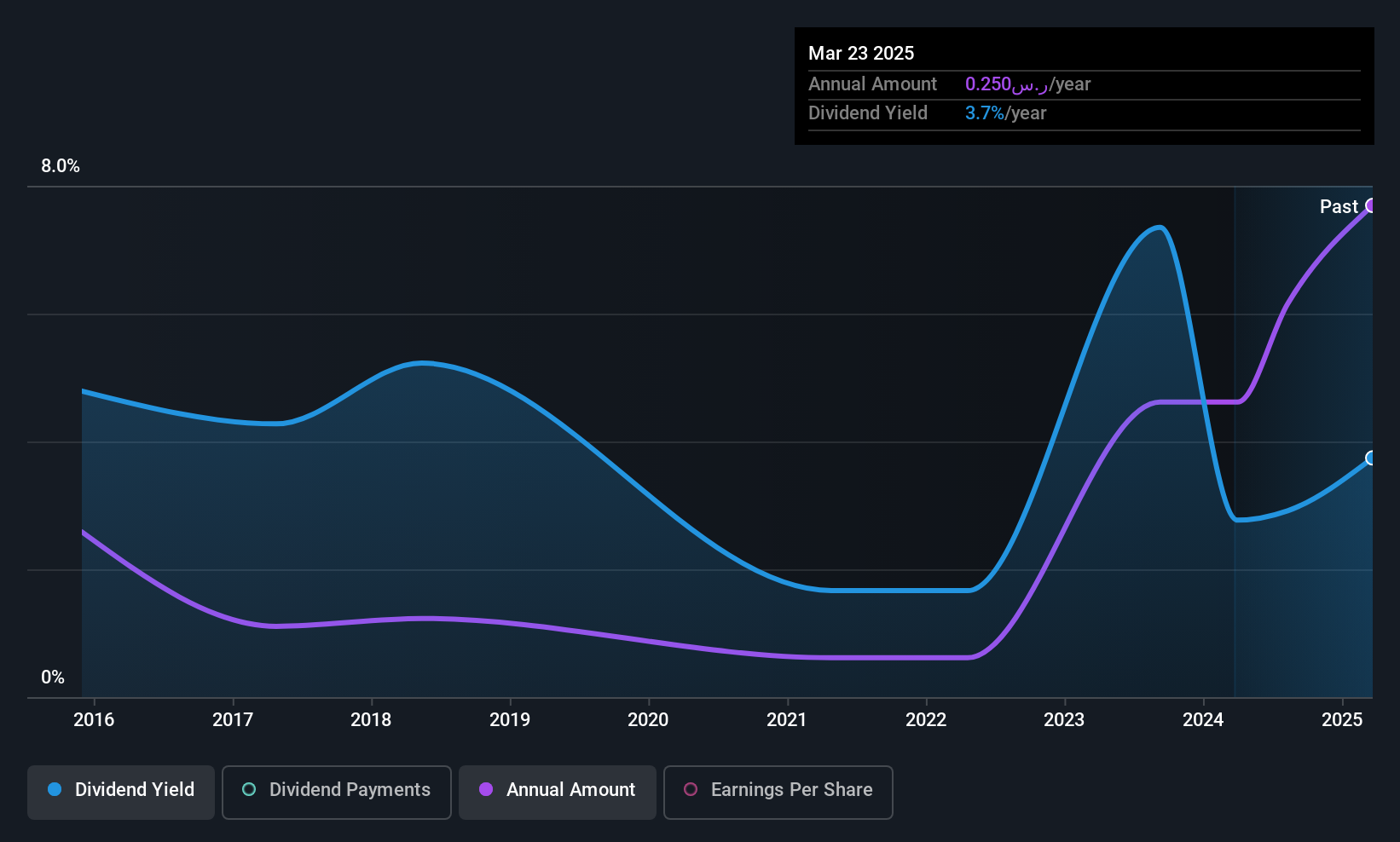

Dividend Yield: 3.4%

Electrical Industries' dividends are well-covered by earnings and cash flow, with payout ratios of 55.6% and 42.2%, respectively, despite a volatile dividend history over the past decade. While its current dividend yield of 3.36% is below the top tier in Saudi Arabia, recent financials show a significant rise in net income for Q1 2025 to SAR 123.43 million from SAR 75.23 million year-on-year, indicating potential stability improvements ahead.

- Click here to discover the nuances of Electrical Industries with our detailed analytical dividend report.

- Our valuation report here indicates Electrical Industries may be undervalued.

Seize The Opportunity

- Dive into all 70 of the Top Middle Eastern Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Driving Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:DRIVE

Emirates Driving Company P.J.S.C

Manages and develops motor vehicles driving training in the United Arab Emirates.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives